Avoid Henan ZhongGong Design & Research Group And Explore One Better Dividend Stock Option

Large dividends can be alluring, offering the potential for substantial income from investments. However, it's crucial to assess whether these dividends are sustainable in the long term. Companies like Henan ZhongGong Design & Research Group with high payout ratios may indicate that their dividends could be at risk, which is a significant concern for investors seeking reliable returns. In this article, we will explore two Chinese dividend stocks—one to avoid due to such financial vulnerabilities and another that presents a more secure option.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Lao Feng Xiang (SHSE:600612) | 3.27% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.64% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 4.09% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.69% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.01% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.63% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.64% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.78% | ★★★★★★ |

Click here to see the full list of 241 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

Guangdong Provincial Expressway Development

Simply Wall St Dividend Rating: ★★★★★☆

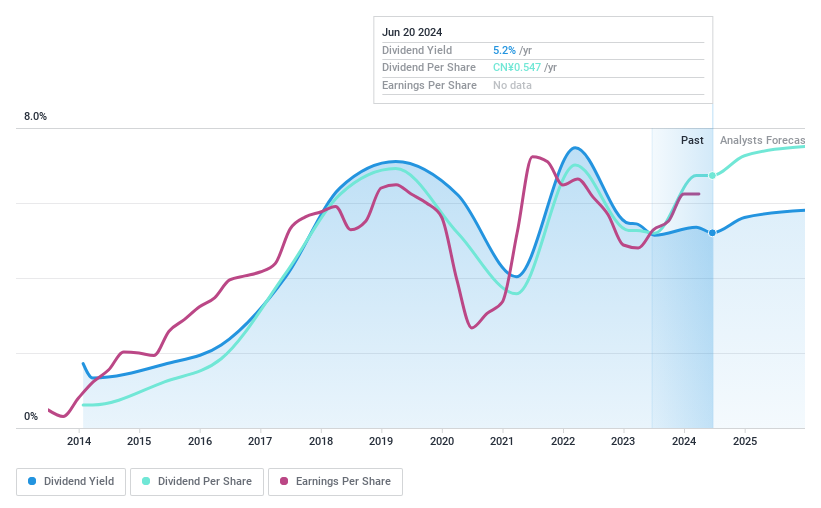

Overview: Guangdong Provincial Expressway Development Co., Ltd. focuses on developing and operating expressways and bridges in the People's Republic of China, with a market capitalization of approximately CN¥21.62 billion.

Operations: The company primarily generates revenue from the development and operation of expressways and bridges across China.

Dividend Yield: 5%

Guangdong Provincial Expressway Development maintains a sustainable dividend with a payout ratio of 70.1%, ensuring earnings adequately cover distributions, unlike firms with excessive ratios risking cuts. Despite its recent inclusion in an index and stable quarterly earnings, concerns linger due to past dividend volatility and unreliable patterns over the decade. Nonetheless, it trades at 30% below estimated fair value and offers a competitive yield of 4.96%, aligning it favorably within the top quartile of Chinese dividend stocks.

One To Reconsider

Henan ZhongGong Design & Research Group

Simply Wall St Dividend Rating: ★☆☆☆☆☆

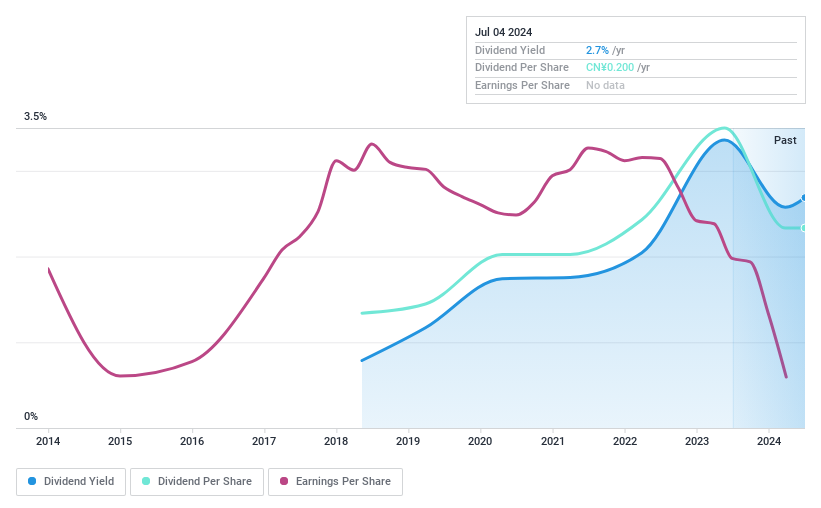

Overview: Henan ZhongGong Design & Research Group Co., Ltd. provides engineering consulting, investigation, mapping, design, supervision, and construction management services both in China and internationally, with a market capitalization of approximately CN¥2.41 billion.

Operations: The company generates revenue primarily through engineering consulting, investigation, mapping, design, supervision, and construction management services.

Dividend Yield: 2.7%

Henan ZhongGong Design & Research Group Co., Ltd. recently changed its name and reported a significant downturn in its financials, with a recent net loss of CNY 34.49 million contrasting sharply with the previous year's net income of CNY 41.57 million. Despite offering a dividend yield in the top 25% for Chinese stocks, its high payout ratio of 107% coupled with no free cash flows and volatile share price over the last three months raises concerns about the sustainability and reliability of future dividends, especially given the historical volatility in payments over six years and large one-off items impacting earnings.

Seize The Opportunity

Access the full spectrum of 241 Top Dividend Stocks by clicking on this link.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SZSE:000429 and SZSE:300732.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance