Better Buy: Couche-Tard Stock vs. Canadian Tire

Written by Kay Ng at The Motley Fool Canada

Both Alimentation Couche-Tard (TSX:ATD) and Canadian Tire (TSX:CTC.A) are specialty retailers under the consumer cyclical category. The former has been a much better performer over different periods. For example, Couche-Tard stock’s 10-year total returns are 22.9% per year — more than double Canadian Tire stock’s returns of 10.5% annually in the period.

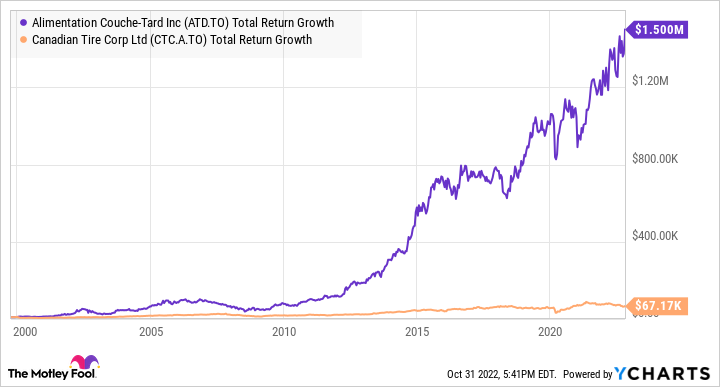

Consider the graphs below to see the action of both stocks across different periods.

Two retail stocks of different worlds

Couche-Tard’s recent returns continue to outperform Canadian Tire’s returns. Year to date, ATD stock has returned about 16.6%, while Canadian Tire stock has returned roughly -12.2%. Although both are specialty retailers, they’re very different companies.

Couche-Tard is a convenience store consolidator with a broad, global scale. It has a presence in 24 countries or territories. Most of its locations also include road transportation fuel, which helps drive traffic to its stores. It earns about 66% of its revenues in the United States.

The retailer sells time and convenience. Approximately 80% of its in-store merchandise is consumed within an hour of purchase. Management has a strong track record of generating quality cash flow and reinvesting it in mergers and acquisitions. Going forward, the company still sees a significant runway with global opportunities, particularly in the U.S. and Asia.

Canadian Tire is a markedly different kind of specialty retailer. Other than Canadian Tire, the retailer’s brands include SportChek, Mark’s, Party City, Helly Hansen, Atmosphere, Sports Experts, PartSource (an auto part chain), and Gas+ (a gasoline retailer). Its retail revenue makes up about 90% of its total revenue. It also offers financial services (such as credit cards) and owns a stake in CT REIT.

Canadian Tire’s product mix primarily consists of durable and discretionary goods. The demand for this type of product tends to weaken during economic contractions, which is the type of environment that we’re heading into. RBC and other experts believe a recession will descend upon Canada in 2023, potentially as soon as the first quarter.

Valuation

Because they’re a different type of retailer with a unique set of product mix, Couche-Tard enjoys a premium valuation. ATD stock trades at about 17 times earnings at $61 per share at writing. At $152.69 per share at writing, Canadian Tire stock trades at a depressed valuation of about 8.3 times earnings. Their current valuations suggest that Couche-Tard remains a growth stock, while Canadian Tire is a value stock.

Dividends

Both dividend stocks are Canadian Dividend Aristocrats. Couche-Tard’s 10-year dividend-growth rate is 25.1%. Canadian Tire stock’s dividend-growth rate is 15.6% in this period. As a growth stock, Couche-Tard pays out a smaller yield of 0.7% versus Canadian Tire’s decent dividend yield of 4.3%. Both dividends are sustainable.

The Foolish investor takeaway

A picture speaks a thousand words. Here’s a graph showing how an initial investment of $10,000 have grown in both retail stocks over the years. Long-term investors that have stayed with Couche-Tard stock could have become millionaires! The same can’t be said for Canadian Tire investors. Consequently, for long-term investors who seek total returns, Couche-Tard is likely a better buy.

ATD and CTC.A Total Return Level data by YCharts

That said, investors who need income now might still choose Canadian Tire over Couche-Tard.

The post Better Buy: Couche-Tard Stock vs. Canadian Tire appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Alimentation Couche-Tard?

Before you consider Alimentation Couche-Tard, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in October 2022 ... and Alimentation Couche-Tard wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 16 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 10/19/22

More reading

Want $1,000 in Monthly Passive Income? Buy 12,821 Shares of This TSX Stock

Just Released: The 5 Best Stocks to Buy in October 2022 [PREMIUM PICKS]

How I’d Invest $1,000 in October 2022 to Generate Passive Income for Life

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alimentation Couche-Tard Inc. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance