Hedge funds are falling out of love with Netflix and Apple

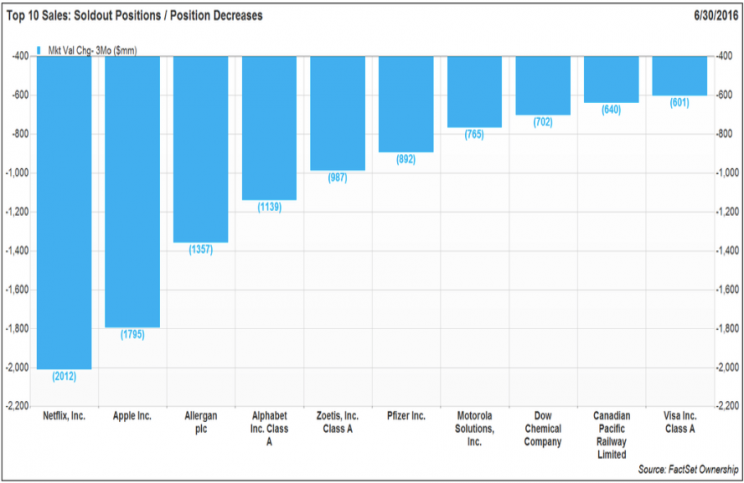

The top 50 biggest hedge funds biggest stock sales in the second quarter were Netflix and Apple.

Those hedge funds dumped just over $2 billion worth of Netflix (NFLX) stock and nearly $1.8 billion worth of Apple (AAPL) shares, according to data compiled by FactSet.

Tiger cub hedge fund Tiger Global’s public-equity business, run by Scott Shleifer and Chase Coleman, ditched its massive bet of more than 17.9 million shares, according to the fund’s most recent 13-F filing. The position had been valued at just over $1.8 billion at the end of the first quarter. Tiger Global had been in the stock since the fourth quarter of 2014. In the second quarter of 2015, the fund massively increased its stake, making it a billion-dollar plus bet.

Elsewhere, fellow Tiger cub hedge fund Viking Global, led by billionaire Andreas Halvorsen, reduced its stake in Netflix in the second quarter by 22%, selling just over 1.77 million shares. Viking last held over 6.28 million shares, a position valued at over $575.2 million at the end of the quarter.

Shares of Netflix fell 10.5% during the second quarter. The stock is currently down 16% year-to-date.

Meanwhile, Apple, a longtime hedge fund darling, was the second largest sale among the 50 biggest hedge funds.

Tiger Global massively reduced its stake in Apple, selling 4.2 million shares, a 75% reduction in its position.

David Einhorn’s Greenlight Capital sold 1,358,300 shares, or 16%, of his stake. Apple remained Greenlight’s largest long equity holding with 6.85 million shares, a position valued at just over $655.3 million at the end of the quarter.

Meanwhile, Warren Buffett’s Berkshire Hathaway, which has historically shied away from tech stocks, increased its Apple position by 55% from 9.8 million shares to just over 15.2 million shares.

Shares of Apple slumped 12.3% during the quarter. The stock is still up 3.8% year-to-date.

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Legends of finance have big bets on the market going down

Tiger Global ditches its billion-dollar Netflix stake, cuts Apple

Here’s what hedge fund titans have been buying and selling

Hedge fund billionaire Dan Loeb bought a bunch of Facebook

Warren Buffett ramps up his huge bet on Apple, cuts back Walmart

Yahoo Finance

Yahoo Finance