Barclays Says UK Can Add £20 Billion to Coffers by Revising QE

(Bloomberg) -- The last time the Labour party took over from the Conservatives, it shocked markets by surrendering control of UK interest rates to a newly-independent Bank of England in its first days on the job.

Most Read from Bloomberg

US Allies Allege China Is Developing Attack Drones for Russia

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Now, with polls flagging a similar sweeping win, some investors are wargaming another surprise at the central bank.

According to strategists at Barclays Plc, Citigroup Inc. and TS Lombard, Labour could launch an accounting overhaul that shields the incoming government from mounting losses on the BOE’s debt pile. Such a move could potentially save the Treasury about £20 billion ($25.3 billion) a year, Barclays estimates, freeing up funds that could be used to meet Labour’s spending pledges.

The change would mean the government needs to sell less debt to finance its spending, which in turn could cause bonds to climb and yields to drop. But the market response might be less rosy if the move is seen as diminishing the central bank’s independence. A representative for the Labour Party declined to comment when contacted by Bloomberg News.

The losses at the heart of the politically fraught discussion stem from the structure created to allow the government and the BOE to keep rates low by buying bonds. The Asset Purchase Facility, which holds the bonds and is indemnified by the government, is financed by a loan from the BOE at Bank Rate.

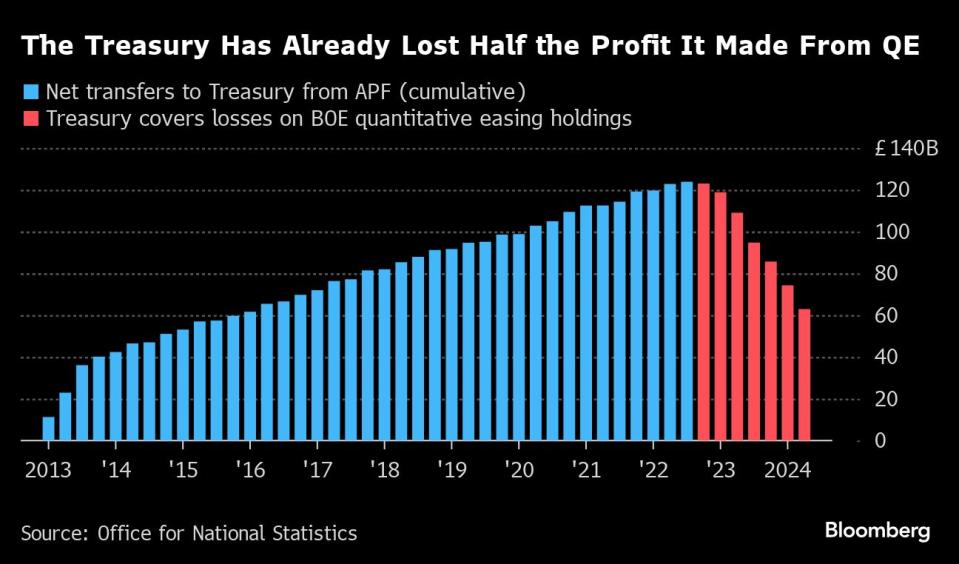

When rates were low, this worked out well for the UK Treasury. The interest the government had to pay on the loan was lower than the coupons it was earning from the APF bonds. Under a policy introduced by then-Chancellor George Osborne in 2012, the government was entitled to these profits generated from the APF.

Then inflation took off and the central bank hiked rates aggressively. Now the government pays out more in interest than it receives in coupon income.

“We think the Labour team will be looking at alternatives to the current APF cashflow arrangements,” said the Barclays team, including Jack Meaning, which predicted that the changes could be discussed in the first year of the next parliament. “There is a high probability that some amendment to the APF cashflows arrangement happens over this time horizon.”

Dragged Into Politics

A Bloomberg analysis in May found the BOE’s net losses on its portfolio are on track to reach £115 billion. By one measure, the UK losses are three times the hit to the US Federal Reserve from its quantitative-easing program.

The scale of the loss, which might otherwise go toward public services or tax cuts, has dragged the BOE into politics with just days to go before the July 4 election. It’s helped spur a range of policy proposals to generate more fiscal headroom.

Nigel Farage’s right-wing populist party Reform UK has advocated for the BOE to scrap the interest it pays out to commercial banks entirely. Labour’s candidate for Chancellor Rachel Reeves has said that even a more moderate proposal of tiering — whereby a portion of banks’ deposits are paid either zero interest or a discounted rate — comes with “dangers” for the transmission of monetary policy.

Given those concerns, the Barclays team proposed a combined approach that would see government debt transferred from the APF onto the BOE’s balance sheet and the central bank receive the right to earn coupon income. Rules that allow BOE losses to be accounted for with a delay could also be implemented.

It’s more likely that APF liability and the right to receive coupon income are shifted to the Bank of England, than a reserves tiering regime is implemented, Citigroup strategists including Ben Nabarro said. Such a move is possible “perhaps in the second year of a potential Labour government,” they wrote.

According to TS Lombard, a change to the cashflow arrangements is far from given, but a new Labour government might use it to “emulate” the surprise announcement under Tony Blair.

“Any such move is unlikely, and 1997-style ‘morning after’ timing even less likely: but it cannot be ruled out by end-2024,” said the TS Lombard analysts led by Christopher Granville. If it happens, it could cause an “uncertainty premium in gilts” that would present a buying opportunity, they said.

Labour’s Reeves described Osborne’s 2012 deal as “smoke and mirrors” at the time, and warned that it could end up “costing the taxpayer more in the long-term” if the profits turned to losses. Last year, she described the BOE’s portfolio as a “Tory bond black hole” owing to the rise in interest rates.

Read: UK’s Fiscal Hole Deepens on Osborne’s QE Accounting Ploy

“If elected, the approach Rachel Reeves takes to reduce these losses will be key,” said Christopher Mahon, head of dynamic real return at asset manager Columbia Threadneedle, who has written about the QE portfolio losses. “Our view is that a middle ground will be sought.”

--With assistance from Philip Aldrick.

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance