The Biggest Mistake Marijuana Stock Investors Are Making Right Now

Marijuana stocks have inspired a new generation of investors to look more closely at the stock market, and the budding industry has seen a lot of activity recently. In just the past year, the legalization of recreational marijuana across Canada has been a trigger point for explosive growth among some of the largest cannabis companies in the world. Ongoing efforts to make pot legal across the U.S. have also drawn attention to the industry, leading investors to try to identify those companies most likely to take full advantage of the coming opportunity in cannabis.

Yet over the past month, key marijuana stocks have seen huge declines, and that's left many people frustrated with the sector. As cannabis investors try to make informed decisions about what to do in response to the recent drop, though, many are making a big mistake that's unfortunately all too common among stock market participants more broadly. All it takes to avoid these errors is some perspective that can help you reset expectations and get yourself focused on the more important aspects of investing.

Image source: Getty Images.

Why are marijuana stocks falling?

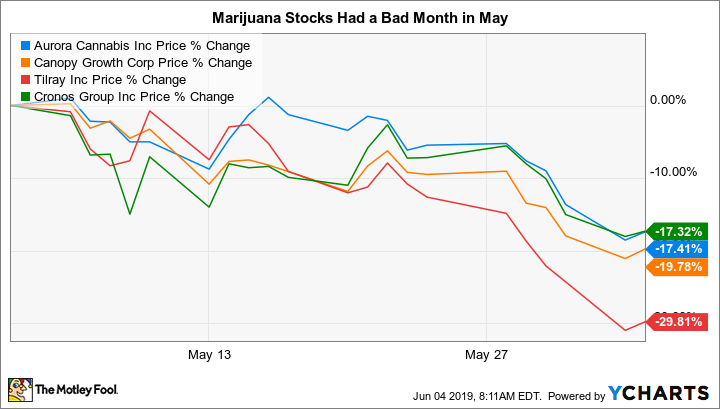

The declines that marijuana stocks have suffered over the past month have come as a surprise to many investors, not just because of the size of the drop, but also the breadth of the weakness across the industry. Two cannabis companies that have attracted valuable partners in the consumer goods space, Canopy Growth (NYSE: CGC) and Cronos Group (NASDAQ: CRON), have seen their shares drop roughly 20% in just the past month. Meanwhile, two others that have thus far largely remained independent, Aurora Cannabis (NYSE: ACB) and Tilray (NASDAQ: TLRY), are also down sharply, with Tilray's losses approaching 30% since early May.

Those who follow the industry day in and day out have come up with plausible reasons for these declines. Some pointed to overall stock market weakness in May as having a negative impact on marijuana stocks, arguing that speculators who helped drive share prices in the space higher pulled back from the sector as major market indexes fell. Others focused on marijuana earnings season, noting that although Aurora, Tilray, and Cronos all posted solid revenue gains, only Cronos was able to make money, and its profit came due to the accounting rules surrounding the investment that tobacco giant Altria Group has made in the pot producer.

The big picture

It's always difficult to pull yourself out of a short-term mindset, especially when times are tough. Yet especially in an industry that's really only come into its own over the past year or two, you have to think long term if you want to keep things in perspective and make informed choices about how to handle the inevitable ups and downs.

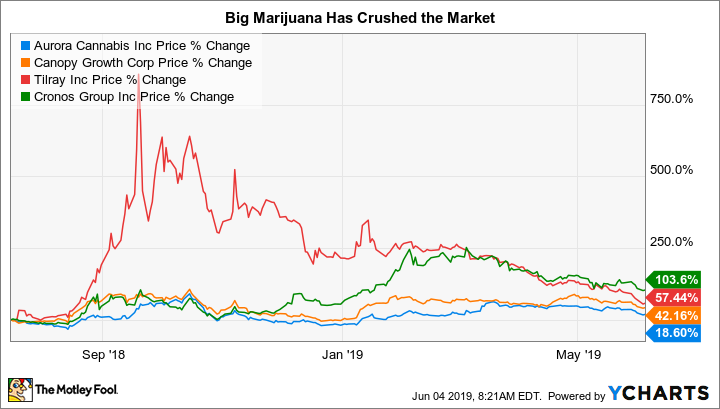

To see how a longer-term perspective can change your thinking, consider what happens when you pull back from the chart above and instead look at performance since last summer.

As you can see, all four of these stocks are up, and with the exception of Aurora, the gains they've posted have been huge. When you consider that the overall stock market has basically treaded water over that time, it makes the gains that the cannabis sector has produced even more impressive.

What the future will bring

Admittedly, a period of less than a year is hardly long term. But in any young industry, you don't have the luxury of decades of performance to evaluate. What you do have, though, are cycles of exuberance and despair that produce immense volatility for shareholders but that tend to even out and reveal the overall long-term direction of the industry.

The jury's still out on what direction the overall marijuana market will take in search of expansion. Some companies are looking at international opportunities, while others are focusing their attention on the potential for the U.S. market to open in the next few years. Investors can expect Canopy Growth, Aurora Cannabis, Tilray, and Cronos Group all to stake their claims to try to take advantage of the growing demand for cannabis. If you believe that they're making the right moves, then it would be a mistake to let a single month's poor performance scare you out of the stock market.

More From The Motley Fool

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance