Bear of the Day: Sphere Entertainment (SPHR)

Sphere Entertainment (SPHR) currently lands a Zacks Rank #5 (Strong Sell) as the company has moved futher away from profitability at the moment.

The road ahead may be bumpy upon Sphere's spinoff from Madison Square Garden Entertainment (MSGE) on April 20. Sphere’s first independent venue is currently under construction in Las Vegas and will weigh on its bottom line with the company planning to open a second venue in London as well.

Furthermore, Sphere’s two regional television networks, MSG Network and MSG Sportsnet will naturally face increasing competition from a plethora of streaming services.

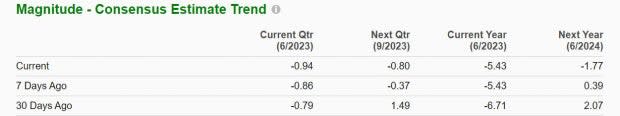

Declining Earnings Estimates

Alluding to the challenges ahead and the near-term impact of potentially opening a second venue in London is the decline in fiscal 2024 earnings estimates. Fiscal 2024 EPS estimates have largely declined from projections of $2.54 per share a month ago to forecast of an adjusted loss of -$1.77 a share.

While earnings estimates for the current year have gone up, an adjusted loss of -$5.43 a share is still expected.

Image Source: Zacks Investment Research

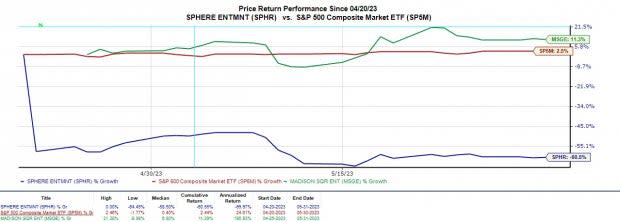

Spinoff Performance

Trading at $23 a share, the declining earnings estimates point to more volatility and downside risk ahead for Sphere stock. To that point, shares of SPHR dropped -20% in May and are now down -60% since its spinoff from Madison Square Garden.

Image Source: Zacks Investment Research

Bottom Line

Although Sphere has a vision of being a next-generation entertainment company its growth potential from live performances is still a few years away. For now, investors may want to stay on the sidelines as declining earnings estimates for FY24 have dimmed Sphere’s outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sphere Entertainment Co. (SPHR) : Free Stock Analysis Report

Madison Square Garden Entertainment Corp. (MSGE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance