Best Income Stocks to Buy for March 1st

Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 1st:

Canadian Imperial Bank of Commerce CM: This leading North American financial institution that offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada, in the United States and around the world, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.2% over the last 60 days.

Canadian Imperial Bank of Commerce Price and Consensus

Canadian Imperial Bank of Commerce price-consensus-chart | Canadian Imperial Bank of Commerce Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.54%, compared with the industry average of 3.32%.

Canadian Imperial Bank of Commerce Dividend Yield (TTM)

Canadian Imperial Bank of Commerce dividend-yield-ttm | Canadian Imperial Bank of Commerce Quote

Sasol SSL: This company which is engaged in the mining and processing of coal and also produces chemicals, explores and refines crude oil, and manufactures fertilizers and explosives, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 14.6% over the last 60 days.

Sasol Ltd. Price and Consensus

Sasol Ltd. price-consensus-chart | Sasol Ltd. Quote

This Zacks Rank #1 company has a dividend yield of 4.75%, compared with the industry average of 3.50%.

Sasol Ltd. Dividend Yield (TTM)

Sasol Ltd. dividend-yield-ttm | Sasol Ltd. Quote

Ingredion INGR: This company which specializes in nature-based sweeteners, starches and nutrition ingredients, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 8.7% over the last 60 days.

Ingredion Incorporated Price and Consensus

Ingredion Incorporated price-consensus-chart | Ingredion Incorporated Quote

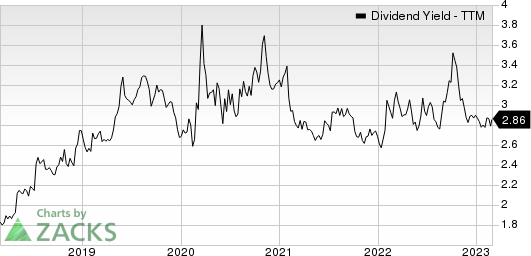

This Zacks Rank #1 company has a dividend yield of 2.86%, compared with the industry average of 0.00%.

Ingredion Incorporated Dividend Yield (TTM)

Ingredion Incorporated dividend-yield-ttm | Ingredion Incorporated Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sasol Ltd. (SSL) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance