Beyond the Balance Sheet: What SWOT Reveals About Bristol-Myers Squibb Co (BMY)

Comprehensive SWOT analysis based on the latest SEC 10-Q filing.

Insight into Bristol-Myers Squibb's financial health and strategic positioning.

Identification of key strengths, weaknesses, opportunities, and threats facing BMY.

Analysis of recent acquisitions and their impact on BMY's portfolio.

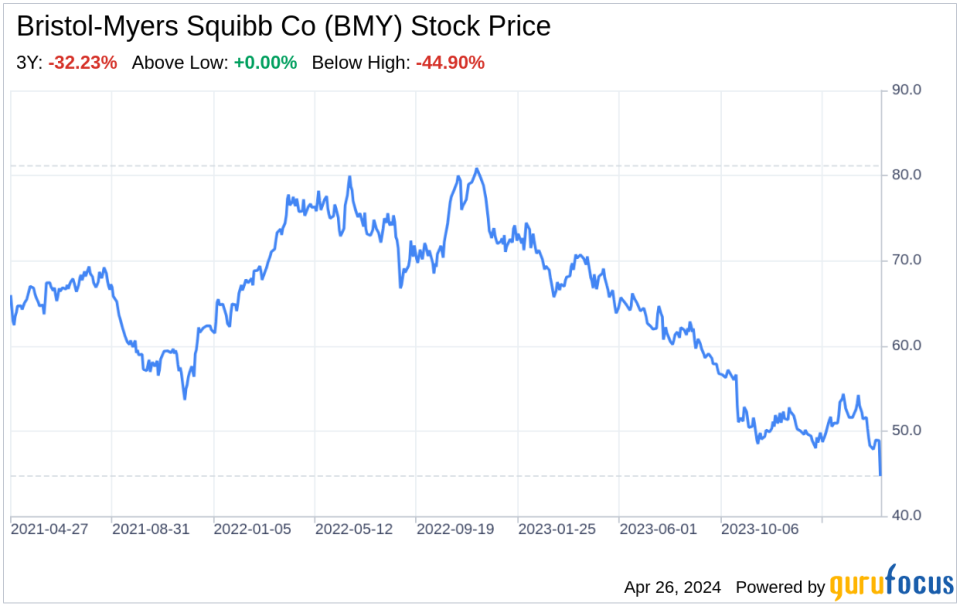

Bristol-Myers Squibb Co (NYSE:BMY), a leader in the pharmaceutical industry, recently filed its 10-Q report on April 25, 2024. The company, known for its innovative medicines in various therapeutic areas, has reported a net loss of $(11,908) million for the three months ended March 31, 2024, a significant downturn from the net earnings of $2,267 million in the same period last year. This financial overview indicates a challenging quarter for BMY, with comprehensive loss/income standing at $(11,762) million compared to a comprehensive income of $2,180 million in the previous year. The stark contrast in financial performance sets the stage for a detailed SWOT analysis to understand the underlying factors and strategic implications for the company.

Strengths

Robust Product Portfolio and Pipeline: Bristol-Myers Squibb Co (NYSE:BMY) boasts a diverse and innovative product portfolio, particularly strong in the immuno-oncology sector. The company's leading drugs have maintained a strong market presence, contributing significantly to revenue. The recent approvals of Abecma and Breyanzi for multiple myeloma and lymphoma, respectively, underscore BMY's commitment to expanding treatment options and enhancing its competitive edge. Moreover, the company's pipeline is bolstered by strategic acquisitions such as Karuna and RayzeBio, which bring promising new therapies into the fold, potentially driving future growth.

Financial Resilience and Investment in R&D: Despite the reported net loss, BMY has demonstrated financial resilience with a strong balance sheet, supported by a consistent investment strategy in research and development (R&D). This commitment to innovation is evident in the $12.1 billion expensed to Acquired IPRD for the Karuna acquisition, reflecting the company's willingness to invest heavily in potential blockbuster treatments. The focus on R&D positions BMY to deliver long-term value through a robust pipeline of drugs that can address unmet medical needs and drive future earnings.

Weaknesses

Financial Volatility and High Acquisition Costs: The recent financial performance of Bristol-Myers Squibb Co (NYSE:BMY) has been marked by volatility, as evidenced by the substantial net loss in the latest quarter. This downturn is largely attributed to significant one-time charges related to acquisitions, such as the non-tax deductible charge for acquiring Karuna. While these acquisitions are strategic, the immediate financial impact has been a considerable strain on earnings, highlighting the risks associated with aggressive expansion strategies and the need for careful financial management.

Dependence on U.S. Market: BMY's financials reveal a heavy reliance on the U.S. market, which accounts for nearly 70% of total sales. This concentration increases the company's exposure to domestic market risks, including policy changes, pricing pressures, and competition. Diversifying revenue streams geographically could mitigate this risk and provide more stability to the company's financial performance.

Opportunities

Expansion into Emerging Markets: Bristol-Myers Squibb Co (NYSE:BMY) has the opportunity to reduce its dependence on the U.S. market by expanding into emerging markets. These regions offer significant growth potential due to rising healthcare expenditures and an increasing demand for innovative treatments. By leveraging its strong product portfolio and pipeline, BMY can tap into new revenue streams and achieve a more balanced global presence.

Strategic Collaborations and Alliances: The strategic collaboration with SystImmune to co-develop and co-commercialize BL-B01D1 represents an opportunity for BMY to enhance its immuno-oncology portfolio and share development costs. Collaborations like these can accelerate drug development, spread risk, and provide access to new technologies and markets, ultimately driving growth and innovation.

Threats

Intense Competition and Patent Expirations: The pharmaceutical industry is highly competitive, with numerous companies vying for market share. Bristol-Myers Squibb Co (NYSE:BMY) faces the constant threat of competitors introducing new drugs that could erode the market share of its key products. Additionally, patent expirations expose BMY's top-selling drugs to generic competition, which can significantly impact revenue. The company must continue to innovate and protect its intellectual property to maintain its competitive position.

Regulatory and Pricing Pressures: BMY operates in a heavily regulated environment, where changes in healthcare laws and policies can have a profound impact on business operations. The ongoing litigation and government investigations, such as the IRA litigation, pose potential risks to the company's financial stability and reputation. Moreover, increasing pressure to lower drug prices can affect profitability, necessitating strategic responses to navigate these challenges effectively.

In conclusion, Bristol-Myers Squibb Co (NYSE:BMY) faces a complex landscape characterized by both promising opportunities and significant threats. The company's strong product portfolio and pipeline, coupled with strategic acquisitions, provide a solid foundation for growth. However, financial volatility, market concentration, and external pressures require vigilant management and strategic agility. As BMY navigates these challenges, its ability to innovate, collaborate, and adapt will be critical in shaping its future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance