Best Value Stocks to Buy for April 26th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, April 26th:

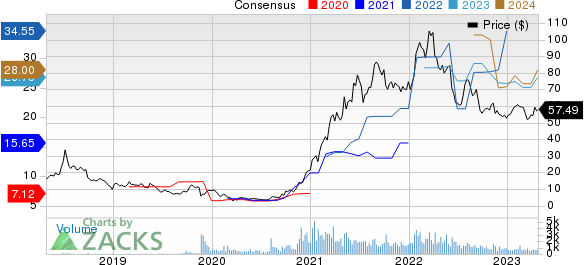

Vaalco Energy EGY: This independent energy company which is principally engaged in the acquisition, exploration, development and production of crude oil and natural gas, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.7% over the last 60 days.

Vaalco Energy Inc Price and Consensus

Vaalco Energy Inc price-consensus-chart | Vaalco Energy Inc Quote

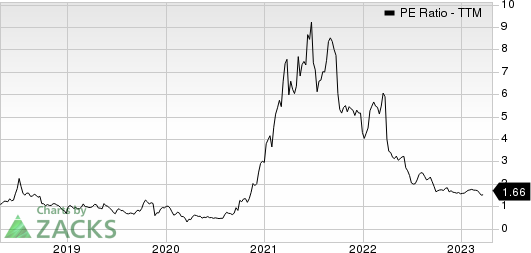

Vaalco Energy has a price-to-earnings ratio (P/E) of 1.89 compared with 7.00 for the industry. The company possesses a Value Score of A.

Vaalco Energy Inc PE Ratio (TTM)

Vaalco Energy Inc pe-ratio-ttm | Vaalco Energy Inc Quote

Danaos DAC: This company which is a leading international owner of containerships, chartering vessels to many of the world's largest liner companies, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.8% over the last 60 days.

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

Danaos has a price-to-earnings ratio (P/E) of 2.15 compared with 4.80 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

NatWest Group NWG: This banking and financial services company which provides personal and business banking, consumer loans, asset and invoice finances, commercial and residential mortgages, credit cards and financial planning services, as well as life, personal and income protection insurance, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.5% over the last 60 days.

NatWest Group plc Price and Consensus

NatWest Group plc price-consensus-chart | NatWest Group plc Quote

NatWest Group has a price-to-earnings ratio (P/E) of 5.64 compared with 7.40 for the industry. The company possesses a Value Score of B.

NatWest Group plc PE Ratio (TTM)

NatWest Group plc pe-ratio-ttm | NatWest Group plc Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vaalco Energy Inc (EGY) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

NatWest Group plc (NWG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance