Baron Funds' Top Trades of the 1st Quarter

- By Graham Griffin

Ron Baron (Trades, Portfolio), founder of Baron Funds, has disclosed the firm's portfolio for the first quarter of 2021. Top trades include reductions in top holdings Tesla Inc. (NASDAQ:TSLA) and IDEXX Laboratories Inc. (NASDAQ:IDXX), a new buy into TripAdvisor Inc. (NASDAQ:TRIP) and additions to the firm's BridgeBio Pharma Inc. (NASDAQ:BBIO) and EPAM Systems Inc. (NYSE:EPAM) holdings.

The firm invests primarily in small and mid-size growth companies and likes companies with open-ended growth opportunities and defensible niches. It applies bottom-up company research, invests for the long term and tries to purchase companies at what are believed to be attractive prices.

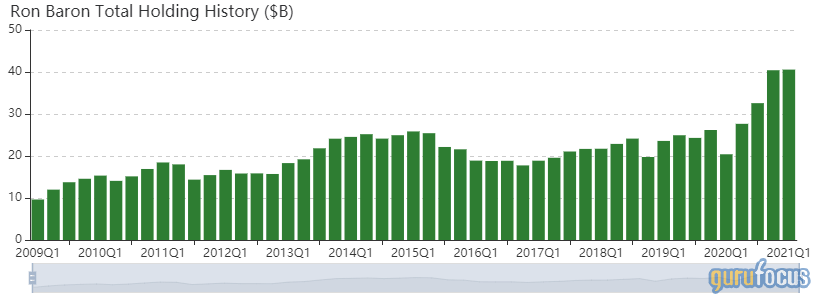

Portfolio overview

At the end of the quarter, the firm's portfolio contained 394 stocks, with 38 new holdings. It was valued at $40.57 billion and has seen a turnover rate of 5%. Top holdings include Tesla, CoStar Group Inc. (NASDAQ:CSGP), IDEXX Laboratories, Vail Resorts Inc. (NYSE:MTN) and Penn National Gaming Inc. (NASDAQ:PENN).

The top three sectors represented are consumer cyclical (28.28%), technology (20.51%) and health care (15.09%).

Tesla

The firm's top trade of the quarter came from the sale of 582,656 shares of Tesla (NASDAQ:TSLA). The sale shrunk the holding by 8.65% and the shares traded at an average price of $754.20 during the quarter. Overall, the sale had a -1.02% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at a staggering 1,140.45%.

Founded in 2003 and based in Palo Alto, California, Tesla is a vertically integrated sustainable energy company that also aims to transition the world to electric mobility by making electric vehicles. It sells solar panels and solar roofs for energy generation plus batteries for stationary storage for residential and commercial properties including utilities. It also makes solar roofs and plans to enter the HVAC market. The Tesla Roadster debuted in 2008, Model S in 2012, Model X in 2015, Model 3 in 2017 and Model Y in 2020. Global deliveries in 2020 were 499,647 units. Tesla went public in 2010 and employs about 71,000 people.

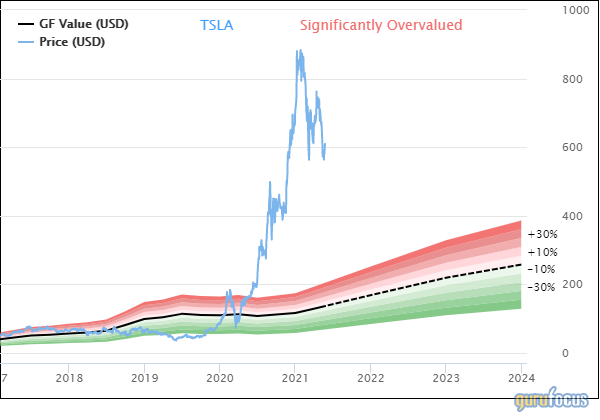

On May 24, the stock was trading at $609.43 per share with a market cap of $586.30 billion. According to the GF Value Line, the shares are still trading at a significantly overvalued rating.

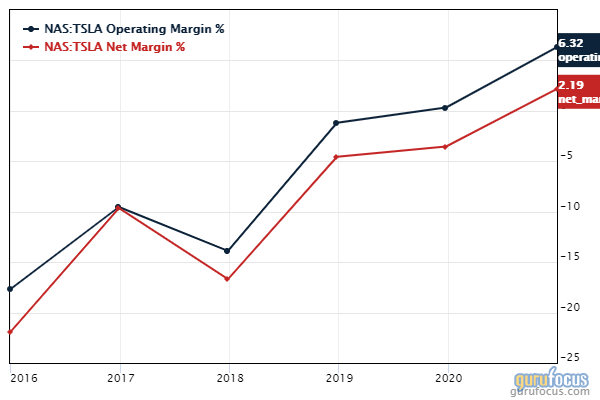

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rank of 3 out of 10. There is currently one severe warning sign issued for a declining gross margin. The company's operating margin of 6.13% ranks the company above 62.23% of the industry and the net margin of 3.09% is the maximum seen over the last 10 years.

TripAdvisor

The firm's second-largest trade of the quarter came from a new position established in TripAdvisor (NASDAQ:TRIP). The 4.97 million shares that were purchased traded at an average price of $42.81 during the quarter. The holding has lost an estimated 3.99% since it was purchased and the new position had a 0.66% impact on the equity portfolio overall.

TripAdvisor is the world's leading travel metasearch company. The website offers 884 million reviews and information on 8.3 million accommodations, restaurants, experiences, airlines and cruises. In 2020, 60% of revenue came from the company's hotel, media and platform segment, which includes hotel revenue generated through advertising on its metasearch platform as well as commissions received on its Instant Booking platform. Experiences and dining represented 31% of revenue with the remainder consisting of flight, rental and non-branded TripAdvisor sales.

As of May 24, the stock was trading at $41.14 per share with a market cap of $5.62 billion. The shares are given a significantly overvalued rating by the GF Value Line.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 6 out of 10. There are currently two severe warning signs issued for a low Piotroski F-Score and declining revenue per share. The company has struggled to balance their profitability over the last several years and the weighted average cost of capital has started to exceed the return on invested capital.

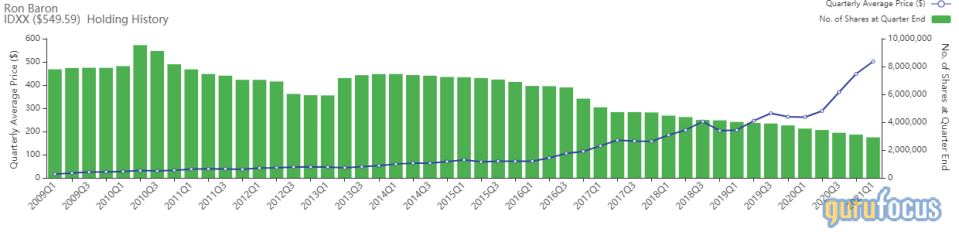

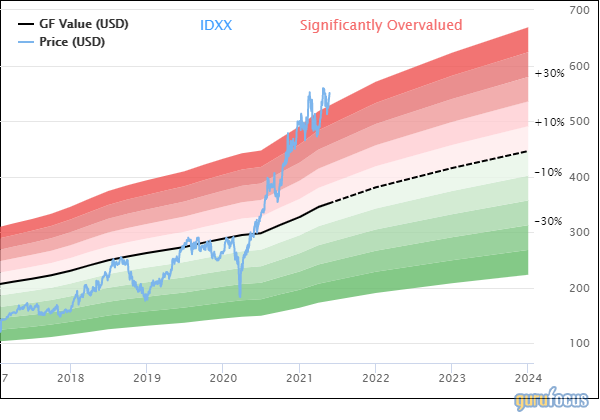

IDEXX Laboratories

Another of the firm's top holdings to be scaled back was IDEXX Laboratories (NASDAQ:IDXX). The firm sold 197,133 shares during the quarter to reduce the holding by 6.34%. Throughout the quarter, the shares traded at an average price of $501.70. The sale had an overall impact of -0.24% on the equity portfolio and GuruFocus estimates the total gain of the holding at 940.34%.

Idexx Laboratories primarily develops, manufactures and distributes diagnostic products, equipment and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services and tests to detect and manage disease in livestock. The company also offers vet practice management software and consulting services to animal hospitals. Idexx gets about 38% of its revenue from outside the United States.

The stock was trading at $550.44 per share with a market cap of $46.94 on May 24. The GF Value Line shows the stock trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 10 out of 10 and a valuation rank of 1 out of 10. There are currently no severe warning signs issued for the company. The company's cash-to-debt ratio of 0.35 ranks it lower than 80.35% of competitors and is well below the median value seen over the last decade.

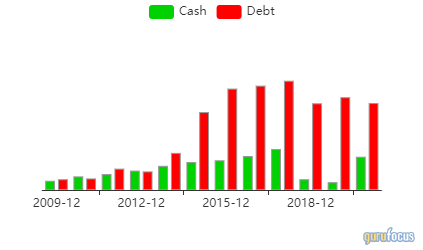

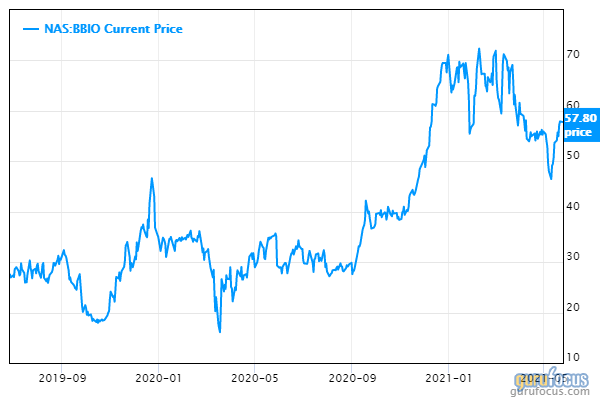

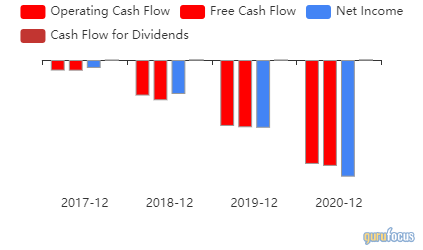

BridgeBio Pharma

The firm added to its freshly acquired BridgeBio Pharma holding during the first quarter. The 987,850 shares purchased grew the holding by 3,817.63% and traded at an average price of $65.45 during the quarter. GuruFocus estimates the total loss of the holding at 12.25% and the addition had an overall impact of 0.15% on the equity portfolio.

BridgeBio Pharma is involved in identifying advanced transformative medicines to treat patients who suffer from Mendelian diseases, which are diseases that arise from defects in a single gene, and cancers with clear genetic drivers. Its product pipeline categories include Mendelian, Genetic Dermatology, Oncology and Gene therapy.

On May 24, the stock was trading at $57.80 per share with a market cap of $8.59 billion. There is currently not enough data to generate a GF Value Line or Peter Lynch chart.

GuruFocus gives the company a financial strength rating of 2 out of 10. There are currently four severe warning signs issued, including new long-term debt and an Altman Z-Score of 1.51 placing the company in the distress column. The company has seemingly struggled financially with net income and free cash flow dropping increasingly into negative values over the last several years.

EPAM Systems

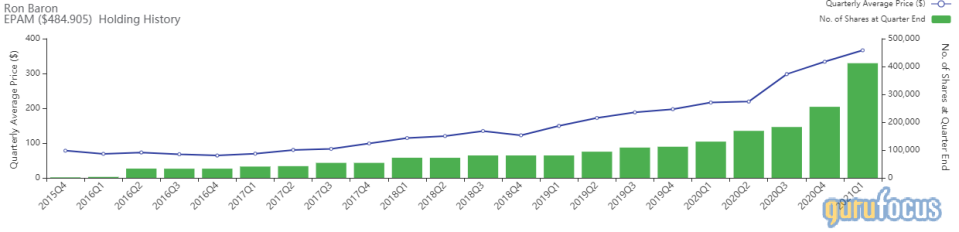

Rounding out the firm's top trades of the quarter was another addition to its EPAM Systems (NYSE:EPAM) holding. The firm purchased 156,546 shares to grow the holding by 61.33%. The shares traded at an average price of $366.52 during the quarter. GuruFocus estimates the total gain of the holding at 79.64% after several years of growing the holding and the purchase had an impact of 0.15% on the portfolio overall.

EPAM Systems provides software product development and digital platform engineering services to clients located around the world. The company services include Software Product Development, Custom Application Development, Application Testing, Enterprise Application Platforms, Application Maintenance and Support and Infrastructure Management. The company focuses on innovative and scalable software solutions. The company uses industry standard and custom developed technology, tools and platforms to deliver results to handle business challenges. The company primarily offers its solutions in the following industries: financial services, travel and consumer, software and hi-tech, life sciences and health care. The majority of revenue is generated from North American clients.

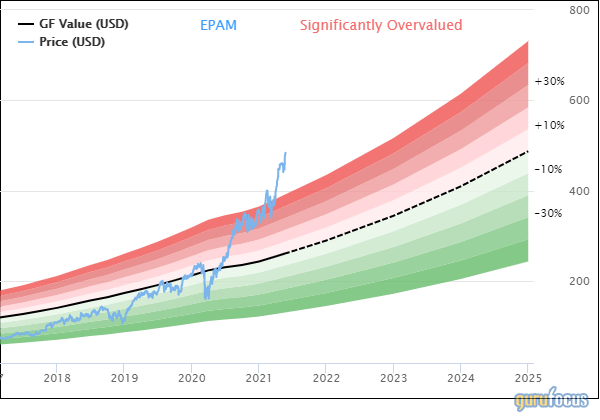

As of May 24, the stock was trading at $484.07 per share with a market cap of $27.35 billion. According to the GF Value Line, the shares are trading at a significantly overvalued rating.

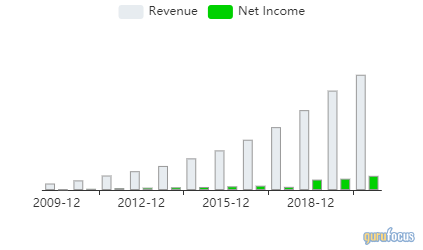

GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rank of 8 out of 10. There is currently one severe warning sign issued for a declining gross margin percentage. The company's financial strength has led to consistent growth in both revenue and net income over the last decade.

Disclosure: Author owns no stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance