Aussie Dollar Focus Split as China PMI Comes in Strong

DailyFX.com -

Talking Points

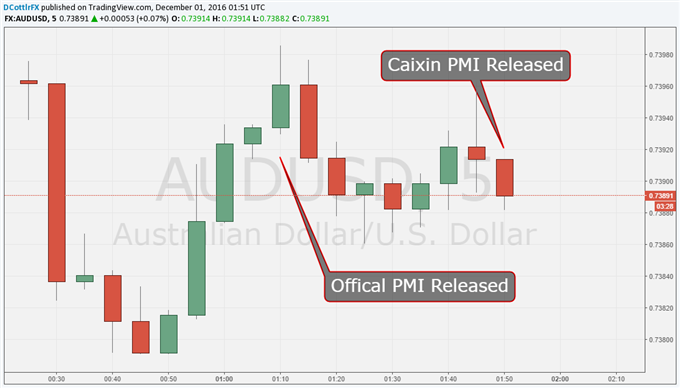

China’s official manufacturing PMI survey was very strong for November

Its private counterpart was less so, but still better than expected

The Australian Dollar’s reaction was hard to gauge in a session replete with “noise”

The Australian Dollar rose on Thursday after news of a strong month for Chinese manufacturing hit the wires. However, a variety of international and local factors are in play in the Aussie market so a direct link is tough to prove.

China’s official Purchasing Managers Index (PMI) for November showed that the manufacturing sector expanded at its fastest pace since July, 2014. The PMI came in at 51.7. In the logic of PMIs, 50 is the “magic” level which separates expansion from contraction.

The markets had been looking for a more modest, 51.0 level. Published after the official data, the Caixin PMI took a little of the shine off. It focuses on smaller, private enterprises and was nowhere near as strong.

It came in at 50.9. That was just ahead of the 50.8 which markets had been looking for, but all the same a big plunge from the 51.2 seen in October. This PMI did show prices climbing for producers, which may be welcome news for Beijing as it seeks to fight deflationary pressures.

The Australian Dollar often functions as a liquid proxy-market for the Chinese economy thanks to Australia’s strong commodity-export links with the giant to its North. It may have done so on Thursday, although a backdrop of more general US Dollar strength and the fillip given to Australian raw material producers by oil prices’ OPEC-inspired surge makes it hard to tell.

There was also some weak capital spending data out of corporate Australia which could have weighed on the currency. At any rate, the Aussie has had a whipsaw sort of morning.

Have financial markets matched DailyFX analysts’ Q4 forecasts? Find out here!

Chart compiled using TradingView

--- Written by David Cottle, DailyFX Research

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance