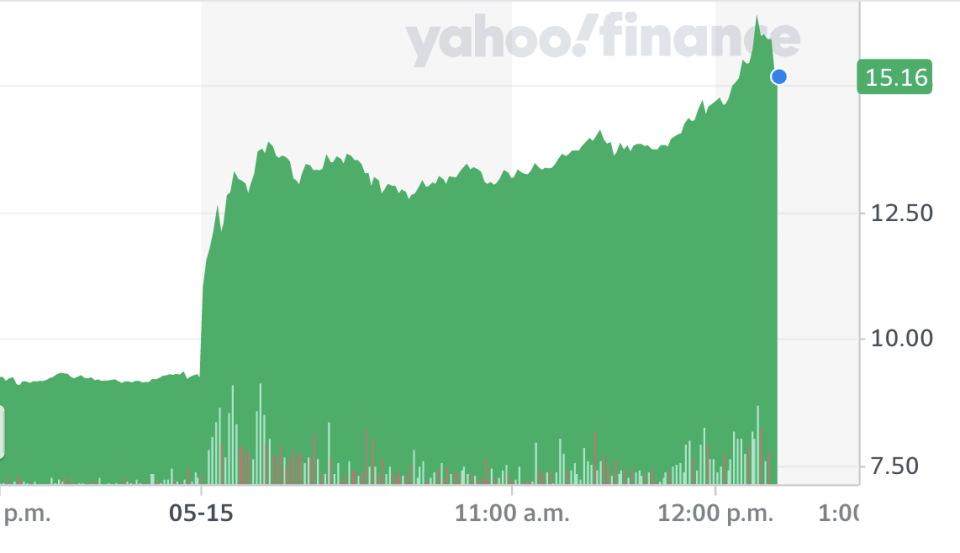

Aurora Cannabis shares surge 70%, analysts say ‘reset’ is underway

Shares of Aurora Cannabis (ACB.TO)(ACB) surged as much as 70 per cent on Friday as investors embraced stronger sales and a clearer path to profitability.

The Edmonton-based pot producer reported a 35 per cent quarterly net sales increase to $75.5 million on Thursday, exceeding analyst expectations. The company maintained its number two spot by net cannabis revenues in the Canadian market, behind Canopy Growth (WEED.TO)(CGC). Aurora’s $137 million net loss in the three months ended March 31 was an improvement from the $1.3 billion lost in the prior quarter.

Aurora narrowed its adjusted EBITDA loss, showing progress towards its goal of turning a profit in the September quarter, while reporting lower costs and more frugal spending.

“The company has started to deliver on its reset, with cost cuts and capex in line with guidance, while delivering above-market average growth and maintaining leadership in key segments,” Cantor Fitzgerald analyst Pablo Zuanic wrote in a research note late Thursday.

Zuanic maintains an “overweight” rating on Toronto-listed shares, with a price target of $22.

After reporting two consecutive quarters of declining recreational sales, Aurora improved its consumer net revenues by 68.6 per cent in the quarter. The company saw sales strength from its value-priced dried flower called “Daily Special.” Cowen analyst Vivien Azer noted that SKU contributed a 14 per cent bump to recreational dried flower sales.

She lowered her price target to $11 from $12, and maintains a “market perform” rating on Canadian shares.

Aurora shares were up 47 per cent to $9.79 at 11:39 a.m. ET in Toronto.

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance