AUD/USD Forex Technical Analysis – September 20, 2017 Forecast

The AUD/USD is trading higher on Wednesday. Traders are responding to the relatively hawkish message of Tuesday’s Reserve Bank of Australia (RBA) meeting minutes.

Traders may also be responding to comments from RBA Assistant Governor Luci Ellis’ comments. She said the global economy is looking better that it did a year ago and this is positive news for the Australian economy too. The turning point was around the end of last year, she said at the event organized by the Australian Business Economists.

“While it doesn’t seem to have picked up further recently, neither is this expansion a flash in the pan,” the banker said.

Daily Technical Analysis

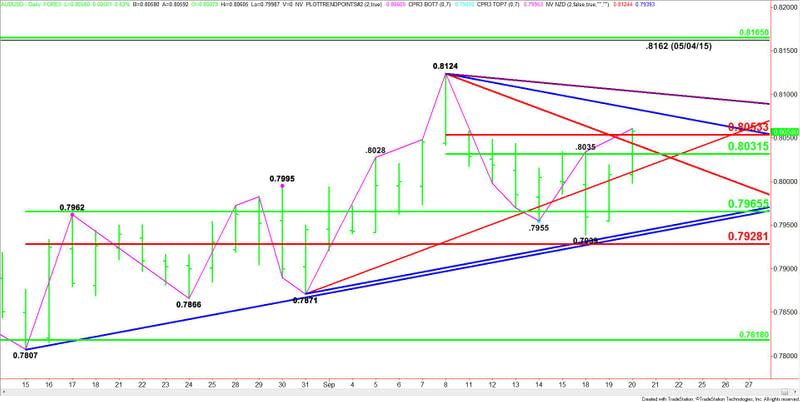

The main trend is up according to the daily swing chart. The trend turned back up on the move through .8035.

The main support is the retracement zone at .7965 to .7928.

The short-term range is .8124 to .7939. Its retracement zone is .8031 to .8053. The market is currently trading on the strong side of this zone, helping to give it it’s upside bias. This zone is also new support.

Daily Forecast

Based on the current price at .8058 and the earlier price action, the direction of the AUD/USD the rest of the session is likely to be determined by trader reaction to the short-term Fibonacci level at .8053.

A sustained move over .8053 will indicate the presence of buyers. If the upside momentum continues then look for a surge into the next downtrending angle at .8084. This is followed by another target angle at .8104. This is the last potential resistance angle before the .8124 main top.

A break back under .8053 will signal the presence of sellers. This could trigger a further break into a series of potential support levels at .8044, .8032 and .8011.

The trigger point for an acceleration to the downside is .8011.

Although the current price action suggests traders may be shrugging off the Fed announcements, we still could see a volatile reaction when the FOMC releases its decisions at 1800 GMT, especially if the Federal Open Market Committee is hawkish or Fed Chair Janet Yellen hints that a December rate hike is still on the table.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance