Better Buy: Metro or Loblaw Stock?

Written by Kay Ng at The Motley Fool Canada

CBC reported Monday that the Deputy Prime Minister Chrystia Freeland and Industry Minister François-Philippe Champagne have met with the heads of grocery chains Loblaw (TSX:L), Metro (TSX:MRU), Sobeys, Costco, and Walmart. In brief, the “five largest grocery chains have ‘agreed to work with’ the federal government to stabilize food prices.”

This could be a relief for Canadian citizens who have been experiencing outrageous food inflation. MoneySense highlighted that food price inflation averaged about 10.5% from 2021 to 2022. Further, Canada’s Food Price report conducted by four universities in Canada predicted that food prices will increase another 5-7% this year. Remember that the Bank of Canada aims to keep inflation, expressed as the year-over-year increase in the consumer price index, at 1-3%.

Strikes and wage hikes weighing on earnings

Global News reported that “more than 3,700 Metro workers went on strike at the end of July after rejecting their first tentative agreement, fighting for better pay. On August 31, they voted `yes’ on a second agreement, which included front-loaded wage gains beginning with a $1.50 hike.” This suggests that more wage hikes will be coming.

The Metro workers that went on strike only made up about 3.9% of the employees hired by the food and pharmacy leader across Quebec and Ontario. Supermarket News also reported that Loblaw workers in Manitoba are going on strike after their contract ends on the 28th if negotiations for a new deal fail. Strikes would be a temporary disruption to the businesses. As well, general wage hikes will cause costs to climb and hit the companies’ bottom lines.

Generally, grocery stores are more or less able to translate inflation into higher prices. However, in the near term, there’s a cap from their agreement to stabilize food prices.

Stock valuation

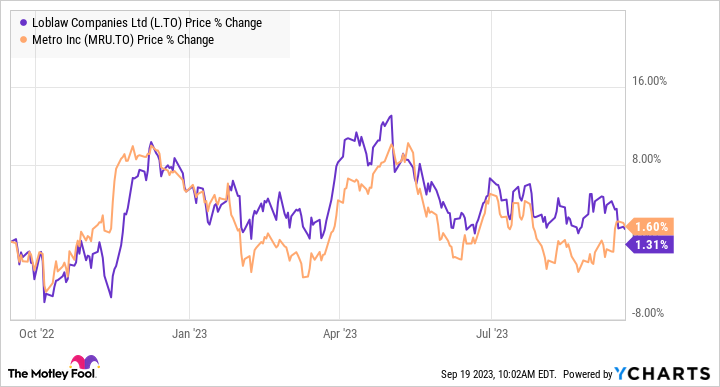

L and MRU data by YCharts

In the last 12 months, Loblaw and Metro stocks have moved in tandem, as shown in the graph above. Their total returns in this period have also been similar at about 3% and 3.6%, respectively.

Ultimately, the price is what you pay and value is what you get. At $114.66 per share at writing, Loblaw trades at about 15.5 times adjusted earnings. And analysts believe it trades at a discount of over 18% based on the 12-month consensus price target. At this price, Loblaw stock also offers a dividend yield of almost 1.6%.

At $72.26 per share at writing, Metro trades at about 16.5 times adjusted earnings. The 12-month analyst consensus price target represents a discount of about 9%. At this price, Metro stock offers a dividend yield of almost 1.7%.

Investor takeaway

Metro has a longer dividend growth track record than Loblaw. It has increased its dividend by about 28 consecutive years with a five-year dividend growth rate of 11.1%. In comparison, Loblaw has increased its dividend by about 11 consecutive years with a five-year dividend growth rate of 8.1%. That said, Loblaw stock offers a bit more value from a lower multiple while having a similar expected earnings growth rate of about 10% over the next couple of years. Therefore, Loblaw stock is probably a slightly better buy at current levels. Just be cautious as, in the short term, the stocks may be pressured from the food price stabilization initiatives.

The post Better Buy: Metro or Loblaw Stock? appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Loblaw Companies?

Before you consider Loblaw Companies, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2023... and Loblaw Companies wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 26 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/16/23

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends Costco Wholesale and Walmart. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance