How Beyond Meat, the red-hot vegan unicorn, can finally make a profit

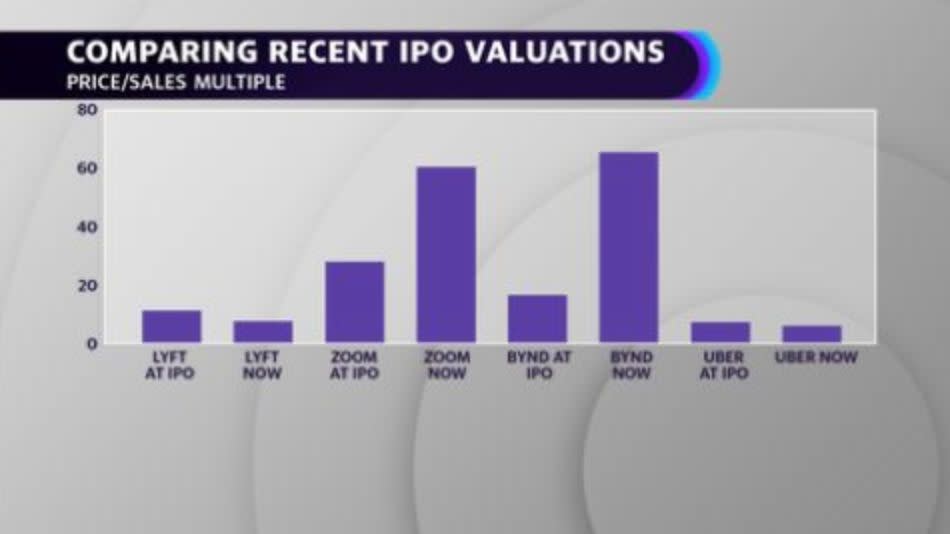

One of the hottest unicorns to IPO in 2019 is not only defying the market’s selloff, but rallying. Plant-based alternative meat company Beyond Meat (BYND) is up nearly 300% from its initial listing price with almost $6 billion in market value. But it’s still not profitable, at least not yet.

“The most important thing for Beyond Meat in the near-term is going to be the progression of revenues and the ability to continue to sign up new customers,” Bryan Spillane, senior U.S. food and beverage analyst at Bank of America Merrill Lynch, told Yahoo Finance’s YFi PM on Friday. “Whether it’s grocery retailers or restaurants, I think what investors will be focused on most is what that trajectory is and what [company] expectations are going forward.”

But the company is not just marketing its products to vegetarians — a group that makes up less than 5% of the U.S. population, according to a Gallup Poll from last year. Beyond Meat is also targeting meat eaters who just want to cut back, whether it be for health or environmental reasons, opening the company up to a far bigger market.

And that strategy seems to be working. The company reported over a 26-week period, 93% of customers who purchase Beyond Meat products at Kroger also bought traditional animal proteins.

But industry heavyweights could quickly be moving in on the space. Spillane, who has a neutral rating and an $85 price target on the stock, notes competition from more established brands is Beyond Meat’s biggest risk to investors.

“If a company like Nestlé decides to put its attention and energy behind this, can they get up the curb faster than it took for Beyond Meat to get there?” Spillane asked. “Right now, most of what we are seeing is a lot of trial. There isn’t much information about repeat purchases. So a risk would be people try it and don’t like it or it doesn’t necessarily have the sticking power.”

Beyond Meat had only 2% of the market for meat alternatives in 2018, according to research firm Euromonitor. That pales in comparison to household names like MorningStar Farms, owned by Kellogg (K), which raked in 17% of the market.

Beyond Meat’s best chance for expansion may be in partnerships with fast food restaurant giants. KFC’s U.S. President, Kevin Hochman, told Yahoo Finance’s YFi PM this week that he would not rule out adding vegan options to the menu. This comes as Jefferies says a McDonalds-sized corporate partnership could give Beyond meat about a 30% revenue bump. But Spillane says the key metric will be brand acceleration.

“The important thing to work in as well is how quickly they ramp,” Spillane notes. “You think about what Impossible Foods has done with Burger King. It’s a relatively limited test right now.”

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance