'Big Short' investor Michael Burry hints the stock market could bottom within weeks - if this banking fiasco plays out like a previous one

Michael Burry hinted stocks could bottom in weeks, based on how a past banking crisis played out.

The "Big Short" investor noted the "1907 Bankers' Panic" concluded in just three weeks.

Three US lenders folded last week, sparking fears of a banking-sector meltdown and financial crisis.

Michael Burry of "The Big Short" fame has hinted the US stock market could bottom within weeks, if history repeats itself.

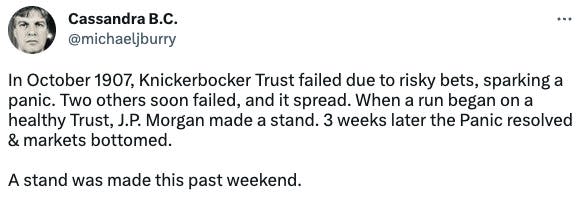

"In October 1907, Knickerbocker Trust failed due to risky bets, sparking a panic," Burry said in a now-deleted tweet on Wednesday. "Two others soon failed, and it spread. When a run began on a healthy Trust, J.P. Morgan made a stand."

"3 weeks later the Panic resolved & markets bottomed," Burry continued. "A stand was made this past weekend."

The Scion Asset Management chief was recounting the "1907 Bankers' Panic," when a bungled short squeeze culminated in a bank run on Knickerbocker Trust, one of New York City's largest banks.

The incident spooked depositors across the county, galvanizing a wave of withdrawals and a credit crunch. The chaos touched off one of the biggest stock-market crashes ever, leaving the Dow Jones Industrial Average down almost 50% from its peak the previous year.

John Pierpont Morgan Sr. pledged a chunk of his personal fortune to calm the nerves of investors and depositors, and convinced other financiers to do the same. Their efforts helped restore faith in the city's banking system, ending the crisis after just three weeks.

Burry's tweet suggests he sees a parallel between the JPMorgan founder intervening to halt that panic, and the Federal Deposit Insurance Corporation (FDIC), US Treasury, and Federal Reserve agreeing on Sunday to guarantee Silicon Valley Bank's deposits. The California-based lender faced a bank run and collapsed last week.

Two other banks, Silvergate and Signature Bank, also folded last week, stoking fears of a banking-sector meltdown and financial crisis.

Investors were already on edge, as historic inflation has spurred the Fed to hike interest rates from nearly zero to upwards of 4.5% over the past year. Higher rates increase borrowing costs and encourage saving over spending, which can curb upward pressure on prices. However, they can also weigh on asset prices and demand, increasing the risk of a recession.

Growing signs of strain in the banking system have hammered financial stocks, with titans such as Bank of America and Citigroup slumping more than 10% over the past five days, and smaller banks tumbling even more.

Yet Burry, who called the collapse of the mid-2000s housing bubble, tweeted on Monday that he isn't too worried about current pressures on banks.

"This crisis could resolve very quickly," he said. "I'm not seeing true danger here."

Here's a screenshot of Burry's latest tweet:

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance