AutoZone (AZO) to Report Q3 Earnings: What's in the Cards?

AutoZone AZO is slated to release third-quarter fiscal 2023 results on May 23, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $30.84 per share and $4.09 billion, respectively.

The Zacks Consensus Estimate for AZO’s fiscal third-quarter earnings per share has moved 8 cents (0.3%) north in the past seven days. Also, the bottom-line projection indicates year-over-year growth of 6.2%. The Zacks Consensus Estimate for quarterly revenues implies a 5.9% rise from the prior-year level.

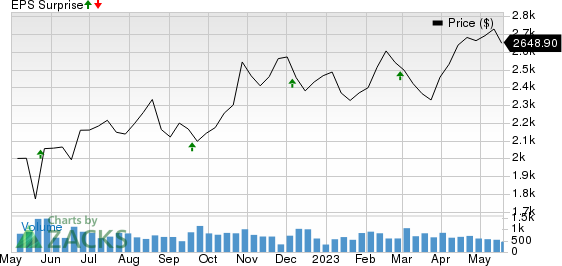

The automotive parts retailer posted better-than-anticipated results in the last reported quarter. Earnings of $24.64 per share improved 10.5% from the prior-year figure and topped the Zacks Consensus Estimate of $21.33. Over the trailing four quarters, the company surpassed earnings estimates on all occasions, the average being 10.61%. This is depicted in the graph below:

AutoZone, Inc. Price and EPS Surprise

AutoZone, Inc. price-eps-surprise | AutoZone, Inc. Quote

Things to Note

AutoZone’s omni-channel efforts to improve customer shopping experiences are reaping profits. The company’s e-commerce efforts that are driving traffic to the company’s online site are likely to have positively impacted the company’s performance in the third quarter of fiscal 2023. Continued strength across its DIY as well as commercial businesses, amid the expansion of coverage and parts availability, is also likely to have boosted revenues in the to-be-reported quarter.

While doubling down on expansion with the opening of new distribution centers, mega hubs and stores is set to boost prospects in the long run, it is expected to have strained the operating margin in the quarter under review due to high capex. Rising commodity prices amid the chip crisis is likely to have put pressure on gross margins in the quarter under review. Escalating expenses are likely to have adversely impacted third-quarter 2023 results.

What Does Our Model Say?

Our proven model does not conclusively predict an earnings beat for AutoZone this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: AutoZone has an Earnings ESP of -0.87%. This is because the Most Accurate Estimate is pegged 27 cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AutoZone currently carries a Zacks Rank #3.

Earnings Whispers for Other Auto Companies

Advance Auto AAP will release fiscal first-quarter 2023 results on May 31. The company has an Earnings ESP of -7.89% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Advance Auto’s to-be-reported quarter’s earnings and revenues is pegged at $2.60 per share and $3.43 billion, respectively. AAP surpassed earnings estimates in two of the trailing four quarters, met once and missed in the other, the average surprise being 1.54%.

NIO NIO will release fiscal first-quarter 2023 results on Jun 9. The company has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell).

The Zacks Consensus Estimate for NIO’s to-be-reported quarter’s loss and revenues is pegged at 22 cents per share and $1.69 billion, respectively.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance