Bank of Nova Scotia's Strategic Acquisition in Colliers International Group Inc

Overview of the Transaction

On December 30, 2022, Bank of Nova Scotia marked a significant expansion in its investment portfolio by acquiring 2,546,386 shares of Colliers International Group Inc (NASDAQ:CIGI). This transaction was classified as "New Holdings," indicating a fresh entry into Bank of Nova Scotias diverse portfolio. The shares were purchased at a price of $92.04 each, reflecting a strategic move by the firm to bolster its holdings in the real estate sector. This acquisition not only diversifies the firm's investments but also underscores its confidence in Colliers International's growth prospects.

Profile of Bank of Nova Scotia

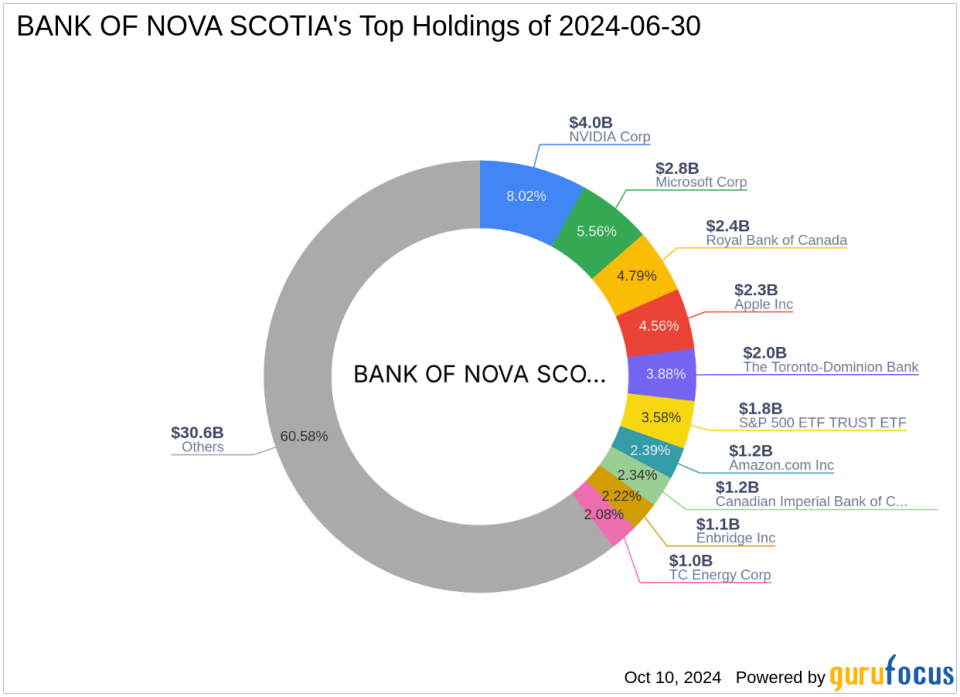

Bank of Nova Scotia, headquartered at 44 King Street West, Toronto, is a prominent player in the global investment landscape. With an equity portfolio worth $50.51 billion and top holdings in major corporations like Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT), the firm has a well-rounded investment strategy focusing on technology and financial services. The firm's investment philosophy is geared towards sustainable growth and value creation across various sectors.

Introduction to Colliers International Group Inc

Colliers International Group Inc, based in Canada, is a powerhouse in real estate services and investment management. Since its IPO on January 20, 1995, Colliers has expanded its operations globally, offering services such as leasing, property management, and investment management. The company operates through several segments including Americas, EMEA (Europe, Middle East, and Africa), Asia, Australasia, and Investment Management, showcasing its extensive international footprint and diversified service offerings.

Financial and Market Analysis of Colliers International Group Inc

As of the latest data, Colliers International boasts a market capitalization of $7.66 billion with a current stock price of $147.7675, significantly up from the price at which Bank of Nova Scotia made its purchase. The stock is currently rated as "Significantly Overvalued" with a GF Value of $109.55. Despite this, Colliers has shown robust growth metrics, including a PE Ratio of 50.26 and a GF Score of 84/100, indicating good potential for future performance.

Impact of the Trade on Bank of Nova Scotias Portfolio

The acquisition of Colliers International shares has increased the firm's exposure to the real estate sector, with the new holdings constituting 0.75% of its total portfolio. This strategic move not only diversifies the firm's investments but also aligns with its objective of capitalizing on sectors with substantial growth potential. The position size, representing 6.10% of the total shares of Colliers, signifies a substantial stake and a vote of confidence in the company's future trajectory.

Market Reaction and Stock Performance Post-Trade

Since the acquisition, Colliers International's stock has appreciated by 60.55%, outperforming many of its peers. This increase is reflective of the company's strong market position and operational success. Year-to-date, the stock has also seen a rise of 20.71%, further validating Bank of Nova Scotia's investment decision.

Broader Market Implications

This transaction by Bank of Nova Scotia is indicative of a broader trend where major investment firms are increasingly focusing on real estate as a key component of their investment strategy. Other notable investors, including Fairfax Financial Holdings and Joel Greenblatt (Trades, Portfolio), have also maintained positions in Colliers, highlighting the attractiveness of the real estate services sector.

Conclusion

The strategic acquisition of Colliers International Group Inc by Bank of Nova Scotia represents a significant enhancement to its investment portfolio, reflecting confidence in the real estate sector's growth. This move not only diversifies the firm's holdings but also positions it to benefit from the ongoing global expansion and robust performance of Colliers International. As the market continues to evolve, this investment may yield substantial returns, underscoring the strategic foresight of Bank of Nova Scotia.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance