Baillie Gifford Reduces Stake in Ginkgo Bioworks Holdings Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On June 1, 2024, Baillie Gifford (Trades, Portfolio), a prominent investment management firm, executed a significant transaction involving the shares of Ginkgo Bioworks Holdings Inc (NYSE:DNA). The firm decided to reduce its holdings by 98,573,807 shares, resulting in a new total of 134,425,866 shares. This move reflects a -42.31% change in their position, impacting the firm's portfolio by -0.04%. The shares were traded at a price of $0.5285 each.

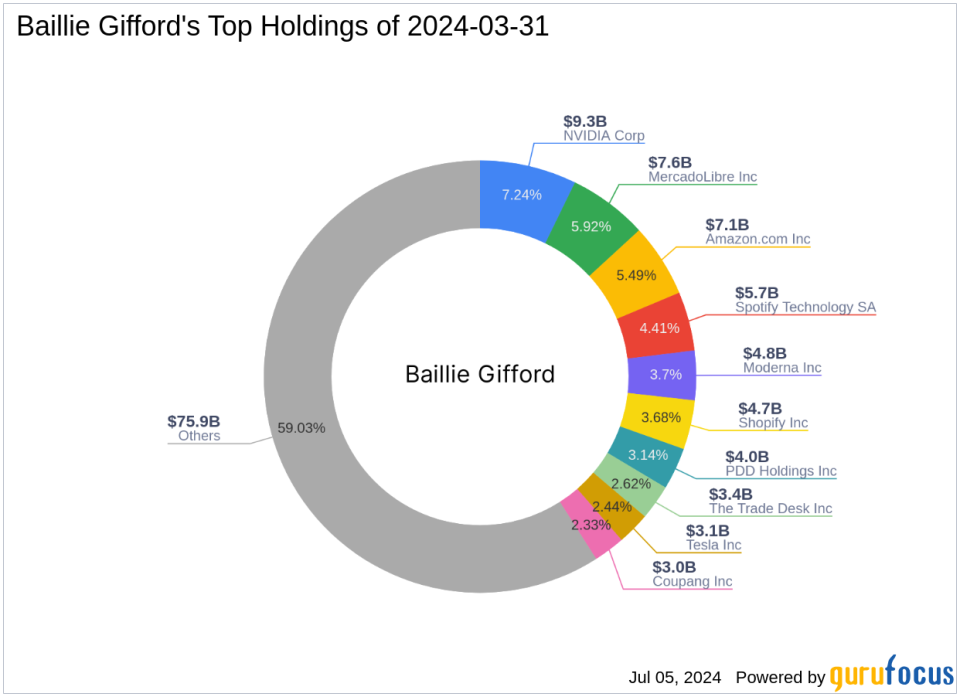

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), established over a century ago, is renowned for its commitment to long-term, bottom-up investment approaches, focusing on fundamental analysis and proprietary research. The firm manages assets for some of the worlds largest professional investors, emphasizing the potential for sustainable growth. Baillie Gifford (Trades, Portfolio)s top holdings include major names such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA), with a strong inclination towards the technology and consumer cyclical sectors.

Insight into Ginkgo Bioworks Holdings Inc

Ginkgo Bioworks Holdings Inc, based in the USA, operates as a cell programming platform. Since its IPO on April 19, 2021, the company has focused on two main segments: Cell Engineering and Biosecurity. Despite its innovative approach, the company's financial health has been under scrutiny, with a market capitalization of $741.001 million and a current stock price of $0.3351, significantly below its GF Value of $0.90.

Analysis of the Trade's Impact

The reduction in Baillie Gifford (Trades, Portfolio)s stake in Ginkgo Bioworks has altered the firm's exposure to the biotechnology sector, now holding 7.87% of its portfolio in DNA. This adjustment might reflect a strategic shift or a response to the stocks performance, which has seen a significant decline of 36.59% since the transaction date.

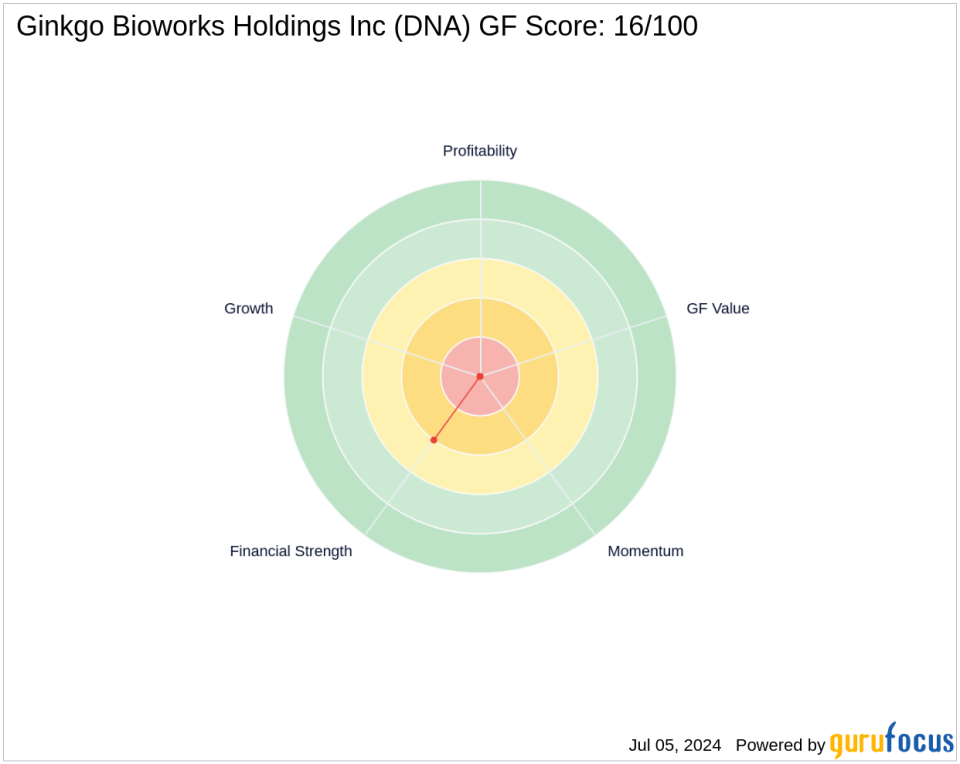

Financial and Market Analysis of Ginkgo Bioworks

Ginkgo Bioworks exhibits a challenging financial profile with a GF Score of 16/100, indicating potential risks in future performance. The company's financial strength and profitability are low, with significant concerns about its Altman Z score of -5.08, suggesting financial distress. Furthermore, its stock price to GF Value ratio stands at 0.37, categorizing it as a possible value trap.

Sector and Industry Context

Within the biotechnology industry, Ginkgo Bioworks aims to innovate but faces intense competition and high operational risks. The industry demands constant innovation and significant investment in research and development, factors that Ginkgo is grappling with, as evidenced by its financial metrics.

Implications for Investors

Baillie Gifford (Trades, Portfolio)s decision to reduce its stake in Ginkgo Bioworks could be indicative of a strategic realignment or concerns over the company's long-term profitability and market position. Investors should consider these factors and the firms broader portfolio strategy when evaluating similar biotechnology stocks.

Conclusion

This transaction by Baillie Gifford (Trades, Portfolio) marks a significant adjustment in its investment strategy, particularly in the biotechnology sector. The firm's move might signal caution to value investors, given Ginkgo Bioworks' current financial health and market challenges. As the market evolves, the implications of such strategic shifts are critical for investors aiming to optimize their portfolios in a volatile sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance