Best Growth Stock Picks

Analysts are bullish on these following companies: Héroux-Devtek, Cortex Business Solutions, CES Energy Solutions. These companies are relatively strong financially, and have a great outlook in terms of profits and cash flow. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

Héroux-Devtek Inc. (TSX:HRX)

Héroux-Devtek Inc. engages in the design, development, manufacture, integration, testing, and repair and overhaul of aircraft landing gears, hydraulic flight control actuators, and fracture-critical components in Canada, the United States, and the United Kingdom. Formed in 1942, and now run by Gilles Labbé, the company size now stands at 1,408 people and with the company’s market cap sitting at CAD CA$591.15M, it falls under the small-cap stocks category.

HRX’s projected future profit growth is a robust 31.50%, with an underlying 57.21% growth from its revenues expected over the upcoming years. It appears that HRX’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 5.90%. HRX’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add HRX to your portfolio? Take a look at its other fundamentals here.

Cortex Business Solutions Inc. (TSXV:CBX)

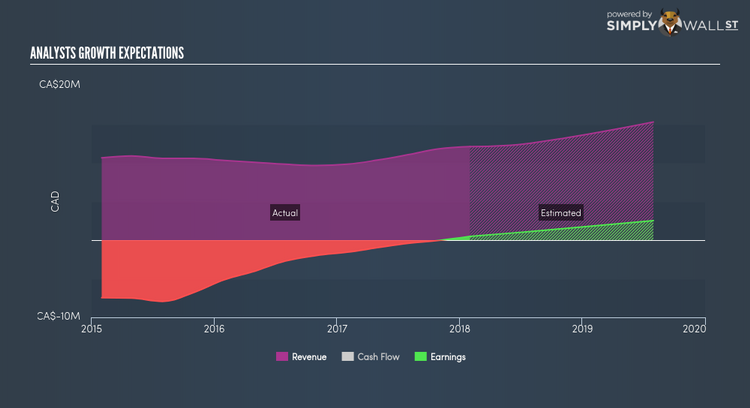

Cortex Business Solutions Inc. supplies e-commerce products and services in Canada and the United States. Established in 1999, and run by CEO Joel Leetzow, the company currently employs 63 people and with the stock’s market cap sitting at CAD CA$34.72M, it comes under the small-cap stocks category.

Considering CBX as a potential investment? Other fundamental factors you should also consider can be found here.

CES Energy Solutions Corp. (TSX:CEU)

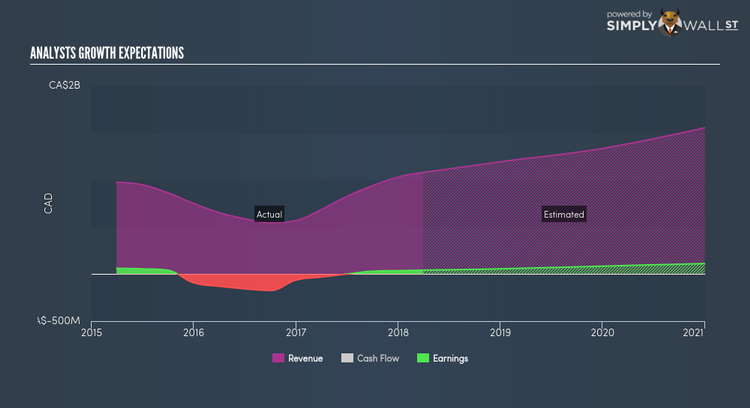

CES Energy Solutions Corp., together with its subsidiaries, provides consumable chemical solutions throughout the life-cycle of the oilfield. Formed in 1986, and currently run by Thomas Simons, the company provides employment to 1,724 people and with the stock’s market cap sitting at CAD CA$1.34B, it comes under the small-cap stocks category.

CEU is expected to deliver a buoyant earnings growth over the next couple of years of 37.93%, driven by a positive double-digit revenue growth of 28.71% and cost-cutting initiatives. It appears that CEU’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 13.07%. CEU’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in CEU? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance