Barry Callebaut And Two Additional Stocks Seemingly Priced Below Fair Value On SIX Swiss Exchange

The Switzerland market has shown resilience, shaking off a slow start to end on a positive note as evidenced by the SMI's recent gains. A slight dip in consumer price inflation, indicating easing pressures, has contributed positively to market sentiment. In such an environment, identifying stocks that appear undervalued could offer potential opportunities for investors looking for value in a stable market setting.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sulzer (SWX:SUN) | CHF134.80 | CHF219.30 | 38.5% |

COLTENE Holding (SWX:CLTN) | CHF47.00 | CHF76.57 | 38.6% |

Julius Bär Gruppe (SWX:BAER) | CHF52.32 | CHF96.37 | 45.7% |

Burckhardt Compression Holding (SWX:BCHN) | CHF611.00 | CHF848.98 | 28.0% |

Sonova Holding (SWX:SOON) | CHF281.10 | CHF463.94 | 39.4% |

SGS (SWX:SGSN) | CHF81.04 | CHF125.41 | 35.4% |

Temenos (SWX:TEMN) | CHF63.10 | CHF85.60 | 26.3% |

Comet Holding (SWX:COTN) | CHF372.00 | CHF581.10 | 36% |

Medartis Holding (SWX:MED) | CHF68.70 | CHF129.75 | 47.1% |

Kudelski (SWX:KUD) | CHF1.47 | CHF1.87 | 21.4% |

Let's uncover some gems from our specialized screener

Barry Callebaut

Overview: Barry Callebaut AG operates in the production and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.43 billion.

Operations: The company's revenue is primarily derived from its Global Cocoa segment, which generated CHF 5.31 billion.

Estimated Discount To Fair Value: 14.6%

Barry Callebaut, with a current trading price of CHF 1541, is positioned below our estimated fair value of CHF 1804.13, marking it as modestly undervalued. Despite recent earnings showing a significant drop to CHF 77.93 million from last year's CHF 235.49 million, forecasts are optimistic with expected annual revenue and profit growth outpacing the Swiss market at rates of 9% and 25.1% respectively. However, concerns include high volatility in share price and debt not well covered by operating cash flow.

SGS

Overview: SGS SA operates globally, offering inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 15.34 billion.

Operations: The company's revenue is diversified across several segments, with Industries & Environment generating CHF 2.19 billion, Natural Resources at CHF 1.58 billion, Connectivity & Products contributing CHF 1.25 billion, Health & Nutrition at CHF 0.86 billion, and Business Assurance bringing in CHF 0.75 billion.

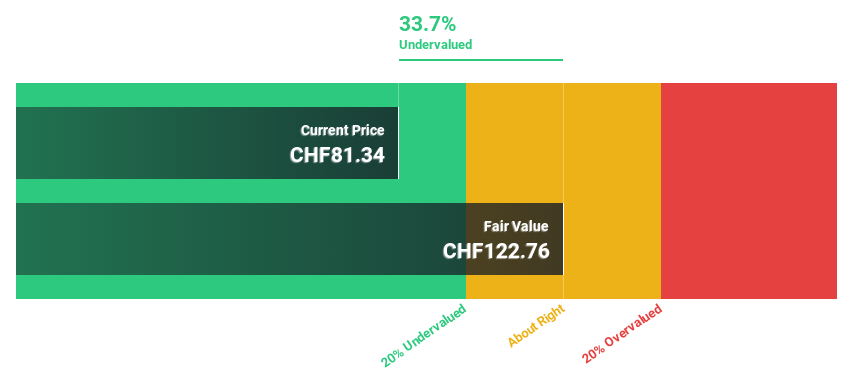

Estimated Discount To Fair Value: 35.4%

SGS, priced at CHF81.04, trades significantly below our fair value estimate of CHF125.41, reflecting a 35.4% undervaluation based on discounted cash flows. Despite a modest revenue growth forecast of 4.7% annually—slightly above the Swiss market's 4.5%—SGS's earnings are expected to outperform with a 9.73% annual increase, surpassing the market's 8.2%. Challenges include shareholder dilution over the past year and high debt levels which could impact financial flexibility.

Sulzer

Overview: Sulzer Ltd specializes in developing and selling products and services for fluid engineering and chemical processing applications globally, with a market capitalization of CHF 4.56 billion.

Operations: The company's revenue is divided into three main segments: Chemtech, which generated CHF 772.50 million; Services, with CHF 1.15 billion; and Flow Equipment, contributing CHF 1.35 billion.

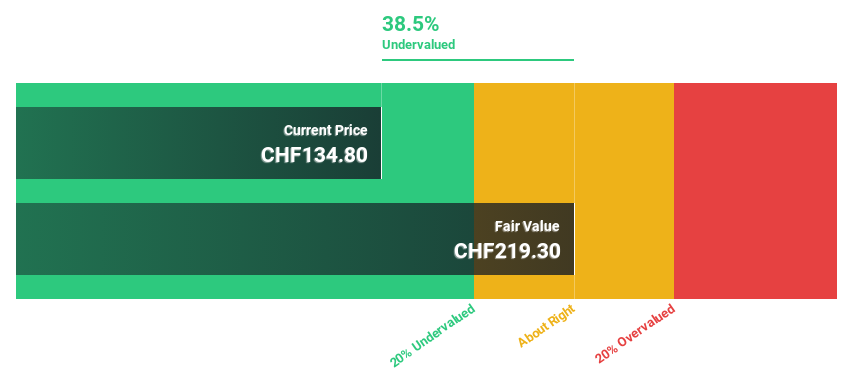

Estimated Discount To Fair Value: 38.5%

Sulzer, with a current price of CHF134.8, is assessed to be well below its calculated fair value of CHF219.3, indicating a significant undervaluation based on discounted cash flows. The company has experienced a substantial earnings growth of 701% over the past year and anticipates further increases at an annual rate of 9.66%. Despite this robust growth trajectory, Sulzer's dividend record remains inconsistent. Recent engagements include presentations at major industry events across Europe and Africa, underscoring its active market presence.

The growth report we've compiled suggests that Sulzer's future prospects could be on the up.

Delve into the full analysis health report here for a deeper understanding of Sulzer.

Key Takeaways

Reveal the 14 hidden gems among our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BARN SWX:SGSNSWX:SUN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance