There’s a Big Sale on the Big 6 Bank Stocks Right Now

Written by Kay Ng at The Motley Fool Canada

Economists are expecting a recession to occur this year in Canada and the United States. Therefore, the banks are expected to have higher percentages and amounts of bad loans. Consequently, they are generally increasing their provision for credit losses, which are recorded as expenses on their financial statements and reduces their near-term earnings expectations. This is why the Big Six Canadian bank stocks are relatively cheap. Let’s see how big the sale really is.

Big sale at these big Canadian bank stocks

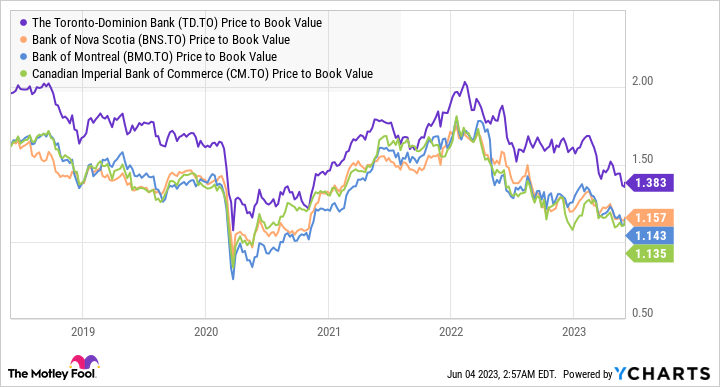

A few big Canadian bank stocks have declined meaningfully in the last 12 months, including Toronto-Dominion Bank (TSX:TD), Bank of Nova Scotia (TSX:BNS), Bank of Montreal (TSX:BMO), and Canadian Imperial Bank of Commerce (TSX:CM). In fact, because of Bank of Nova Scotia’s exposure to higher-risk international economies, BNS stock has fallen the most — down almost 22% — and slipped to the place of the fourth-largest Canadian bank based on market cap.

If you’re looking for the best bargains in the banking industry, explore these banks first. Interestingly, based on the price to book value, CIBC appears to be the cheapest, followed by Bank of Montreal and then Bank of Nova Scotia.

TD Price to Book Value data by YCharts

Based on price to earnings (P/E), you’ll notice that Bank of Nova Scotia has the lowest valuation. However, it tends to trade at a lower P/E than its peers because of its higher-risk exposure. It may be more appropriate to compare each bank stock’s P/E to that of its normal levels. Specifically, at $66.71 per share, BNS stock trades at a discount of about 25% from its long-term normal valuation.

TD Bank, BMO, and CIBC all trade at discounts of approximately 19-20% from their respective long-term normal valuations.

Enjoy big dividend yields from these bank stocks

Because of the sale in these big bank stocks, investors now have the opportunity to accumulate shares for bigger dividend yields. BNS and CIBC shares offer the highest dividend yields of close to 6.4% and 6.1%, respectively. TD and BMO’s yields of about 4.9% and 5.0%, respectively, are also relatively high versus their usual dividend yields.

Due to lower expected earnings this year, their payout ratios would spike up. However, they all have hefty levels of retained earnings from the profits they have made through the years, which could act as a buffer for their dividends if needed.

For example, currently analysts estimate that TD Bank’s earnings per share would shrink 29% this fiscal year, which would trigger the payout ratio to rise to roughly 57% whereas its normal payout ratio is below 50%. TD’s retained earnings could cover about 11 years of dividend payments if needed.

Resilient big bank stocks

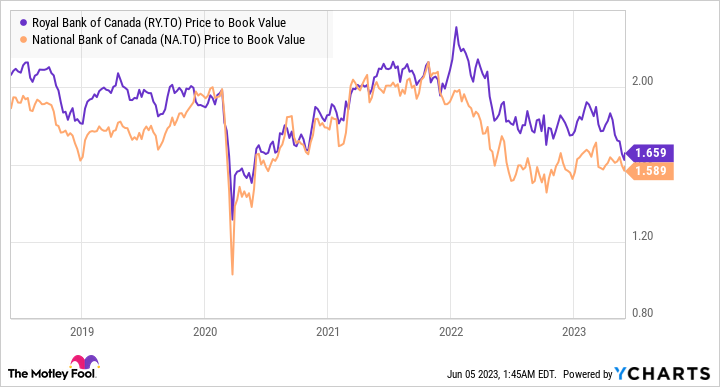

The stocks of Royal Bank of Canada and National Bank of Canada have been more resilient than their peers in the current macro environment. So, conservative investors might consider them first.

As there’s a general weakness in banking stocks, they also trade at relatively cheap levels to their normal levels. Here’s a chart displaying their price-to-book ratios over the last five years.

RY and NA Price to Book Value data by YCharts

RBC and National Bank stocks offer dividend yields of about 4.4% and 4.1%, respectively.

Investor takeaway

The Big Six Canadian banks are blue-chip stocks that offer safe dividend income. In this sale, investors could capture higher initial yields if they have long-term capital to allocate for the diversified portfolios.

The post There’s a Big Sale on the Big 6 Bank Stocks Right Now appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Bank of Montreal?

Before you consider Bank of Montreal, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in May 2023... and Bank of Montreal wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 23 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 5/24/23

More reading

Fool contributor Kay Ng has positions in Bank of Montreal, Bank Of Nova Scotia, Canadian Imperial Bank of Commerce, and Toronto-Dominion Bank. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance