AUD/USD Forex Technical Analysis – Strengthens Over .6922, Weakens Under .6921

The Australian Dollar is trading lower on Wednesday following a 0.4% decline the previous session. Sentiment for the Aussie has taken a hit after coronavirus lockdown measures were reimposed in Australia’s second biggest city of Melbourne on Tuesday.

At 06:52 GMT, the AUD/USD is at .6936, down 0.0008 or -0.12%.

The Aussie is also being pressured by a strong U.S. Dollar as a resurgence of the coronavirus in the United States and the return of lockdowns in some countries boosted safe-haven demand for the U.S. currency.

Risk sentiment was also undermined after Federal Reserve officials expressed concern that rising coronavirus cases could harm economic growth just as stimulus measures start to expire.

Essentially, the Fed officials told traders it’s ok to be worried because it’s hard to determine when the virus will be brought under control.

Daily Swing Chart Technical Analysis

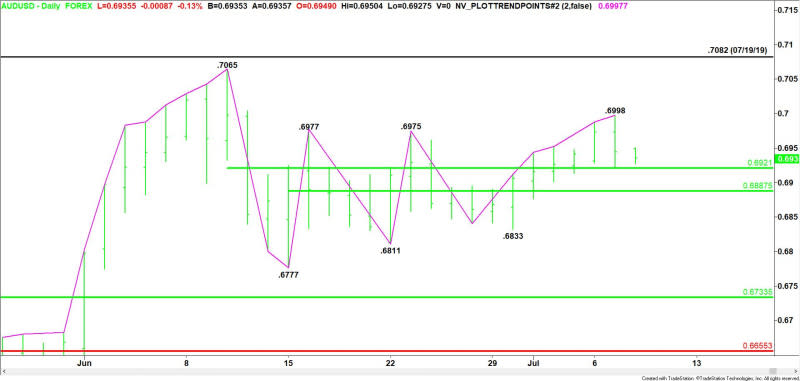

The main trend is up according to the daily swing chart, however, momentum shifted to the downside on Tuesday with the formation of a closing price reversal top.

A trade through .6998 will negate the closing price reversal top and signal a resumption of the uptrend. The main trend will change to down on a trade through the last swing bottom at .6833.

The first minor range is .7065 to .6777. Its 50% level at .6921 is the first support.

The second minor range is .6777 to .6998. Its 50% level at .6888 is the second support.

Daily Swing Chart Technical Forecast

The key area to watch on Wednesday is yesterday’s low at .6922 and the 50% level at .6921. A trade through .6922 will confirm yesterday’s closing price reversal top, while a move through .6921 could trigger an acceleration to the downside.

Bullish Scenario

A sustained move over .6922 will keep the momentum intact. This could trigger a rebound into .6963. Overcoming this level will indicate the buying is getting stronger. This could lead to a retest of yesterday’s high at .6998.

Bearish Scenario

Taking out .6922 will confirm the closing price reversal top and signal a shift in momentum. A breakdown under .6921 could trigger an acceleration to the downside with the next target the 50% level at .6887.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

A Quiet Economic Calendar Leaves COVID-19 to Test the Risk Appetite

GBP/USD Daily Forecast – British Pound Continues Its Upside Move

GBP/USD Attempts to Hold on to Gains Following a Break above 1.2500

U.S. Insurer Allstate to Acquire National General for $4 Billion in Cash

Price of Gold Fundamental Daily Forecast – Gloomy Fed Officials May Have Greenlit Next Rally

Yahoo Finance

Yahoo Finance