Baillie Gifford Reduces Stake in Guardant Health Inc.

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On June 1, 2024, Baillie Gifford (Trades, Portfolio), a prominent investment management firm, executed a significant transaction involving the shares of Guardant Health Inc. (NASDAQ:GH). The firm decided to reduce its holdings by 138,818 shares, which adjusted its total share count to 6,093,286. This move reflects a -2.23% change in their position, with the shares traded at a price of $27.10 each. Despite this reduction, Guardant Health still represents 0.13% of Baillie Gifford (Trades, Portfolio)s portfolio, indicating a continued, albeit reduced, interest in the company.

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), established over a century ago, is renowned for its commitment to long-term, bottom-up investing, focusing on companies with potential for significant growth. The firm manages assets worth $128.56 billion, emphasizing a rigorous fundamental analysis to identify investment opportunities. Baillie Gifford (Trades, Portfolio)s investment philosophy centers on global opportunities, aiming to deliver substantial returns over extended periods.

Guardant Health Inc.: Innovating Medical Diagnostics

Guardant Health, based in Redwood City, California, specializes in advanced liquid biopsy tests for cancer diagnosis and management. Since its IPO on October 4, 2018, the company has introduced several groundbreaking products, including the Guardant360 CDx and the recent Shield test for colorectal cancer screening. These innovations underscore Guardant Healths pivotal role in the medical diagnostics and research industry.

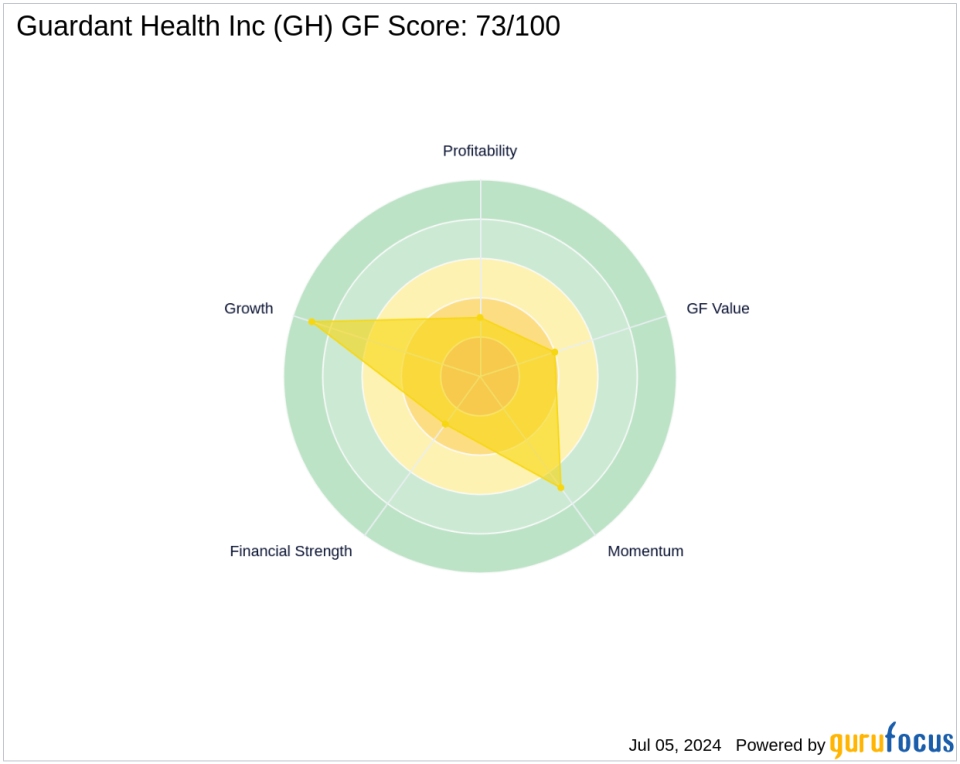

Financial and Market Analysis of Guardant Health

Currently, Guardant Health boasts a market capitalization of $3.5 billion, with a stock price of $28.595. The company does not have a PE Ratio, indicating it is not profitable at this time. The GF Value of the stock is $52.14, suggesting that it is potentially undervalued. However, the stock is labeled as a "Possible Value Trap" by GuruFocus, advising investors to think twice due to its financial metrics and market performance.

Impact of Baillie Gifford (Trades, Portfolio)s Trade on Its Portfolio

The recent transaction by Baillie Gifford (Trades, Portfolio) has slightly decreased its exposure to Guardant Health, which now constitutes a 4.98% position in its portfolio. This adjustment aligns with the firms strategy of managing risk and optimizing portfolio performance, reflecting a cautious approach towards Guardant Healths current market dynamics and financial health.

Market Trends and Sector Analysis

Technology and consumer cyclical sectors dominate Baillie Gifford (Trades, Portfolio)s top holdings, showcasing the firm's strategy to invest in high-growth areas. The ongoing innovations in medical technology, including those developed by Guardant Health, play into these trends, presenting opportunities and challenges for investors.

Future Outlook and Analyst Insights

Analysts are cautiously optimistic about Guardant Healths growth potential, given its innovative product pipeline and leadership in precision oncology testing. However, the markets mixed signals and the companys current financial health suggest a careful approach. Baillie Gifford (Trades, Portfolio)s recent stock reduction might be indicative of a strategic realignment in response to these factors.

Conclusion

Baillie Gifford (Trades, Portfolio)s recent adjustment in its holdings of Guardant Health reflects a nuanced strategy in managing a complex investment landscape. This transaction highlights the importance of staying responsive to market conditions and underlying company fundamentals, ensuring that investment decisions align with long-term financial goals and risk management strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance