Bank of France Chief Warns Next Government Not to Widen Deficit

(Bloomberg) -- France cannot afford to keep increasing its deficit or burden its companies with more taxes and costs, Bank of France Governor François Villeroy de Galhau warned as political parties jostle to form the country’s next government.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

Snap legislative elections have returned a hung parliament with no group in a position to have enough lawmakers to pass economic policy, leading to uncertainty for businesses. President Emmanuel Macron has called for a broad majority to emerge from the political center and has said he’ll leave more time for talks before naming a new prime minister.

The leftist New Popular Front alliance, which won the largest number of seats and has called on the president to pick a premier from its ranks, has campaigned on pledges including a significant increase in the minimum wage and reversing Macron’s pension reform.

Villeroy cautioned that there is “no hidden treasure” in France and that the euro area’s second-biggest economy must rely on work and innovation.

“That’s the first golden rule: don’t weigh down our businesses in economic competition,” he told Franceinfo radio on Thursday. “There is a second golden rule: we can’t dig deeper deficits as they cost more and more to finance and weigh on our sovereignty.”

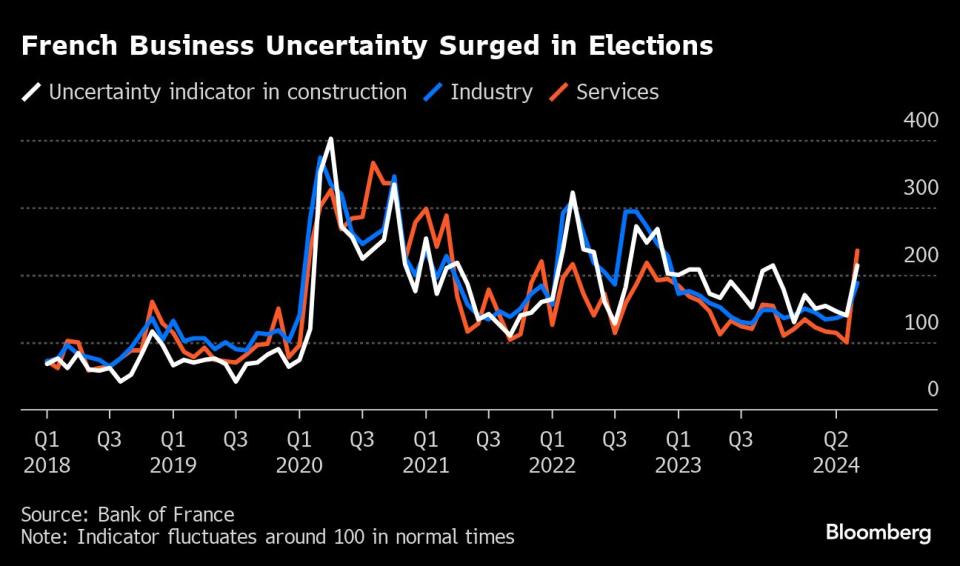

The central banker’s comments came as the Bank of France’s monthly survey showed a sharp increase in uncertainty among business leaders during the election campaign. Villeroy said companies polled before the final round of voting were concerned about issues ranging from a lack of spending by customers to a pause in hiring.

He said the French economy is resisting but remains fragile even as victory against inflation is within sight and the pace of price increases is set to come back toward the European Central Bank’s 2% target.

“As we exit the inflation shock, unfortunately there’s another shock threatening – an uncertainty shock,” he said. “Business leaders are telling us they are worried about the wait-and-see approach of their customers who are choosing to save instead of spend, about delay of investment, and about freezing hiring.”

He said that would be a “very negative shock for growth and jobs.”

The timing of Villeroy’s comments is unusual as policymakers are supposed to be in quiet spell in the seven days ahead of any ECB rate decision. The next one is on July 18, which means that period kicked in on Thursday.

(Updates with comments on economic situation starting in fourth paragraph.)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance