Axalta (AXTA) Closes CoverFlexx Buy, Boosts Refinish Coatings

Axalta Coating Systems Ltd. AXTA completed the acquisition of The CoverFlexx Group from Transtar Holding Company. Specializing in manufacturing and selling coatings for automotive refinish and aftermarket applications, The CoverFlexx Group primarily serves economy customers in North America.

Axalta stated that the acquisition enhances its offerings in Refinish coatings. As emphasized during their recent Strategy Day, investing in growth of the Refinish business is a key priority and this acquisition supports that objective.

Axalta expressed excitement about welcoming the new team members from The CoverFlexx Group. It is committed to ensuring a smooth integration process while maintaining its current commitments and is eager to see the collaborative potential to expand the Refinish business.

The CoverFlexx Group offers a range of primers, basecoats, clearcoats, aerosols, fillers, bedliners, detailing products and paint shop accessories. Its established brands include Transtar Autobody Technologies, Pro-Form, and Aftermkt Armor products. The group operates manufacturing and product development facilities in Brighton, MI, and Milton, Ontario.

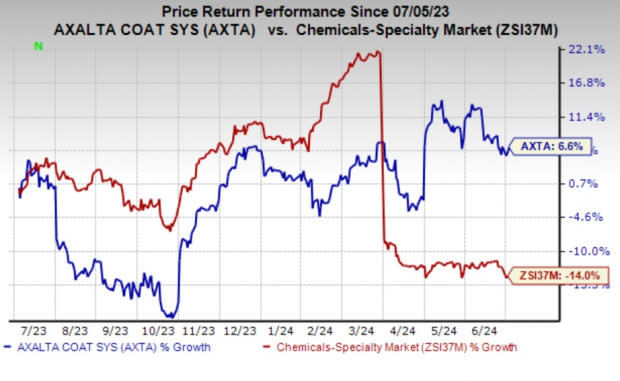

AXTA’s shares are up 6.6% in a year against the industry’s fall of 14% in the same period.

Image Source: Zacks Investment Research

In the first quarter, Axalta Coating reported robust performance with a 37.1% year-over-year increase in adjusted earnings and a 0.8% year-over-year growth in sales, reaching $1.3 billion. Adjusted EBITDA significantly rose to $259 million from $213 million, with an adjusted EBIT margin of 20%, up by 340 basis points (bps) from the previous year’s tally.

The Performance Coatings segment saw net sales remain flat, while its adjusted EBITDA increased 16% year over year to $196 million, achieving a margin of 23.1%. The Mobility Coatings segment registered 2% growth in net sales, driven by strong volume growth in China. Despite modest headwinds from raw material indexed contracts, Light Vehicle's price and product mix remained nearly flat. The segment's adjusted EBITDA surged to $63 million, with an adjusted EBITDA margin of 14.2%, up 410 bps from the previous year’s figure.

Other Key Picks

Axalta currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, L.B. Foster Company FSTR and Ecolab Inc. ECL. Carpenter Technology and L.B. Foster sports a Zacks Rank #1 (Strong Buy) and Ecolab carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $4.35, indicating a year-over-year rise of 282%. CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, the average earnings surprise being 15.1%. The company’s shares have soared 89.3% in the past year.

The Zacks Consensus Estimate for FSTR’s current-year earnings is pegged at $1.72, indicating a year-over-year rise of 1223%. FSTR’s earnings estimates have gone up 61% in the last 60 days. The stock has rallied 55.9% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a rise of 26.5% from the year-ago levels. ECL beat the consensus estimate in each of the last four quarters, the average earnings surprise being 1.3%. The stock has rallied nearly 26.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL): Free Stock Analysis Report

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

L.B. Foster Company (FSTR): Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance