Avoid Kelsian Group And Explore This One Superior ASX Dividend Stock Instead

In the quest for reliable dividend income from Australian stocks, investors should be wary of companies with unstable dividend histories. While a high yield might seem appealing, a history of significant dividend cuts, as seen with Kelsian Group, can indicate underlying financial challenges. Today we will compare two distinct examples to help guide your investment decisions in this area.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.09% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.26% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.21% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.07% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.99% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.76% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.96% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.60% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.16% | ★★★★★☆ |

Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

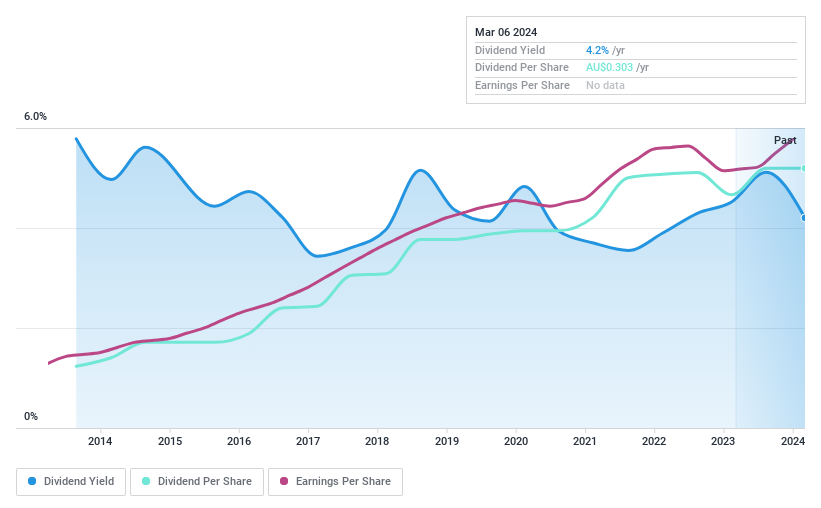

Fiducian Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd operates as a financial services provider in Australia, with a market capitalization of approximately A$239.23 million.

Operations: The company generates revenue through four primary segments: Funds Management (A$20.49 million), Corporate Services (A$12.06 million), Financial Planning (A$28.95 million), and Platform Administration (A$15.38 million).

Dividend Yield: 4%

Fiducian Group maintains a solid track record in dividend reliability, consistently increasing payouts over the past decade with a current yield of 4.09%. Despite dividends being slightly lower than the top Australian dividend payers, they are well-supported by earnings and cash flows, with payout ratios at 83.7% and cash payout ratios at 60.5%, respectively. This stability contrasts sharply with some peers who have experienced significant dividend cuts, underlining Fiducian's dependable income stream for investors.

One To Reconsider

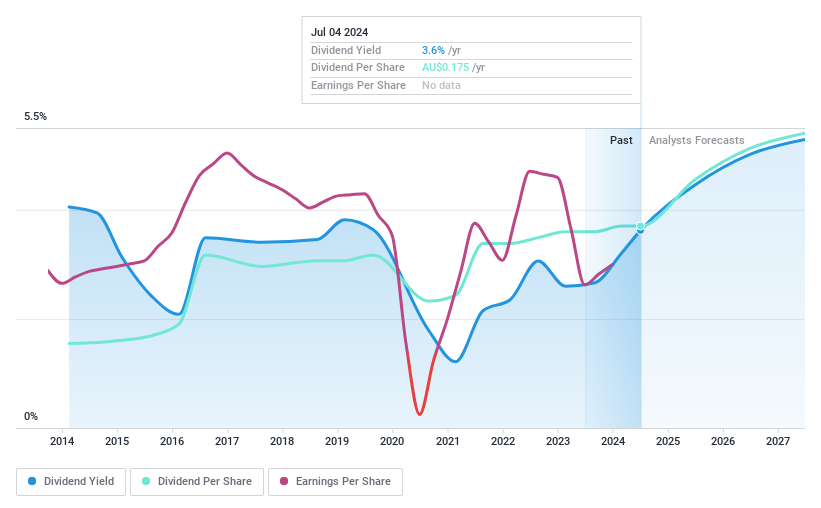

Kelsian Group

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Kelsian Group Limited operates in the provision of land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.30 billion.

Operations: The company generates its revenue through three primary segments: Australian Bus services contributing A$934.76 million, International Bus services adding A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

Dividend Yield: 3.6%

Kelsian Group's dividend history shows instability, with significant drops including an annual decline over 20%. Currently, the dividend yield is 3.62%, below the Australian market's top quartile of 6.58%. The payout ratio stands high at 148.2%, indicating dividends are not adequately covered by earnings or cash flows. Additionally, profit margins have decreased from last year's 3.8% to just 1.7%, further straining its financial health despite a projected earnings growth of 25.62% per year.

Turning Ideas Into Actions

Get an in-depth perspective on all 27 Top ASX Dividend Stocks by using our screener here.

Hold shares in some of these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FID and ASX:KLS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance