Australia’s Faster Inflation Raises Risk of RBA Rate Hike

(Bloomberg) -- Australia’s inflation accelerated faster than expected for a third straight month in May, sending the currency higher as traders boosted bets that the Reserve Bank will resume raising interest rates at its next meeting.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

VW Latches Onto Rivian in $5 Billion EV Pact to Regain Momentum

Nvidia Rout Takes Breather as Traders Scour Charts for Support

Julian Assange Leaves Court ‘Free Man,’ Ending 14-Year Drama

The monthly consumer price indicator climbed 4% from a year earlier, exceeding economists’ estimate of 3.8%, government data showed Wednesday. The trimmed mean core measure, which smooths out volatile items, advanced to 4.4% versus 4.1% a month earlier.

The Australian dollar rose as much as 0.4% as traders priced a greater chance of a rate hike at the RBA’s Aug. 5-6 meeting. Yields on policy sensitive three-year bonds jumped as much as 15 basis points to 4.08%, the biggest one-day gain since April.

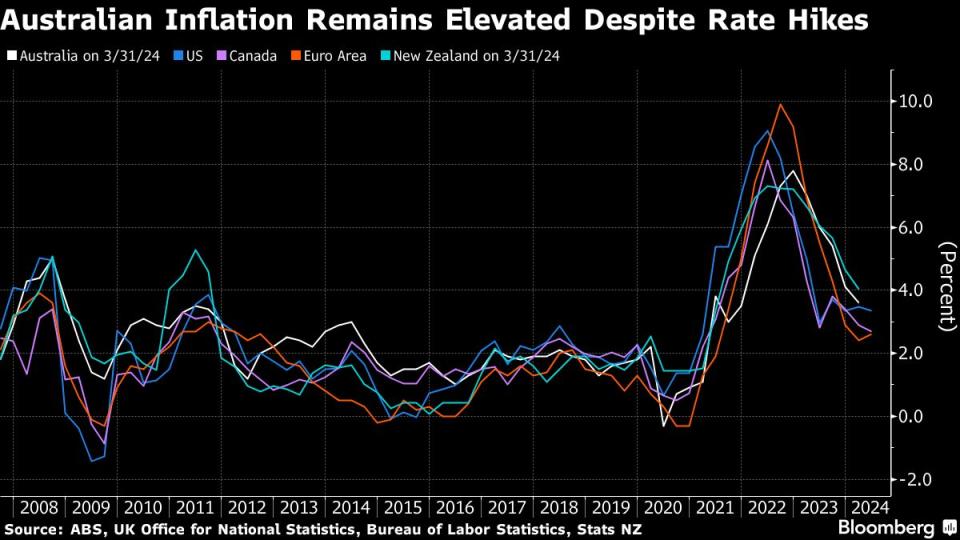

Australian Bonds at Sharp End of Global Pain Trend on Inflation

The RBA’s next meeting “is now live,” said Tony Sycamore, a market analyst at IG in Sydney. “The only possible way out is for a series of softer numbers in most, if not all, of the key data points” ahead including jobs, retail sales and second-quarter inflation on July 31.

The report comes after RBA Governor Michele Bullock restated last week that the rate-setting board isn’t ruling out a rate hike after leaving the benchmark at a 12-year high of 4.35%.

Earlier Wednesday, Assistant Governor Christopher Kent said the central bank is “alert” to upside risks to inflation. Indeed, Overnight Index Swaps are now implying a 40% chance of a hike in August, up from about 20% pre-data.

RBA No. 2 Andrew Hauser is due to speak at an economic forum in Sydney on Thursday evening, when he’s likely to be asked about the latest inflation report.

Central bank officials have frequently cautioned about reading too much into the monthly figures, given they only provide a partial picture of prices in the economy whereas the quarterly report delivers a complete overview.

In the U.S., Federal Reserve officials have said that while they’re encouraged by an improvement in price data, they will need to see months of such progress before reducing rates. A healthy job market is providing them with some flexibility.

That’s also true in Australia, where the jobless rate is hovering around levels that are below estimated full employment. The RBA’s goal is to bring consumer prices back within its 2%-3% target while holding onto the significant job gains made since the pandemic.

Treasurer Jim Chalmers tried to play down the implications of the spike in prices. “We’ve seen around the world that inflation can zig and zag on its way down, it doesn’t always moderate in a straight line and the last mile can be a bit harder,” he said.

What Bloomberg Economics Says...

“Our bet is that the RBA will opt to hold. For one, the next inflation readings should be a little cooler. What will tip the balance will be the RBA’s judgment on inflation expectations and forecasts for where inflation will be in 18-24 months — we think the central bank will likely stay in a high-for-longer holding pattern.”

— James McIntyre, economist.

— For the full note, click here

The RBA has held rates since a surprise tightening in November, while highlighting that aggregate demand still exceeds the economy’s supply capacity. Australia’s 13 hikes between May 2022 and November 2023 are at the lower end of the global tightening scale.

Bullock has expressed a willingness to be patient as she seeks to slow inflation without choking off economic growth. The bank’s forecasts show CPI will only return to target in 2025.

“While we maintain that the current macroeconomic settings will eventually be sufficient to contain inflation, there will be significant pressure on the RBA to act to avoid the perception that they aren’t fully committed to beating inflation,” said Callam Pickering, economist at global job site Indeed who previously worked at the central bank.

The CPI report showed:

The most significant contributors were housing, food — led by takeaway meals — and transport

Rents increased 7.4% for the year, reflecting a tight rental market across the country, the ABS said

Energy Bill Relief Fund rebates from July 2023 mostly offset electricity price rises, the bureau said. Excluding the rebates, energy prices would have risen 14.5% in the 12 months through May 2024

--With assistance from Matthew Burgess and Ben Westcott.

(Adds comments from analysts and treasurer.)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance