Big Bank Stocks’ Market-Beating Rally Puts Onus on Outlooks

(Bloomberg) -- Shares of the biggest US banks have been trouncing the broader market this year as investors anticipate the lenders’ earnings outlook will brighten in the coming quarters.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

Five of the nation’s six major banks — led by Citigroup Inc., Goldman Sachs Group Inc. and Bank of America Corp. — have seen their shares race past the S&P 500 Index in 2024, for the group’s best year-to-date performance relative to the benchmark since 2021.

As the Wall Street stalwarts kick off their second-quarter earnings announcements Friday, investors are looking past another projected drop in net interest income — a key source of revenue for the lenders. Instead, they’re anticipating a rosy view on fee-generating businesses like investment banking and signals that at least some banks see a rebound in loan profits.

“I think near-term that momentum will continue” for the stocks, said David Konrad, an analyst with Keefe, Bruyette & Woods. “We do expect modestly declining net interest income trends, but frankly the capital markets revenue, the fee income kind of overshadows that.”

JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup start the earnings cycle Friday morning, followed by Goldman Sachs on Monday. Morgan Stanley and Bank of America follow Tuesday, with investors particularly focused on commentary from the latter about the trajectory of its net interest income, after the company said the second quarter would be its trough. NII is the difference between what banks earn on their assets and what they pay out for funds.

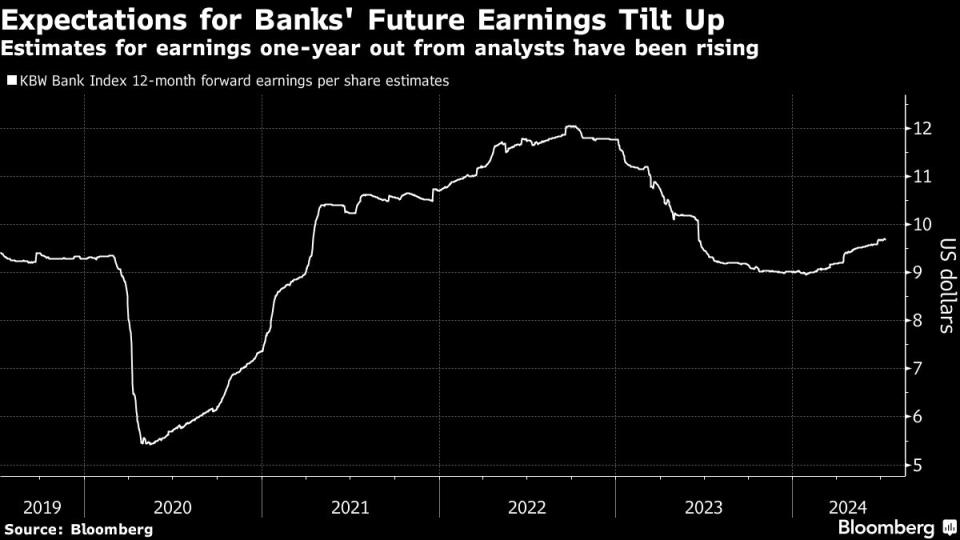

Investors who are bullish on the sector can point to Wall Street’s estimate for banks’ earnings per share for the next 12 months, which is looking as rosy as it has since the middle of last year. Part of that optimism stems from expectations that the Federal Reserve will eventually cut interest rates, which could lower deposit costs, ease credit concerns and boost capital markets.

Bank stocks’ outperformance in 2024 is a stark contrast to their struggles in the same stretch last year, in the wake of the tumult fueled by a spate of regional bank failures.

Shares of the largest lenders have done far better than the stocks of their smaller rivals, which tend to have less diversified sources of revenue. JPMorgan and Goldman Sachs are trading at records, while Wells Fargo and others are around multi-year highs.

“The larger your balance sheet and the more diverse revenue-making operations you own inside your bank, the better off you seem to be,” said Brian Mulberry, client portfolio manager at Zacks Investment Management.

Investors will be keen to get bank executives’ views on the economic outlook, as loan demand has remained muted aside from credit cards.

For investors, the key for the shares in last quarter’s earnings reports was banks’ outlooks for the rest of the year, and “that behavior is likely to continue,” Mulberry said.

Investment banking revenue will be in focus as investors look for momentum to build from last year’s levels. JPMorgan has said its quarterly investment banking fees could rise as much as 30%. A Citigroup investor event last month included commentary that the company expected investment-banking fees to likely rise 50% in the second quarter.

The earnings reports come just weeks after lenders passed the Fed’s annual stress tests, which led many to boost their dividends and opened the door for broader commentary about returning capital to shareholders. However, executives may take a conservative approach on that front given pending proposals to change bank capital rules.

--With assistance from Magdalena Del Valle, Emily Forgash and Todd Gillespie.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance