Avery Dennison Corp (AVY) Q1 2024 Earnings: Aligns with Analyst Projections

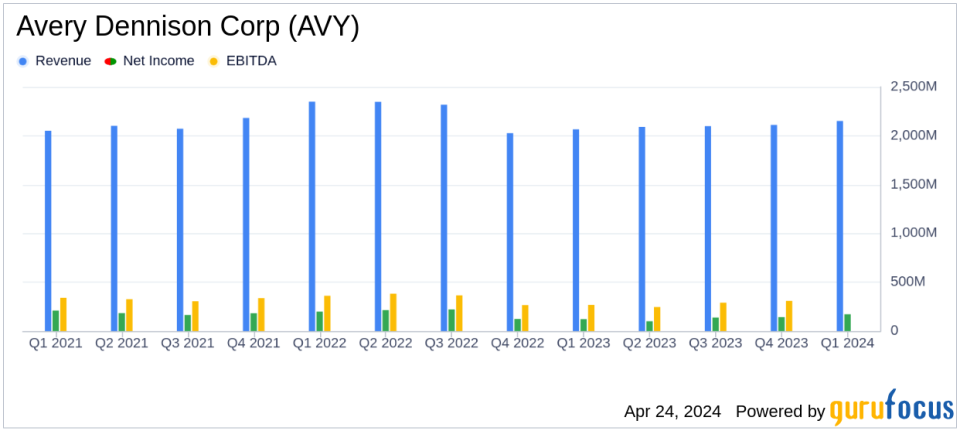

Reported Revenue: $2,151.3 million, a 4.2% increase year-over-year, slightly surpassing the estimate of $2,150.61 million.

Net Income: $172.4 million, up 42% from the previous year, falling just below the estimated $174.58 million.

Earnings Per Share (EPS): $2.13, up 43% year-over-year, slightly below the estimated $2.15.

Operating Income: Increased by 34% year-over-year to $254.4 million, with operating margins expanding to 11.8% from 9.2%.

Adjusted EBITDA: Rose to $351.0 million from $280.2 million, marking a 16.3% margin compared to 13.6% in the previous year.

Capital Return: $81 million returned to shareholders through dividends and share repurchases during the quarter.

Guidance Adjustment: Revised 2024 EPS guidance from $8.65-$9.15 to $8.60-$9.10, maintaining adjusted EPS outlook at $9.00-$9.50.

Avery Dennison Corp (NYSE:AVY) released its 8-K filing on April 24, 2024, detailing its financial results for the first quarter ended March 30, 2024. The company reported net sales of $2,151.3 million and a net income of $172.4 million, with earnings per share (EPS) standing at $2.13. These figures closely align with analyst estimates, which projected an EPS of $2.15 and net income of $174.58 million on revenues of $2,150.61 million.

Avery Dennison, a global leader in materials science and digital identification solutions, continues to leverage its extensive portfolio across various industries including apparel, logistics, and automotive to drive growth. The company's international operations, which contribute significantly to its revenue, have been pivotal in maintaining robust performance levels despite fluctuating global market conditions.

Quarterly Performance Highlights

The first quarter saw Avery Dennison achieving a 4.2% increase in total net sales year-over-year, reaching $2,151.3 million. The Materials Group and Solutions Group segments were notable performers, with the former posting a sales increase of 2.5% to $1,496.5 million, and the latter an 8.3% rise to $654.8 million. This growth was attributed to volume growth, productivity gains, and strategic capital deployment.

Operating income surged by 34% to $254.4 million, reflecting an operating margin of 11.8%, compared to 9.2% in the previous year. The adjusted EBITDA also saw a significant increase, standing at $351.0 million with a margin of 16.3%, demonstrating effective cost management and operational efficiency.

Strategic Initiatives and Future Outlook

Under the leadership of President and CEO Deon Stander, Avery Dennison is focusing on expanding its high-value categories and advancing its leadership in the intersection of physical and digital spheres, particularly in Intelligent Labels. The company is optimistic about continuing its trajectory of earnings growth throughout 2024, backed by strong market positioning and strategic initiatives.

During the quarter, Avery Dennison returned $81 million to shareholders through dividends and share repurchases, reinforcing its commitment to delivering shareholder value. The company's balance sheet remains robust, with a net debt to adjusted EBITDA ratio of 2.3x, indicating sound financial health and strategic capital management.

Challenges and Mitigation

The company faces ongoing challenges such as fluctuating raw material costs and geopolitical uncertainties that could impact demand for its products. However, Avery Dennison's diversified business model and continuous focus on innovation and market expansion mitigate these risks effectively.

For the full year of 2024, Avery Dennison has adjusted its EPS guidance from $8.65-$9.15 to $8.60-$9.10, reflecting cautious optimism in navigating the dynamic market conditions while continuing to pursue growth opportunities.

For more detailed financial information and future updates, stakeholders are encouraged to visit Avery Dennison's investor relations website.

Explore the complete 8-K earnings release (here) from Avery Dennison Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance