Beat the TSX With This Cash-Gushing Dividend Stock

Written by Kay Ng at The Motley Fool Canada

Dividend stocks that are gushing cash can make their investors really rich over time. Brookfield Infrastructure Partners L.P. (TSX:BIP.UN) is one such dividend stock that you should at least put on your radar, as it has beat the TSX in the long run.

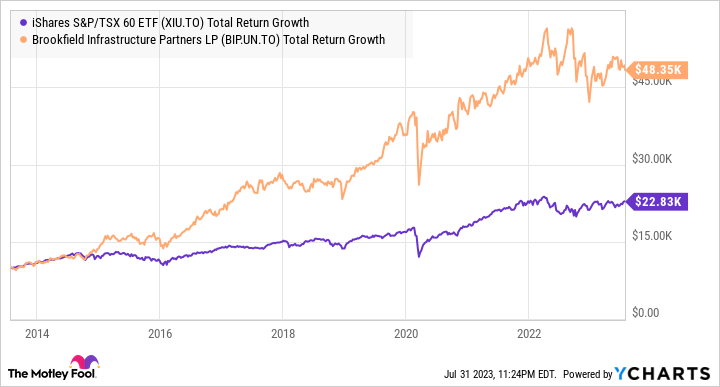

For example, in the last 10 years, the stock has delivered a compound annual growth rate (CAGR) of north of 17% versus the Canadian stock market’s (using iShares S&P/TSX 60 Index ETF as a proxy) return of approximately 8.6%. In other words, an initial investment of $10,000 turned into about $48,350 and $22,830, respectively, in the 10-year period.

XIU and BIP.UN Total Return Level data by YCharts

A growing business

Brookfield Infrastructure Partners has been expanding its diversified portfolio of quality infrastructure assets via acquisitions and organic growth. The growing global business more than doubled its revenues from 2019 to 2022 to US$14.4 billion. The infrastructure investment vehicle can explore the best opportunities across utilities, transport, midstream, and data in the growing sector.

The company earns regulated or contracted cash flows from utilities spanning Canada, the United States, India, Australia, New Zealand, Brazil, Germany, the United Kingdom, and Mexico. Energy assets include 62,000 km of electricity distribution and transmission lines, 4,200 km of gas pipelines, and 2,3 million residential energy customers.

Its transport business consists of 32,300 km of rail operations across Australia, Europe, the U.K., and North and South America. Additionally, it has 3,800 km of toll roads in South America and India. Midstream operations gather, transmit, transport, store, and process natural gas and or natural gas liquids. And the data infrastructure assets include telecom towers, data centres, and semiconductor manufacturing foundries.

Importantly, growing revenues have translated into growing funds from operations (FFO) on a per-unit basis. FFO is a key performance metric that leads to dividend growth. For instance, its FFO per unit rose roughly 12% last year. This translated to a healthy cash distribution hike of about 6% in February.

Gushing cash for investors

Brookfield Infrastructure Partners generates quality cash flows that are about 80% protected from inflation. Because management maintains a sustainable payout ratio of 60-70% of FFO, it has been healthily increasing its cash distribution over time.

Over the last 10 years, BIP.UN’s dividend growth rate has been about 8% per year. Brookfield targets a return on invested capital of 12-15% per year for the long haul. It’s also possible to increase its FFO per unit by about 10%. So, going forward, management is set to continue increasing the cash distribution at a sustainable rate of 5-9% per year.

Investor takeaway

Brookfield Infrastructure Partners is a value investor. It has a track record of making strategic acquisitions and optimizing the acquired assets. Management is not shy about selling mature assets and redeploying the capital for better risk-adjusted returns.

Right now, the analyst consensus 12-month price target suggests the undervalued stock trades at a good discount of about 21%. So, it’s not a bad time to invest shares for a long-term investment. At the recent price quote, it offers a cash distribution yield of about 4.3%.

The post Beat the TSX With This Cash-Gushing Dividend Stock appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Brookfield Infrastructure Partners?

Before you consider Brookfield Infrastructure Partners, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in July 2023... and Brookfield Infrastructure Partners wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 29 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 7/24/23

More reading

Fool contributor Kay Ng has positions in Brookfield Infrastructure Partners. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance