An Attempt to Value Alibaba

In the recent past, I've written quite a bit on Alibaba Group Holding Ltd. (NYSE:BABA). Most of the discussions relate to qualitative factors of the business. However, one question I get asked frequently is how to value the stock.

Many readers find that it is very hard to value Alibaba because of its complexity and the risks related to investing in Chinese equities. In this discussion, I will attempt to provide a framework of my approach to value the stock given what I know about the business. It is worth mentioning that I also acknowledge that Alibaba's valuation is as much art as it is science. Therefore, please take my valuation with a grain of salt.

DCF versus the value investing approach

First of all, I would not use discounted cash flow to value Alibaba even though it is the standard method of valuation. The reason why I do not recommend using DCF to value Alibaba is based on Bruce Greenwald's observation:

The DCF/CAPM methodology that business schools teach is a theoretically elegant formulation. But in practice, the margin of error makes it worthless for investing. These models depend not only on near-term cash flows, which can be projected reliably, but also on long-term cash flows and terminal values, which cannot. Terminal values rely on highly subjective assumptions of costs of capital and growth rates. Any error, however slight, in these variables can dramatically throw off valuations. Furthermore, DCF models ignore balance sheets, throwing away some of the most tangible, reliable and therefore valuable information available.

Instead, he recommended the following approach:

The value investing approach organizes information by the reliability of assumptions, starting with the balance sheet. Within the balance sheet, reliability decreases from cash to accounts receivable, inventory, property, plant and equipment to intangibles like customer acquisition, branding and advertising costs.Value investors use estimates of sustainable, steady-state earnings levels, based on current earnings and cash flows, to value a company's earnings power. This analysis yields three possible scenarios: a company's earnings-power value is lower than its asset value, its earnings-power and asset values are about equal or its earnings-power value is greater than its asset value. The value investing approach looking first at asset value, then earnings-power value, then competitive advantage and managerial ability and then growth is in every way more accurate than the DCF method.

For the reasons listed above, I shall use the value investing approach to value Alibaba.

Assets value

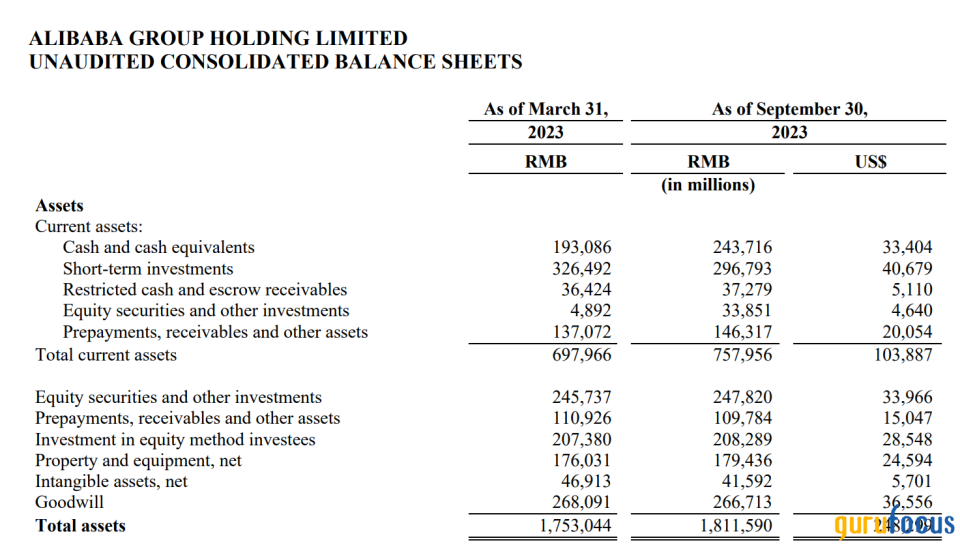

Below is a snapshot of Alibaba's assets from the most recent earnings release:

As of Sept. 30, Alibaba has cash and cash equivalents of $74 billion, equity securities and other investments of $34 billion and investments in equity method investees of $28.50 billion. For conservative purposes, I will take a 20% haircut to both equity securities and other investments and investment in equity method investees. The result is roughly $125 billion in cash and quasi-cash assets. As of Sept. 30, Alibaba had $1.10 billion in short-term bank loans, $7.50 billion in non-current bank loans and $14.20 billion in unsecured senior notes. Combined, Alibaba has total interesting-bearing debt of $22.80 billion. Deducting this from $125 billion in cash and quasi-cash assets, we arrive at Alibaba's net cash position of $102 billion.

Earnings power and growth value

Alibaba's pre-tax income and net income for 2020 to 2023 has been volatile due to large one-off items, but its operating income has been quite stable. Therefore, we will use the company's operating income as a proxy for its earnings power. Over the three-year period, Alibaba's operating income oscillated between $13 billion and $15 billion with an average of about $14 billion. For conservative purposes, we will use the low end of $13 billion as Alibaba's sustainable steady-state pre-tax earnings power. We then apply an 18% tax rate to arrive at after-tax steady-state earnings power of $10.70 billion. Obviously the value of this earnings power depends on the discount rate. For illustration purposes, we will use a 15% discount rate here. The result is total earnings power value of roughly $71.30 billion. If you think Chinese ADRs have higher risks, then you can use a higher discount rate.

Although Alibaba has had some growth over the past few quarters, I would not bet on its future growth given the structural issues. Therefore, here I will assign no growth value for the stock for conservative purposes.

Conclusion

From the above calculation, we can arrive at Alibaba's steady-state valuation of roughly $173 billion (net cash $102 billion and $71 billion of earnings power value assuming a 15% discount rate). This is not far from today's market value of $181 billion. Clearly the market is also currencly assigning no value for Alibaba's growth. If the company can growth its earnings power, then the stock is undervalued. If Alibaba's earnings power declines in the future, then the stock might be a value trap.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance