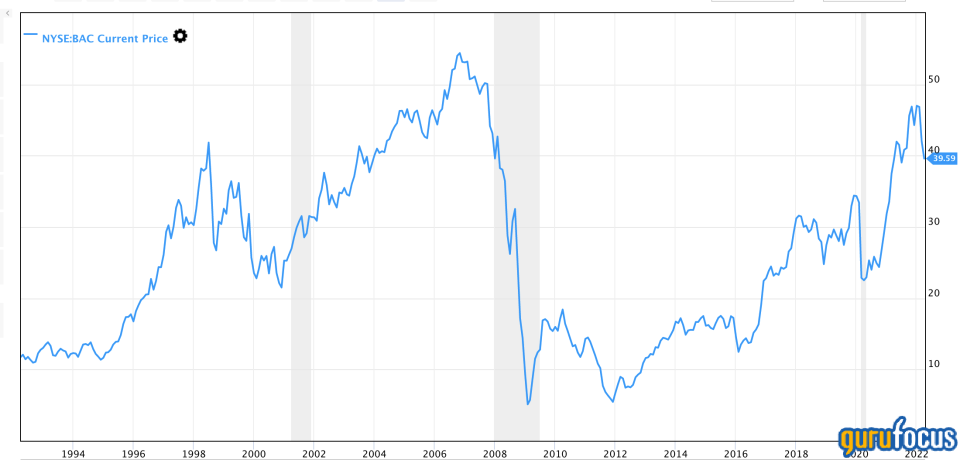

Bank of America Has a Weak Risk-Return Trade-Off

It's been a waiting game for bank stock investors. Many expected the Federal Reserve to burst out of the blocks this year with interest rate increases, which would, in turn, provide support to the banking sector. However, matters have panned out differently than initially anticipated, so I am exceptionally bearish on Bank of America Corp. (NYSE:BAC) after running a few valuation and pricing metrics in relation to the current economic climate. I will explain my key findings and elaborate on what investors can expect moving forward.

Operating shortfalls

Bank of America managed to beat its earnings estimate by 6 cents per share during its fourth quarter, but missed its revenue target by $142.01 million.

Looking ahead, we may see Bank of America's financial results come in at a subpar level. The equity market clearly hasn't sustained its momentum into 2022, and prominent American banks recently suffered a $4.6 billion year-over-year decline in revenue due to a drought in equity raising activities, suggesting we may be headed for a prolonged downturn in non-interest bearing activities for the bank and its peers.

Furthermore, Bank of America's investors were probably hoping for a more aggressive contractionary monetary policy rhetoric from the Federal Reserve. The central bank's year-to-date 25 basis point hike is a far cry from what was anticipated by the market, so Bank of America could suffer as a consequence. The general assumption is that banks' non-interest segments perform better during periods of higher interest environments due to lower erosion of outstanding debt and the ability to issue future debt at higher yield spreads. An abundance of interest rate hikes obviously hasn't been the case, suggesting that many banking stock analysts may have gotten ahead of themselves.

Poor risk-return profile

The company's risk-return profile isn't ideal. As an investor, you usually want to see a Sharpe ratio of 1 or more. A Sharpe ratio below 1 indicates that a stock has a poor risk-return profile and that it's not very investable.

Bank of America has a Sharpe ratio of 0.03, which isn't terrible, but one would expect better from one of the most stable companies in the United States.

The bottom line

Bank of America stock is poorly valued and possesses an unattractive risk-return profile amid an unstable economic climate. The company's stress test is holding firm, but it's likely that it won't be enough as the bank's interest-bearing activities are underperforming significantly, suggesting many analysts may have gotten ahead of themselves.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance