Bear of the Day: Rockwell Automation, Inc. (ROK)

Rockwell Automation, Inc. (ROK) is an industrial automation and digital transformation firm facing a near-term slowdown as manufacturing cools following the post-Covid boom.

Rockwell Automation is still poised to benefit from wider megatrends across the economy. But ROK’s near-term earnings outlook has tumbled, pushing the stock down 15% YTD.

ROK 101

Rockwell Automation is an industrial automation and digital transformation company that aims to usher in the next generation of smart manufacturing. ROK is helping drive forward the tech-supported and constantly-connected economy to help its customers with their automation challenges.

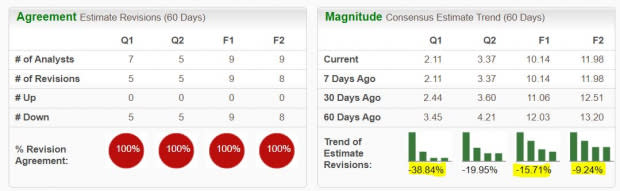

Image Source: Zacks Investment Research

The modern economy runs on tech-focused solutions for practically everything. ROK operates three core business units: Intelligent Devices, Software & Control, and Lifecycle Services.

Rockwell’s products and solutions serve an array of industries including power generation, aerospace, infrastructure, semiconductors, life sciences, warehouse and fulfillment, and beyond.

Near-Term Outlook

Rockwell grew its revenue by 17% last year, following back-to-back years of 11% top-line expansion. The company is currently navigating a slowing industrial sector. The firm lowered its 2024 guidance when it reported its Q2 FY24 results in early May, even though it experienced “sequential order improvement.”

Rockwell CEO Blake Moret said in prepared remarks that ROK is seeing more “excess inventory” at its customers, particularly machine builders, than originally expected. The chief executive said ROK was “not yet seeing the accelerated order ramp this fiscal year and are reducing our full-year guidance.”

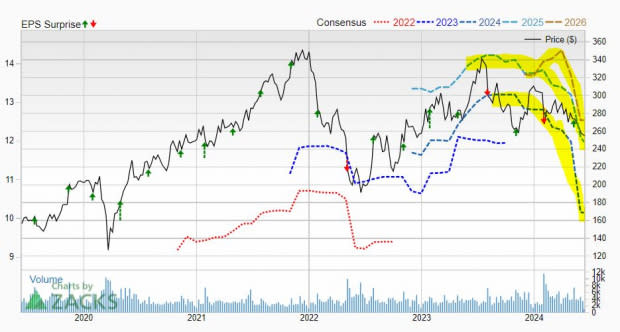

Image Source: Zacks Investment Research

ROK’s sales are projected to slip 6% in FY24 to $8.50 billion. Rockwell’s adjusted fiscal 2024 earnings are expected to fall by 16% YoY. ROK’s FY24 earnings estimate has dropped 16% since its last report, with its FY25 outlook 9% lower.

Bottom Line

Rockwell’s recent downward EPS revisions are part of a prolonged decline over the past year to help it land a Zacks Rank #5 (Strong Sell). ROK shares have fallen 15% during the past 12 months vs. the Zacks Industrial Products sector’s 13% climb.

Rockwell trades below its 21-week, 50-week, and 200-week moving averages. Investors might not want to call a bottom on ROK yet. That said, Rockwell is prepared to grow for decades on the back of reshoring, infrastructure spending, the energy revolution, and the never-ending push to streamline work through automation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance