BD (BDX) Inks Buyout Deal to Expand Smart Connected Care Suite

Becton, Dickinson and Company BDX, popularly known as BD, recently announced a definitive agreement to acquire Edwards Lifesciences’ EW Critical Care product group (Critical Care). The transaction is expected to close before the end of the calendar year 2024, subject to customary regulatory reviews and closing conditions.

EW's Critical Care's portfolio includes the gold-standard Swan Ganz pulmonary artery catheter, minimally invasive sensors, non-invasive cuffs, tissue oximetry sensors and monitors. Upon closing, Critical Care will operate as a separate business unit within BD's Medical segment to align with its smart connected care approach.

The latest acquisition is expected to significantly boost BD's Medical segment on a global scale and solidify its foothold in the smart connected care solutions space.

Financial Details

Per the agreement terms, BD will acquire Edwards Lifesciences’ Critical Care for $4.2 billion in cash.

The transaction is expected to be immediately accretive to all key financial measures, including BD's revenue growth, adjusted gross and operating margins, and adjusted earnings per share. Critical Care's long-term financial profile is also expected to deliver durable revenue growth of approximately 6-7%, with year-one adjusted gross margin of at least 60% and adjusted operating margins of at least 25% that increase over time.

Additional margin expansion and value are expected to be generated from moderate synergies, primarily from cost of goods sold, supply-chain efficiencies, and general and administrative expenses via BD Excellence operating system principles while preserving EW's Critical Care's commercial and innovation resources.

Rationale Behind the Acquisition

Edwards Lifesciences’ Critical Care has solidified its position in advanced patient monitoring with advanced artificial intelligence (AI) algorithms and currently serves millions of patients globally. Critical Care’s, the inventor of the hemodynamic monitoring category, solutions are presently used in more than 10,000 hospitals globally to better understand the cardiovascular condition in real-time for critically ill patients. This, in turn, helps in improving outcomes.

Per BD’s management, Critical Care is expected to expand BD's portfolio of smart connected care solutions with its growing set of leading monitoring technologies, advanced AI-enabled clinical decision tools and robust innovation pipeline that complement BD's existing technologies serving operating rooms and intensive care units.

Industry Prospects

Per a report by Towards Healthcare, the global smart healthcare market is anticipated to grow from $201.83 billion in 2022 and reach $1,097.27 billion by 2032 at a CAGR of 18.5%. Factors like the increasing demand for healthcare services, the rising prevalence of chronic diseases, the growing adoption of digital health solutions, and the need to reduce healthcare costs are likely to drive the market.

Given the market potential, the latest buyout is expected to provide a significant impetus to BD’s business.

Notable Developments in Medical Segment

Last month, BD reported its second-quarter fiscal 2024 results, wherein its Medical segment recorded a solid uptick in year-over-year revenues on a reported and organic basis and at constant exchange rate. The revenue growth was driven by the Medication Delivery Solutions (MDS) and Medication Management Solutions (MMS) business units.

In March, BD’s MMS unit announced positive data from a new study that shows using the BD Pyxis MedBank Automated Dispensing Cabinet system in long-term care facilities results in clinical workflow, operational efficiency and financial improvements.

The same month, BD’s MDS business unit announced that it is further increasing domestic production of syringes to support U.S. healthcare needs, following the latest FDA safety communication regarding certain non-BD plastic syringes.

Price Performance

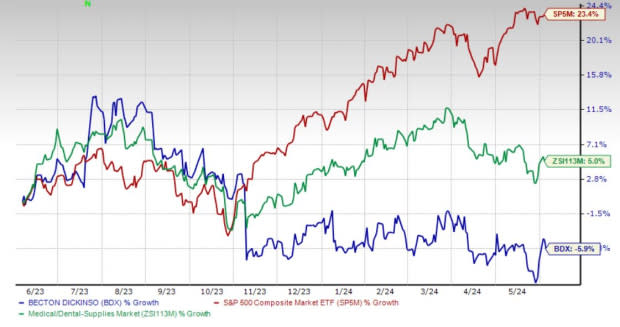

Shares of BD have lost 5.9% in the past year against the industry’s 5% rise and the S&P 500's 23.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, BD carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader medical space are DaVita Inc. DVA and Boston Scientific Corporation BSX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 44.9% compared with the industry’s 20.1% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has gained 49.2% compared with the industry’s 3.2% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance