Australian Dollar Higher on Business Confidence, China Optimism

Created Using Marketscope 2.0

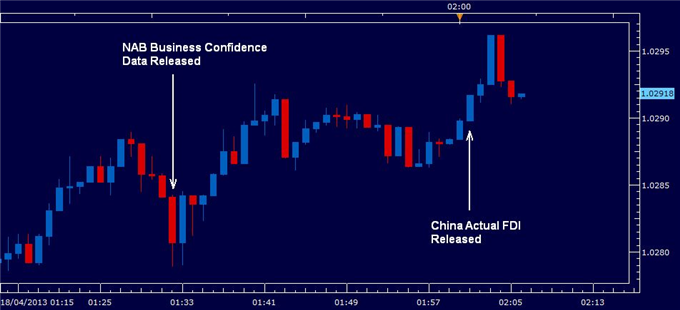

THE TAKEAWAY: The afternoon of Asian trade saw Australian Business Confidence data and Chinese FDI figures improve sending the Australian Dollar slightly higher against the U.S. Dollar.

The NAB Business Confidence figure was the first to be released seeing an improvement of 7 points from -5 in the previous quarter, to +2 in the 1st quarter of 2013. This positive reading is the first one since the final quarter of 2011 as most of 2012 was spent in the negative. After relatively soft data being released for the Australian economy in 2013, the positive business confidence reading was good news for the Australian Dollar as investors became more confident in the region’s growth potential.

Next to be released was China’s FDI which came in at 5.7 per cent for March which was lower than the 6.3 per cent in February but better than the expected value of 1.9 per cent. The FDI or Foreign Direct Investment figure shows the investments into a country from other countries. In terms of sentiment, it is seen as a gauge for how offshore investors see a particular economy performing in the future. China is Australia’s largest two-way trading partner and the so called ‘Aussie’ rallied again as traders saw confidence in China translating to more demand for Australian exports.

The Australian Dollar, after a weak performance in U.S. trading, recovered from a low of 1.0268 to 1.03077 as of midday in Asian trade.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance