Best Stock to Buy Now: Is TD Bank a Buy?

Written by Kay Ng at The Motley Fool Canada

Some of the best stocks to buy now (or anytime) are dividend stocks that provide secure and growing income to investors. How does Toronto-Dominion Bank (TSX:TD) look?

If you observe its stock price action over the last few years, it doesn’t look appealing, and you would pass over the stock. However, the Canadian bank stock has good potential of generating market-beating total returns over the next three to five years because of the cheap valuation it trades at on a forward basis.

Importantly, the quality bank has maintained or increased its dividend every year since at least 2004. This makes it a top candidate for conservative investors or any investors who are looking for reliable returns in the long run.

A better long-term investment than GICs

Right off the bat, the bank stock offers a dividend yield of 5.1%, which is quite attractive, seeing as the best one-year Guaranteed Investment Certificate (GIC) provides a rate of about 5.35%. TD stock’s dividend is safe. Its trailing 12-month payout ratio is about 56% of its net income, while its payout ratio is estimated to be roughly 52% of adjusted earnings this year.

Generally speaking, stocks are riskier than GICs, but TD Bank is a quality business to own. As long as investors do not overpay for the shares, they should get a decent long-term return while getting secure passive income in the meantime. In fact, if you don’t need the money, you can even hold the blue-chip stock forever.

For example, in the last 10 and 15 years, TD stock delivered annual total returns of approximately 7.5% and 10.7%, respectively. As I mentioned earlier, because the stock trades at a decent forward price-to-earnings ratio (P/E), it has good potential of outperforming. Over the next five years, if its valuation normalizes, it could deliver total returns of about 13% per year.

If you need your money back over the near term, say, within the next couple of years, it would be safer to stick with GICs. That said, investors need to plan ahead. When interest rates decline, capital will exit from safe investments like GICs and enter into quality stocks (like TD). As a result, stock prices will generally rise. Therefore, it’s better to park long-term capital in quality stocks, including TD, which tends to increase its payout over time.

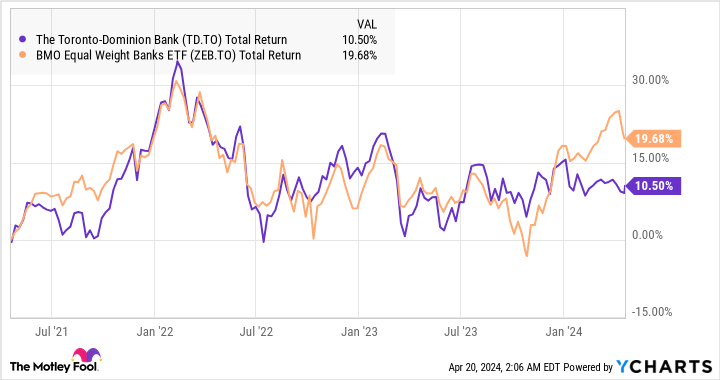

TD Total Return Level data by YCharts

As the graph above shows, TD stock has underperformed in the industry over the last three years. In the near term, it’s anticipated to experience higher loan-loss provisions, reflecting an increase in bad loans in its Canadian personal and commercial banking and U.S. retail businesses. So, it’s possible that the bank will experience another year of earnings decline this year.

In years of better economic conditions, TD stock has outperformed the industry with above-average earnings growth. This could happen again when the North American economy improves.

At $79.88 per share at writing, TD stock trades at about the midpoint of its trading range since early 2022. Adding that it trades at a decent forward P/E and offers a nice dividend, it’s not a bad time to pick up some shares.

The post Best Stock to Buy Now: Is TD Bank a Buy? appeared first on The Motley Fool Canada.

Should you invest $1,000 in TD Bank right now?

Before you buy stock in TD Bank, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TD Bank wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Toronto-Dominion Bank. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance