Bassett Furniture Industries Inc (BSET) Faces Sales Decline: A Look at Fiscal Q1 Earnings

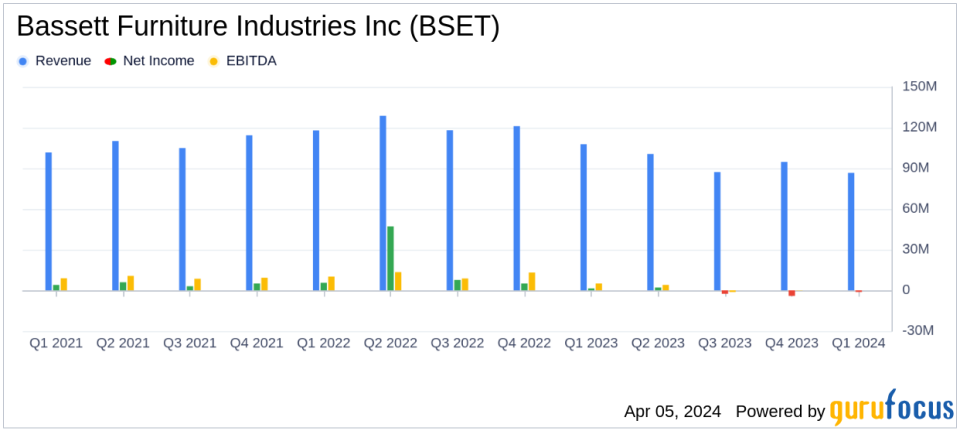

Revenue: Reported $86.6 million, a decline of 19.6% from the previous year, missing analyst estimates of $92.658 million.

Net Income: Posted a net loss of $1.2 million, falling short of the estimated net income of $0.607 million.

Earnings Per Share (EPS): Recorded a loss of $0.14 per share, contrasting with the estimated earnings of $0.07 per share.

Gross Margin: Reached an all-time high of 55.3%, despite the overall decrease in sales and profitability.

Balance Sheet: Maintained a strong balance sheet with $40.6 million in cash and cash equivalents, providing stability in a challenging economic environment.

Bassett Furniture Industries Inc (NASDAQ:BSET), a prominent player in the home furnishings market, released its 8-K filing on April 3, 2024, disclosing the financial results for the first quarter ended March 2, 2024. The company faced a challenging quarter with consolidated sales dropping by 19.6% to $86.6 million, a stark contrast to the $107.7 million reported in the same period last year, and below the analyst revenue estimate of $92.658 million. The earnings per share (EPS) also reflected a loss of $0.14, diverging from the estimated earnings of $0.07 per share.

Bassett Furniture Industries Inc operates through three segments: Wholesale, Retail, and Corporate and others. The Wholesale segment saw a 21.7% decrease in sales, while the Retail segment experienced a 17.2% drop. The company attributed the decline to a combination of factors, including adverse weather conditions that impacted sales events and a shift in consumer preferences away from home-related purchases.

The company reported a net loss of $1.2 million, indicating a downturn from the net income of $1.445 million in the prior year and missing the estimated net income of $0.607 million. Despite achieving a record consolidated gross margin of 55.3%, the reduced sales volume led to an operating loss of $2.4 million. BSET emphasized its efforts on expense reduction strategies to improve profitability without compromising market share in the competitive furniture industry.

In the face of these challenges, Bassett Furniture Industries Inc highlighted several financial achievements. The company's strong balance sheet, with $40.6 million in cash and cash equivalents, provides a cushion against the current downturn while supporting the dividend. Additionally, the company is taking strategic steps to enhance its product offerings and retail operations. These include opening new stores, implementing a new retail distribution model to reduce expenses, and introducing new products to increase unit velocity.

On the wholesale front, the company is focusing on Made-in-America products, with 80% of invoiced products manufactured domestically. The introduction of new product lines and sourcing from India are part of BSET's strategy to diversify its offerings and respond to customer demand.

The company's balance sheet remains robust, with total assets amounting to $361.445 million as of March 2, 2024. The strong financial position is crucial for the company as it navigates through the current economic headwinds and positions itself for future growth.

In summary, Bassett Furniture Industries Inc faces significant headwinds as it reports a decrease in sales and a net loss for the fiscal first quarter of 2024. The company's focus on maintaining a strong balance sheet and innovating in product and retail strategies are pivotal as it aims to rebound from the current challenges and capitalize on future market opportunities.

For a more detailed look at Bassett Furniture Industries Inc's financial performance and strategic initiatives, investors and stakeholders are encouraged to review the full earnings report.

Explore the complete 8-K earnings release (here) from Bassett Furniture Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance