Aumann Leads Trio Of Value Stock Picks On German Exchange

Recent political turbulence and economic uncertainty have left their mark on Germany's DAX index, which experienced a notable decline amid broader European market volatility. In such an environment, identifying undervalued stocks that may offer potential for appreciation becomes particularly pertinent for investors looking to navigate these choppy waters.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €20.24 | €31.51 | 35.8% |

SAP (XTRA:SAP) | €176.00 | €281.69 | 37.5% |

MTU Aero Engines (XTRA:MTX) | €225.00 | €397.54 | 43.4% |

Stratec (XTRA:SBS) | €46.60 | €80.02 | 41.8% |

tonies (DB:TNIE) | €5.72 | €13.98 | 59.1% |

CHAPTERS Group (XTRA:CHG) | €23.60 | €44.40 | 46.8% |

SBF (DB:CY1K) | €2.80 | €5.22 | 46.3% |

Redcare Pharmacy (XTRA:RDC) | €115.10 | €197.69 | 41.8% |

Your Family Entertainment (DB:RTV) | €2.40 | €4.08 | 41.2% |

Dr. Hönle (XTRA:HNL) | €20.10 | €33.31 | 39.7% |

Let's uncover some gems from our specialized screener

Aumann

Overview: Aumann AG, with a market cap of €241.80 million, specializes in manufacturing and selling machines and production lines for components of both electric and classic drive systems across Europe, the Americas, China, and other global markets.

Operations: The company generates €60.25 million from its classic drive systems and €238.18 million from e-mobility segments.

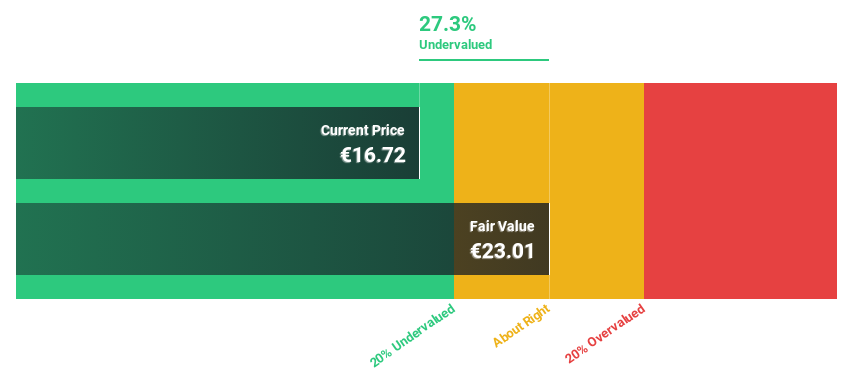

Estimated Discount To Fair Value: 27.3%

Aumann AG demonstrates potential as an undervalued stock based on its cash flows, with significant expected earnings growth of 27.6% per year outpacing the German market's 18.6%. Despite a lower forecasted return on equity at 11.7%, recent financial performance strengthens its case: Q1 sales increased to €65.17 million from €56.2 million year-over-year, and net income improved significantly to €3.94 million from €1.36 million. The company also actively returns value to shareholders through buybacks, completing a repurchase of shares for €14.9 million recently.

Click here and access our complete balance sheet health report to understand the dynamics of Aumann.

SAP

Overview: SAP SE operates globally, offering a wide range of applications, technology, and services through its subsidiaries, with a market capitalization of approximately €204.04 billion.

Operations: The company generates €31.81 billion from its Applications, Technology & Services segment.

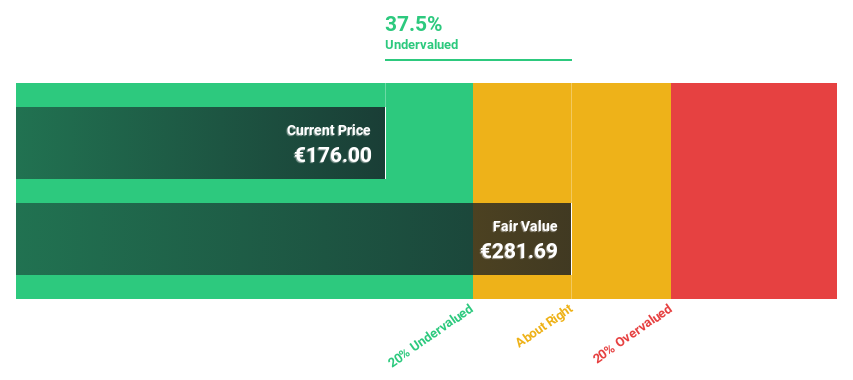

Estimated Discount To Fair Value: 37.5%

SAP, priced at €176, is considered highly undervalued with a fair value of €281.69, trading 37.5% below this estimate. Despite slower forecasted revenue growth at 9.3% annually compared to the desired 20%, SAP's earnings are expected to surge by 33.4% yearly, outpacing the German market's growth rate of 18.6%. Recent strategic alliances aim to enhance efficiencies in manufacturing through advanced technologies and integration with business platforms like SAP S/4HANA, potentially bolstering its market position and financial performance despite some one-off items impacting results.

Our earnings growth report unveils the potential for significant increases in SAP's future results.

Delve into the full analysis health report here for a deeper understanding of SAP.

Verbio

Overview: Verbio SE, operating primarily in Germany and across Europe, is a producer and supplier of fuels and finished products with a market capitalization of approximately €1.29 billion.

Operations: The company generates revenue primarily through two segments: biodiesel, which contributed approximately €1.06 billion, and bioethanol (including biomethane), with revenues of about €0.70 billion.

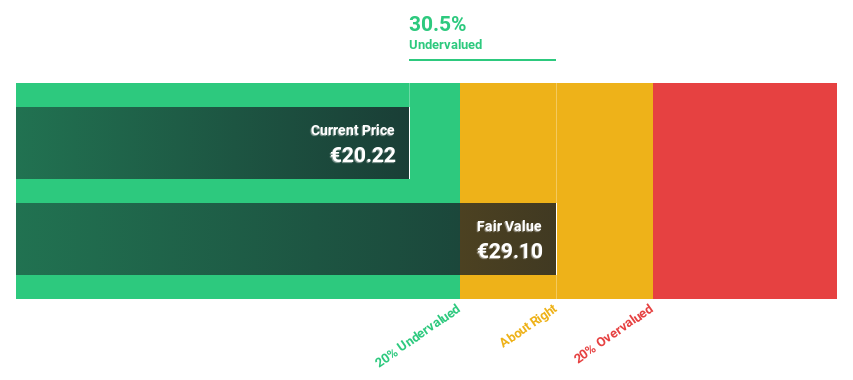

Estimated Discount To Fair Value: 30.5%

Verbio SE, with a forecasted revenue growth of 6.7% per year, is set to outpace the German market average of 5.1%. However, its earnings are expected to increase significantly by 68.3% annually, far exceeding the German market's 18.6%. Despite these positives, Verbio faces challenges as recent figures show a decline in sales and net income with a substantial drop from €124.24 million to €11.44 million in nine months and deteriorating profit margins year-over-year from 11.4% to just 1.1%.

Our growth report here indicates Verbio may be poised for an improving outlook.

Dive into the specifics of Verbio here with our thorough financial health report.

Turning Ideas Into Actions

Click through to start exploring the rest of the 28 Undervalued German Stocks Based On Cash Flows now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:AAG XTRA:SAP and XTRA:VBK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance