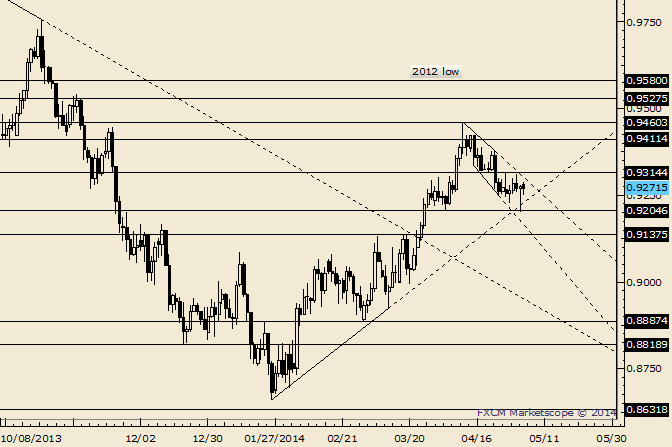

AUD/USD Outside Day Provides Reference Point

Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader and see ideas on other USD crosses

-“AUDUSD has responded to the 2011 low and 2009 high (.9386-.9405), late November high and channel resistance. Look lower as long as price is below last week’s high. Downside levels of interest are .9205 and .9138 (and watch the channel support).”

-The top of former congestion at .9307 is a reaction area too.

LEVELS: .9205 .9264 .9307 | .9362 .9389 .9412

--Trading specifics (setups with entries, stops, targets) are availabletoJ.S. Trade Desk members.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance