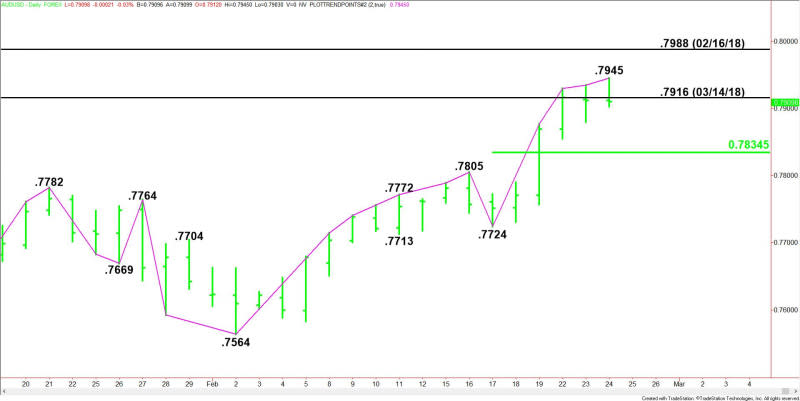

AUD/USD Forex Technical Analysis – Close Under .7912 Forms Potentially Bearish Closing Price Reversal Top

The Australian Dollar is trading flat on Wednesday after giving up earlier gains. The move suggests that investors may be concerned about valuations after the Aussie crossed to the strong side of its March 14, 2018 top at .7916 but fell short of the February 16, 2018 top at .7988.

The Aussie was boosted early in the session after the U.S. Dollar weakened as the promise of extended monetary conditions globally boosted investor appetite for riskier currencies.

At 05:57 GMT, the AUD/USD is trading .7912, up 0.00005 or +0.01%.

The AUD/USD was underpinned at the start of the session after U.S. Federal Reserve Chair Jerome Powell reiterated on Tuesday that interest rates will remain low and the Fed will keep buying bonds to support the U.S. economy. The statement was read as dovish for the U.S. Dollar.

The Aussie was further supported early Wednesday after the Reserve Bank of New Zealand kept interest rates at 0.25% but emphasized patience over the timing of exiting ultra-easy policy settings.

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. The uptrend was reaffirmed earlier in the session when buyers took out yesterday’s high at .7935. Taking out the intraday high at .7945 will signal a resumption of the uptrend.

The main trend will change to down on a trade through .7724. This is highly unlikely but the prolonged move up in terms of price and time has put the AUD/USD in a position to form a potentially bearish closing price reversal top. This won’t change the trend to down, but it could trigger the start of a 2 to 3 day correction.

The minor range is .7724 to .7945. Its 50% level at .7834 is the next potential downside target. Since the main trend is up, buyers could come in on a pullback into this level.

Daily Swing Chart Technical Analysis

The direction of the AUD/USD on Wednesday will likely be determined by trader reaction to .7912.

Bullish Scenario

A sustained move over .7912 will indicate the presence of buyers. If this creates enough upside momentum then look for a retest of the intraday high at .7945. This is a potential trigger point for an acceleration to the upside with the next major target .7988.

Bearish Scenario

A sustained move under .7912 will signal the presence of sellers. This could trigger the start of a short-term correction into .7834.

Closing Price Reversal Top

A close under .7912 will form a closing price reversal top. If confirmed, this could trigger the start of a 2 to 3 day correction with .7834 the next downside target price.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance