Bear of the Day: Digital Turbine (APPS)

Digital Turbine, Inc. APPS is still seeing macro headwinds. This Zacks Rank #5 (Strong Sell) is expected to see declining earnings in Fiscal 2023 but is hopeful for a rebound later this calendar year.

Digital Turbine, headquartered in Austin, Texas, is a mobile growth platform for advertisers, publishers, carriers and OEMS. By integrating a full ad stack with proprietary technology built into devices by wireless operators and OEMs, it supercharges advertising and monetization.

It has offices in large cities across the United States, and in London, Berlin, Singapore, and Tel Aviv.

A Big Miss in Fiscal Third Quarter

On Feb 8, 2023, Digital Turbine reported its fiscal third quarter of 2023 and missed on the Zacks Consensus. It reported earnings of $0.29 versus the consensus of $0.37.

It was the company's second miss in the last 4 quarters.

Revenue fell 25% to $162.3 million compared to the year ago period.

"While nothing has changed regarding our long-term view of the digital media industry or our strategic positioning within the industry, macro headwinds are impacting our near-term results," said Bill Stone, CEO.

"We expect current macro headwinds to continue into the first half of the calendar year, but our high-level strategic vision remains intact, as advertising spending tends to be among the first items to be negatively impacted at the onset of a cyclical downturn, but is typically also among the first items to rebound," he added.

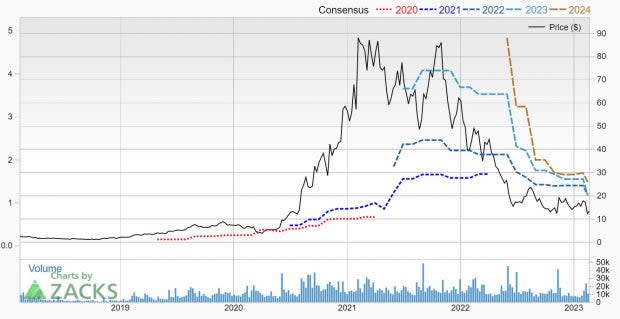

Analysts Cut Fiscal 2023 and 2024 Earnings Estimates

The analysts are bearish given the challenging macro environment.

2 estimates have been cut for Fiscal 2023 since the earnings report, pushing the Zacks Consensus down to $1.18 from $1.32. This is an earnings decline of 28.9% as the company made $1.66 in fiscal 2022.

Analysts also cut for Fiscal 2024 cutting the Zacks Consensus down to $1.17 from $1.40. That's just a penny less than this year but shows that the analysts, for now, think that earnings might stabilize in the second half of this calendar year.

Shares Sink 85% in the Last 2 Years

It's been rough being a shareholder of Digital Turbine the last 2 years. Shares are down 85% during that time.

Image Source: Zacks Investment Research

Even in 2023, shares are down 15.8% year-to-date after the earnings miss sent shares tumbling again.

But, the good news is that they are now cheap. Digital Turbine trades with a forward P/E of 11.3. It also has a PEG ratio of just 0.8. A PEG under 1.0 usually indicates a company is undervalued.

However, investors interested in the online advertising industry might want to wait until the macro headwinds abate before jumping in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance