BHP to Shut Australia Nickel Business as Glut Upends Market

(Bloomberg) -- BHP Group Ltd. will close its loss-making nickel business in Australia until at least early 2027, after a global glut of the metal spread havoc through the market.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Stocks See Big Rotation as Yields Sink on Fed Bets: Markets Wrap

The company will place its Nickel West business on “care and maintenance” from October due to low prices of the metal used in electric-vehicle batteries, it said in a statement Thursday. It will also halt the development of its West Musgrave nickel mine.

BHP plans to spend A$450 million ($304 million) a year to support a potential restart should market conditions and the outlook for nickel improve.

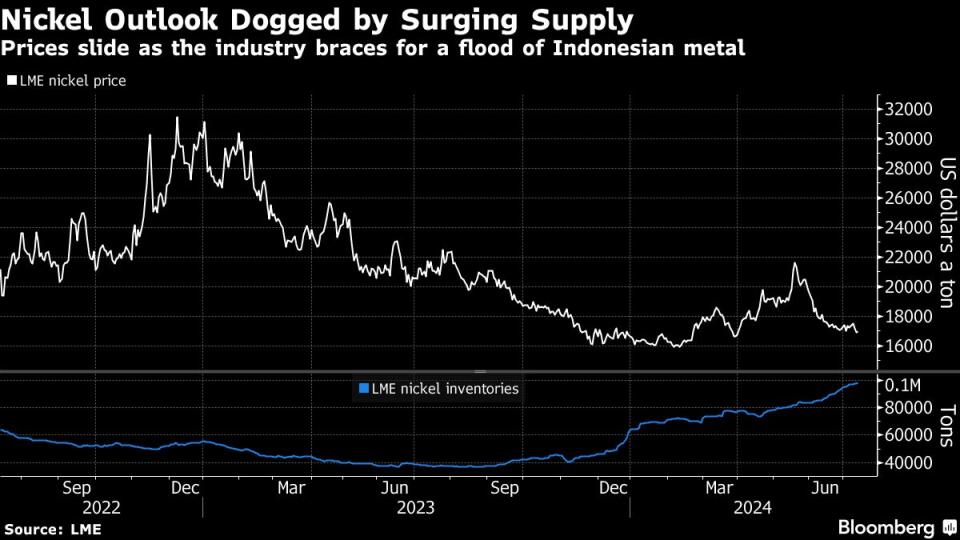

Nickel prices have crashed in recent years as new, low-cost production from Indonesia floods the global market. Benchmark futures on the London Metal Exchange have slumped about 20% since hitting a peak in May, when several mine closures prompted a bump higher. LME nickel traded around $16,960 a ton on Thursday.

The overall price slump has damaged prospects for established producers. Anglo American Plc is the process of looking to either sell or shut its nickel unit, while Glencore has moved to halt operations on the islands of New Caledonia.

Traditionally, nickel has been split into two categories: low grade for making stainless steel, and high grade for batteries. A huge Indonesian expansion of low-grade production led to a surplus, and — crucially — processing innovations have allowed that glut to be refined into a high-quality product.

That upended long-held views on the commodity by many in the industry. BHP previously sought to make nickel a key pillar of its pivot away from fossil fuels.

Market Outlook

BHP and other Australian producers have historically been major suppliers of the forms of refined nickel that underpin prices on the LME. The country accounted for 72% of the nickel in the exchange’s warehousing network in January 2023.

By June this year that share had slipped to 29%, with a steady stream of deliveries of Russian and Chinese metal helping to fuel to a 45% decline in prices over the period. The market is now bracing for a further wave of deliveries from newly built metal refineries in Indonesia that could drag prices lower still.

BHP said Thursday it has a constructive view of nickel from 2030 onwards as demand continues to grow, though it will need to see a sustainable deficit in the market before restarting operations.

The suspension comes after BHP in February announced a $3.5 billion impairment to the Nickel West asset and launched a strategic review. BHP’s Australian nickel business includes open-cut and underground mines, concentrators, and a smelter in Kalgoorlie. It also includes a refinery in Kwinana as well as the West Musgrave project it inherited when it bought Oz Minerals Ltd. last year.

(Updates with LME nickel prices in fourth paragraph.)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance