Better Buy: Royal Bank of Canada Stock or Toronto-Dominion Bank?

Written by Kay Ng at The Motley Fool Canada

Since mid-2022, the big Canadian bank stocks have been range-bound, as illustrated by BMO Equal Weight Banks Index ETF, which has been trading largely between $32 and $36 per unit. The exchange-traded fund (ETF) just bounced from the bottom of the range last week.

The Big Six Canadian bank stocks that the ETF roughly holds an equal weight in all bounced last week. Royal Bank of Canada (TSX:RY) and Toronto-Dominion Bank (TSX:TD) bounced about 3.4% and 4%, respectively. Both have key operations in Canada and the United States. Which is a better buy? Let’s compare the two leading Canadian bank stocks.

A quick business overview

Royal Bank has a market cap of about $171 billion. It is a diversified financial services company that provides personal and commercial banking (40% of fiscal 2022 revenue), wealth management services (30%), insurance (7%), and capital markets services (18%).

TD Bank has a market cap of about $153 billion. It is focused on retail banking in Canada and the United States. It also has wholesale banking operations and a stake of about 13% in Charles Schwab.

Past results

Past results may be indicative of future results. In the past 10 fiscal years, Royal Bank has increased its adjusted earnings per share (EPS) at a compound annual growth rate (CAGR) of close to 8.5%. In the last 10 years, it has delivered annualized returns of almost 10.9%.

In the same period, TD Bank increased its adjusted EPS at a CAGR of close to 8.5%. In the last decade, TD has delivered annualized returns of almost 10.7%.

So, their earnings growth rates and total returns have been similar. In the last 10 years, both dividend stocks have also generated similar total dividends of approximately $6,000 on an initial investment of $10,000.

Valuation

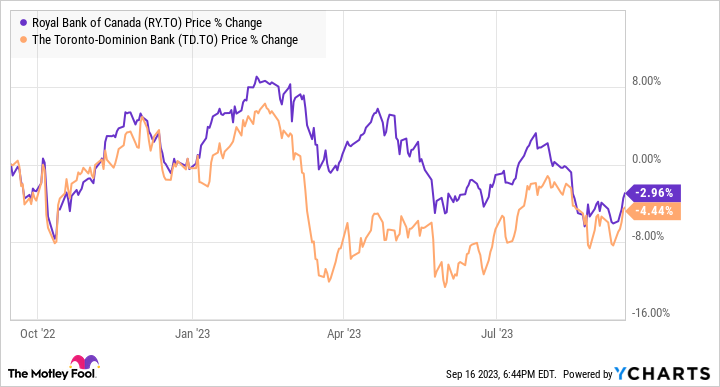

Because of Royal Bank’s diversified business mix, it tends to be more defensive. For example, in the last 12 months, RBC is down about 3% with lower volatility than TD stock, which is down about 4.4%, as shown in the graph below.

RY and TD data by YCharts

The economy is forced to adapt to much higher interest rates than in 2021, which is dampening economic growth. Some economists are even forecasting a recession in Canada and the United States by 2024. The gloomy outlook could continue to weigh on the stock valuations of these quality banking leaders.

Since RBC has a diversified business that allows it to deliver more resilient business results through economic cycles, it tends to trade at a slight premium to TD Bank. At about $124 per share at writing, RBC stock trades at about 11 times earnings versus its long-term, normal price-to-earnings ratio of about 12. In other words, it’s considered to be fairly valued.

At about $84 per share at writing, TD stock trades at about 10.3 times earnings versus its long-term normal price-to-earnings ratio of about 11.8. So, it trades at a discount of about 12%. In other words, TD stock is more undervalued than RBC.

Investor takeaway

At the recent quotations, RBC stock offers a dividend yield of 4.35% while TD stock yields 4.57%. Since TD is also more undervalued, it could be a better buy for potentially slightly higher returns than RBC stock over the next five years. That said, RBC could be a better buy for conservative investors, especially if investors are able to buy on weakness.

The post Better Buy: Royal Bank of Canada Stock or Toronto-Dominion Bank? appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Royal Bank of Canada?

Before you consider Royal Bank of Canada, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2023... and Royal Bank of Canada wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 26 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/16/23

More reading

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Fool contributor Kay Ng has positions in Royal Bank Of Canada and Toronto-Dominion Bank. The Motley Fool recommends Charles Schwab. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance