Axon Enterprise Inc (AXON) Q1 2024 Earnings: Surpasses Revenue Expectations and Raises ...

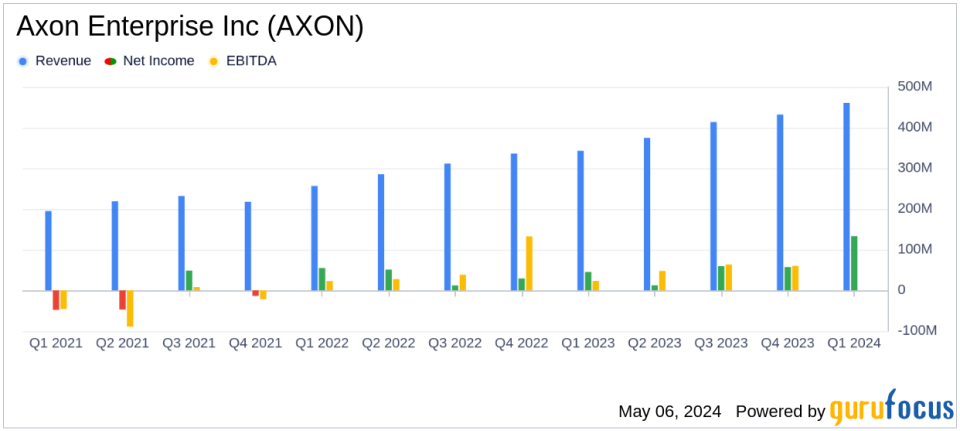

Revenue: $461 million, up 34% year-over-year, surpassing estimates of $441.57 million.

Net Income: $133 million, significantly exceeding the estimated $71.90 million, with a net income margin of 28.9%.

Earnings Per Share (EPS): Reported at $1.73 per diluted share, well above the estimated $0.94.

Gross Margin: Total company gross margin declined to 56.4% from 59.5% year-over-year, influenced by increased stock-based compensation expenses.

Adjusted EBITDA: $109 million, marking a 67.3% increase year-over-year, driven by higher revenue and operational leverage.

Operating Cash Flow: Reported a $16 million outflow, showing a $40 million improvement year-over-year.

Forward-looking Indicators: Annual recurring revenue increased to $825 million, with net revenue retention steady at 122%.

Axon Enterprise Inc (NASDAQ:AXON) released its 8-K filing on May 6, 2024, reporting a significant revenue increase to $461 million for Q1 2024, a 34% rise year-over-year, surpassing the estimated $441.57 million. This marks the company's ninth consecutive quarter of growth above 25%. Net income also exceeded expectations, reaching $133 million compared to the estimated $71.90 million, reflecting a robust net income margin of 28.9%.

Company Overview

Axon Enterprise Inc, a leader in public safety technologies, operates through two main segments: Taser and Software & Sensors. The Taser segment focuses on conducted energy devices, while Software & Sensors deals with integrated hardware and cloud-based solutions like body cameras and digital evidence management systems. The majority of Axon's revenue is generated from the Software & Sensors segment, particularly in the United States.

Operational Highlights and Innovations

The substantial revenue increase was driven by a 52% growth in the Axon Cloud & Services revenue, which reached $176 million. The Taser segment also saw significant growth, with revenue from Taser devices and cartridges increasing by 33% to $179 million, propelled by strong demand for the TASER 10 device. The Sensors & Other revenue grew by 14% to $106 million. Axon's commitment to innovation is evident in its new product launches and enhancements, including significant advancements in AI and VR technologies aimed at improving officer training and productivity.

Strategic Acquisitions and Market Expansion

Axon's strategic direction includes expanding its ecosystem through acquisitions, such as the planned purchase of Dedrone, which aligns with its vision for Drone as a First Responder. This acquisition is expected to add approximately $14 billion to Axons total addressable market, enhancing its capabilities in drone-based security solutions.

Financial Performance Analysis

The company's financial health is solid, with a net cash position of $274 million as of March 31, 2024. Axon reported a non-GAAP gross margin improvement, driven by a higher mix of revenue from the high-margin Axon Cloud & Services. Adjusted EBITDA for the quarter stood at $109 million, a 67.3% increase year-over-year, demonstrating effective operational leverage and cost management.

Future Outlook and Investor Relations

Looking ahead, Axon has raised its revenue and Adjusted EBITDA expectations for 2024, reflecting confidence in its ongoing growth trajectory and operational efficiency. The company will discuss these results and future plans in more detail during its earnings conference call on May 6, 2024.

For investors and stakeholders, Axon's Q1 performance underscores its strong market position and ability to capitalize on growth opportunities in the evolving public safety technology landscape. The company's strategic investments and innovations are set to further enhance its offerings and market reach, promising continued growth and profitability.

Conclusion

Axon Enterprise Inc's impressive Q1 2024 performance, marked by significant revenue growth and strategic expansions, positions it well for sustained success in the public safety technology sector. Investors may look forward to continued innovation and market expansion as Axon pursues its goal of enhancing safety and efficiency for law enforcement agencies worldwide.

Explore the complete 8-K earnings release (here) from Axon Enterprise Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance