Aton Reports Diamond Drill Results from the Hamama East and Central Areas, Including 1.38 g/t Au Equivalent and 8.20% Zn over 22.5m from Surface, and Announces the Issuance of Bonus Warrants and Early Warning Report

VANCOUVER, BC / ACCESSWIRE / March 29, 2023 / Aton Resources Inc. (TSXV:AAN) ("Aton" or the "Company") is pleased to update investors on results from the recent diamond drilling programme at Hamama, located in the Company's 100% owned Abu Marawat Concession ("Abu Marawat" or the "Concession"), in the Eastern Desert of Egypt, (Figure 1).

Highlights:

Diamond drilling was completed at Hamama on March 11, 2022, with a total of 1,612.7 metres drilled from 42 shallow holes. The programme was designed to test for potential oxide mineralisation in areas that previously had been largely undrilled;

22 holes were drilled at Hamama East, with results including 0.82 g/t Au, 47.39 g/t Ag, 1.38 g/t Au equivalent ("AuEq") and 8.20% Zn over an interval of 22.5m from surface (HAD-022) and 0.60 g/t Au, 43.49 g/t Ag, 1.11 g/t AuEq and 3.25% Zn over an interval of 22.7m from 0.45m downhole depth (HAD-021), associated with the main Hamama silica-carbonate mineralised horizon;

5 holes were drilled at Hamama Central, which returned mineralised intersections including 1.20 g/t Au, 15.17 g/t Ag, and 1.38 g/t AuEq over an interval of 15.9m from 11.0m downhole depth (HAD-017) also associated with the highly gossanous Hamama silica-carbonate mineralised horizon;

Aton has issued 20,000,000 bonus warrants to OU Moonrider, a significant shareholder, in respect of a $4M loan provided to the Company.

"We are pleased to be able to announce this year's diamond drill results from Hamama East and Central. We have not drill tested the oxide potential in these areas previously, and we are surely happy with these results that confirm reasonable thicknesses of oxide gold-silver mineralisation, as indicated by our previous surface channel sampling and trenching, in these areas," said Tonno Vahk, Interim CEO. "The grades we are seeing are very much in line with the Hamama West oxide resource, and these newly delineated areas will again be readily amenable to exceedingly low strip ratio open pit mining methods. These results are particularly encouraging, when combined with the recent metallurgical test results from the Rodruin oxides, and we are now considering different potential processing scenarios for the oxide mineralisation at both Hamama West and Rodruin including the potential use of modular CIL technology. We continue to press on towards our stated intention of submitting our application for the mining licence at Abu Marawat in Q3-2023. With further metallurgical testwork programmes ongoing, Cube Consulting working on the revised mineral resource statements, and active preparations on the ground for the upcoming RC drilling at some of our highly prospective regional targets including Semna, Abu Gaharish, Zeno, West Garida, Sir Bakis and Bohlog, we continue to aggressively push our programmes forward. We are working closely with our partners at the Egyptian Mineral Resources Authority, and are very excited about Aton being on course to becoming only the second foreign listed company to be granted a gold mining licence in Egypt, and the benefits this will bring to Egypt, our shareholders, and all of our Egyptian stakeholders including EMRA and the Ministry of Petroleum."

2023 Hamama diamond drilling programme

Diamond drilling re-commenced at Hamama in mid-January 2023, and was completed on March 11, 2023. The drilling was undertaken by Energold Limited using the ID500-G track-mounted rig supplied by Global Drilling (Figure 2), which is specially engineered to be able to drill horizontal and very shallow holes, as well as more usual inclined and vertical holes. The flexibility offered by this rig allowed for horizontal or shallow holes to be drilled in rugged terrain at Hamama East and Central to test the surface mineralisation outcropping in these areas.

The mineralisation at Hamama is hosted in a stratiform silica-carbonate horizon ("SCMH") that outcrops over an approximately 3.2 km strike length, and is variable in thickness. At Hamama West the SCMH is >60m in thickness in places, while at Hamama East it has a typical thickness of c. 15-20m. THE SCMH is typically iron oxide-rich and gossanous at surface and throughout the oxide zone, reflecting weathering and oxidation of the sulphide-rich precursor.

Figure 1: Geology plan of the Abu Marawat Concession showing the location of the Hamama project

During the 2023 diamond drilling programme 42 generally short holes were drilled at Hamama Central, Hamama East and the Crocs Nose Zone, to test for potential surface or shallow oxide mineralisation, which previously had been largely untested by drilling, for a total of 1,612.7m (see Table 1).

Figure 2: Energold's ID-500G rig drilling on hole HAD-020 at Hamama East

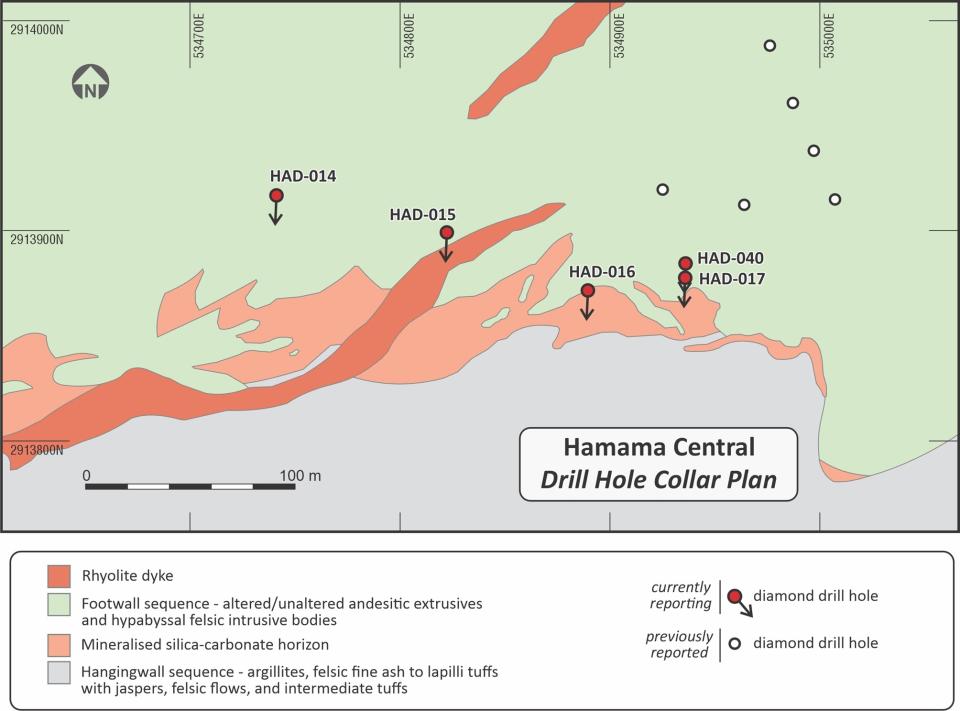

Figure 3: Hamama Central area - geology and drill hole collar plan

5 holes (HAD-014 to HAD-017, and HAD-040) were completed at Hamama Central for a total of 239.4m (see Table 1 and Figure 3), and 22 holes (HAD-018 to HAD-039) were completed at Hamama East for a total of 827.5m (see Table 1 and Figure 4). The remaining 15 holes were drilled at the Crocs Nose Zone at Hamama West, and will be reported when assay results become available.

Hole ID | Collar co-ordinates 1 | Dip 2 | Grid azimuth 2 | EOH depth (m) | Comments | ||

X | Y | Z | |||||

HAD-014 | 534741.6 | 2913916.8 | 491.3 | -1.9 | 174.1 | 87.8 | Hamama Central |

HAD-015 | 534822.5 | 2913899.3 | 494.2 | 0.1 | 182.1 | 69.3 | Hamama Central |

HAD-016 | 534889.7 | 2913871.8 | 498.6 | 1.2 | 182.4 | 22.3 | Hamama Central |

HAD-017 | 534935.9 | 2913878.3 | 499.7 | -10.7 | 182.1 | 28.8 | Hamama Central |

HAD-018 | 535276.9 | 2913972.7 | 509.6 | -0.5 | 122.6 | 34.3 | Hamama East |

HAD-019 | 535280.9 | 2914033.4 | 498.2 | -15.5 | 144.4 | 52.5 | Hamama East |

HAD-020 | 535336.0 | 2914079.7 | 511.0 | -0.1 | 137.7 | 36.0 | Hamama East |

HAD-021 | 535332.5 | 2914057.9 | 510.4 | 0.1 | 134.7 | 32.4 | Hamama East |

HAD-022 | 535358.4 | 2914083.2 | 520.1 | -0.1 | 136.6 | 27.1 | Hamama East |

HAD-023 | 535358.2 | 2914083.5 | 519.0 | -32.8 | 134.0 | 30.1 | Hamama East |

HAD-024 | 535375.4 | 2914125.8 | 510.5 | 0.0 | 137.7 | 24.2 | Hamama East |

HAD-025 | 535375.2 | 2914126.0 | 509.6 | -33.5 | 133.2 | 17.8 | Hamama East |

HAD-026 | 535335.9 | 2914079.7 | 509.6 | -33.3 | 135.5 | 24.3 | Hamama East |

HAD-027 | 535409.7 | 2914222.8 | 513.4 | -1.3 | 155.0 | 41.1 | Hamama East |

HAD-028 | 535451.8 | 2914212.4 | 535.6 | -0.2 | 136.3 | 13.1 | Hamama East |

HAD-029 | 535482.4 | 2914252.5 | 540.1 | -0.4 | 133.3 | 21.9 | Hamama East |

HAD-030 | 535511.6 | 2914274.0 | 542.4 | 0.0 | 134.7 | 31.4 | Hamama East |

HAD-031 | 535542.4 | 2914296.8 | 542.3 | -0.7 | 136.3 | 30.9 | Hamama East |

HAD-032 | 535568.8 | 2914324.2 | 542.2 | -0.7 | 130.8 | 46.1 | Hamama East |

HAD-033 | 535594.8 | 2914347.2 | 539.8 | -0.2 | 136.8 | 55.0 | Hamama East |

HAD-034 | 535433.6 | 2914237.5 | 522.6 | -0.6 | 183.6 | 59.4 | Hamama East |

HAD-035 | 535437.1 | 2914239.4 | 522.0 | -10.4 | 135.2 | 36.5 | Hamama East |

HAD-036 | 535455.7 | 2914278.2 | 520.9 | 0.2 | 134.7 | 53.4 | Hamama East |

HAD-037 | 535482.7 | 2914309.5 | 517.5 | -0.2 | 136.1 | 63.1 | Hamama East |

HAD-038 | 535515.7 | 2914332.0 | 519.9 | 0.1 | 136.5 | 69.0 | Hamama East |

HAD-039 | 535328.2 | 2914059.2 | 508.7 | -35.0 | 142.8 | 27.8 | Hamama East |

HAD-040 | 534935.9 | 2913884.5 | 498.8 | -36.7 | 178.9 | 31.2 | Hamama Central |

Notes:

| |||||||

Table 1: Collar details of diamond drill holes HAD-014 to HAD-040

Discussion of results

Results are now available for the first 27 drill holes, HAD-014 to HAD-040, from the Hamama Central and Hamama East zones. The collar co-ordinates of these holes are provided in Table 1, and details of all mineralised intersections are provided in Appendix A.

Hamama Central

5 holes (HAD-014 to HAD-017, and HAD-040) were completed at Hamama Central for a total of 239.4m (see Table 1 and Figure 3). Previous drilling in the general area intersected sulphide mineralisation including a 14.1m interval grading 6.5% Zn, 0.20% Cu, 0.81 g/t Au and 39.1 g/t Ag, from 108m depth (hole AHA-004), and a 16.0m interval grading 4.71% Zn, 0.22% Cu, 0.81 g/t Au and 33.7 g/t Ag, from 127m depth (AHA-005), see news release dated October 29, 2012. None of the previous drilling at Hamama Central had targeted potential oxide mineralisation.

The first 3 holes, HAD-014 to HAD-016, targeting a heavily dissected and faulted outcrop of the SCMH (Figure 3), failed to intersect any significant mineralisation. Holes HAD-017 and HAD-040, however, drilled close to ancient copper workings, intersected mineralisation associated with gossanous SCMH, returning intervals of 15.9m grading 1.20 g/t Au, 15.17 g/t Ag, and 1.38 g/t AuEq, from 11.0m downhole depth (HAD-017) and 8.7m grading 0.75 g/t Au, 17.17 g/t Ag, and 0.95 g/t AuEq, from 18.0m downhole depth (HAD-040). Recovery from hole HAD-040 was quite poor through the mineralised zone, which strongly suggested that ancient mine workings had been intersected in this hole.

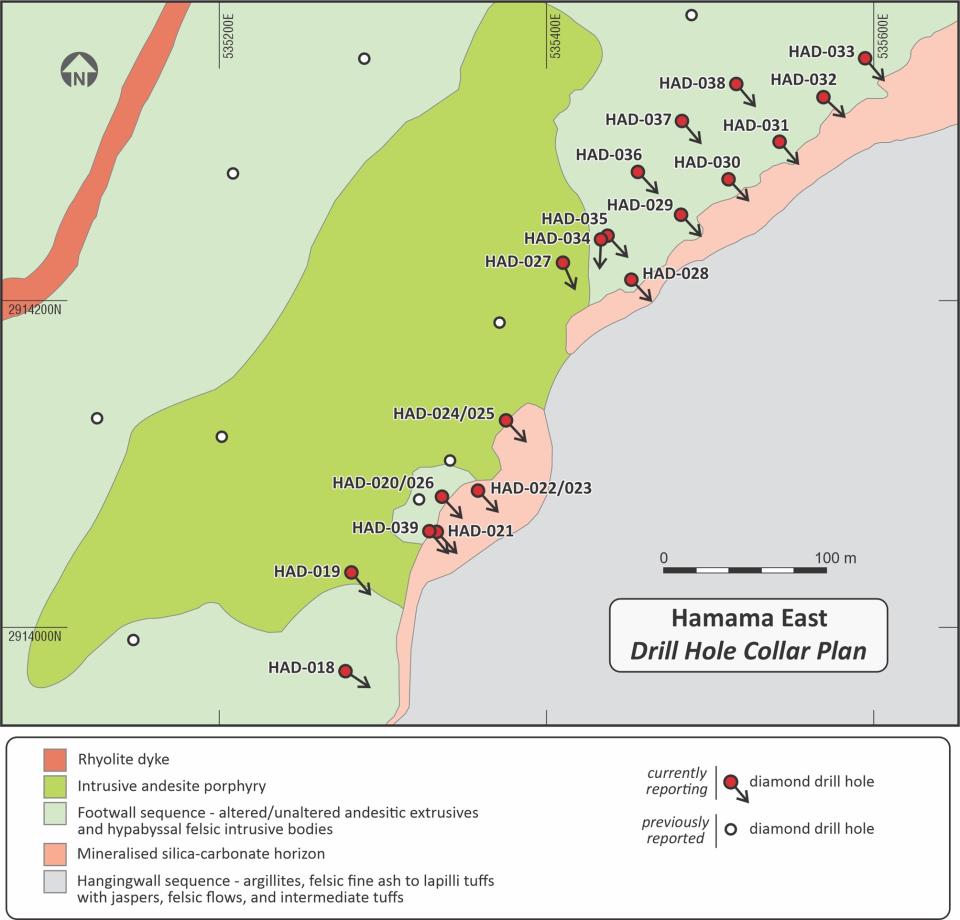

Figure 4: Hamama East area - geology and drill hole collar plan

Hamama East

22 holes (HAD-018 to HAD-018 to HAD-039) were drilled at Hamama East for a total of 827.5m (see Table 1 and Figure 4). Previous drilling at Hamama East intersected base metal dominant sulphide mineralisation including a 46.5m interval grading 1.67% Zn and 0.11% Cu, from 150.3m depth (hole AHA-053). Sulphide mineralisation was also intersected in the main SCMH at depth, including a 10.6m interval grading 1.67% Zn, 0.11% Cu, 0.32 g/t Au and 75.6 g/t Ag, from 180m depth (AHA-052), and an 8.0m interval grading 0.47 g/t Au, 31.2 g/t Ag and 0.38% Zn, from 113m depth (AHA-049), see news release dated October 20, 2015.

Most of the holes at Hamama East intersected gold-silver (±zinc-lead-copper) oxide mineralisation, associated with gossanous SCMH. Selected intersections are shown below in Table 2, and all Hamama East intersections are provided in Appendix A.

Hole ID | Intersection (m) 1 | Au (g/t) | Ag (g/t) | AuEq (g/t) 3 | Cu (%) | Pb (%) | Zn (%) | Comments | ||

From | To | Interval 2 | ||||||||

HAD-018 | 29.20 | 32.30 | 3.10 | 0.29 | 4.56 | 0.34 | 0.37 | 0.49 | 21.34 | SCMH |

HAD-020 | 11.20 | 29.50 | 18.30 | 0.75 | 33.47 | 1.15 | 0.09 | 0.32 | 2.85 | SCMH |

HAD-021 | 0.45 | 23.15 | 22.70 | 0.60 | 43.49 | 1.11 | 0.21 | 0.33 | 3.25 | SCMH |

HAD-022 | 0.00 | 22.50 | 22.50 | 0.82 | 47.39 | 1.38 | 0.30 | 0.71 | 8.20 | SCMH |

HAD-023 | 0.00 | 16.20 | 16.20 | 0.72 | 37.37 | 1.16 | 0.16 | 0.36 | 4.09 | SCMH |

HAD-024 | 0.00 | 13.65 | 13.65 | 0.61 | 40.63 | 1.09 | 0.11 | 0.37 | 2.56 | SCMH |

HAD-025 | 0.00 | 13.40 | 13.40 | 0.56 | 27.29 | 0.88 | 0.06 | 0.26 | 1.51 | SCMH |

HAD-029 | 6.20 | 18.75 | 12.55 | 0.60 | 56.44 | 1.26 | 0.15 | 0.76 | 5.34 | SCMH |

HAD-030 | 13.00 | 23.90 | 10.90 | 0.65 | 76.78 | 1.55 | 0.04 | 0.13 | 0.40 | SCMH |

HAD-034 | 36.70 | 44.80 | 8.10 | 1.06 | 60.98 | 1.78 | 0.11 | 0.39 | 2.03 | SCMH |

HAD-035 | 19.20 | 26.30 | 7.10 | 0.75 | 40.08 | 1.22 | 0.07 | 0.47 | 1.23 | SCMH |

HAD-039 | 2.10 | 24.60 | 22.50 | 0.47 | 28.82 | 0.81 | 0.27 | 0.41 | 6.23 | SCMH |

Notes:

| ||||||||||

Table 2: Selected intersections from Hamama East

The drilling has indicated the presence of outcropping gold-silver (±zinc-lead-copper) oxide mineralisation, at reasonably consistent grades, associated with the SCMH, over a strike length of approximately 300m at Hamama East. The drilling confirms previous mechanical saw-cut channel sampling results from the immediate area, including intersections of 84m @ 1.13 g/t Au, 49.7 /t Ag and 7.29% Zn (channel profile HAC-160) and 42.8m @ 1.28 g/t Au, 55.5 g/t Ag and 10.37% Zn (channel profile HAC-161), see news release dated May 3, 2018. The grade of the mineralisation appears to be increasing towards surface, but this has not been tested by drilling as the hard gossanous carbonate rocks of the SCMH control the topography in this area, making drill testing from higher up on the ridge very difficult.

The SCMH is partially stoped out at depth by an intrusive andesite porphyry (Figure 4), which in places reaches the surface. The mineralisation appears to decrease in strength and width to the south of holes HAD-021 and HAD-039, and also pinches out to the northeast of hole HAD-030, even as the thickness of the SCMH increases (Figure 4).

This incremental oxide mineralisation at Hamama East identified in the recent drilling has not to date been included in any ore resource estimates. This mineralisation outcrops at surface, and is expected to be readily mineable at very low strip ratios, and will now be included in the development plans for the Hamama West starter oxide open pit operation.

Sample processing and analytical procedures

Drill core was logged by Aton geologists, and marked up for cutting and sampling at the Hamama core farm. Samples were typically selected over nominal 1m intervals, but as determined by the logged lithologies. The core was half-cut by Aton staff at the onsite Hamama sample preparation facility.

The split half-core samples were collected and bagged up in cloth bags, weighed and crushed to -4mm onsite, and split to a nominal c. 250-500g sample size. The coarse crushed reject samples are retained onsite at the Hamama sample prep facility.

QAQC samples are inserted at a rate of approximately 1 certified reference material (or "standard" sample) every 30 samples, 1 blank sample every 15 samples, and 1 duplicate split sample every 15 samples.

The c. 250-500g dried, crushed and split samples were shipped to ALS Minerals sample preparation laboratory at Marsa Alam, Egypt where they were pulverised to a size fraction of better than 85% passing 75 microns. From this pulverised material a further sub-sample was split off with a nominal c. 50g size, which was shipped on to ALS Minerals at Rosia Montana, Romania for analysis.

Samples were analysed for gold by fire assay with an atomic absorption spectroscopy ("AAS") finish (analytical code Au-AA23), and for silver, copper, lead and zinc using an aqua regia digest followed by an AAS finish (analytical code AA45). Any high grade gold samples (>10 g/t Au) were re-analysed using analytical code Au-GRA21 (also fire assay, but with a gravimetric finish). Any high grade Ag and base metal samples (Ag >100 g/t, and Cu, Pb and Zn >10,000ppm or >1%) were re-analysed using the ore grade technique AA46 (also an aqua regia digest followed by an AAS finish).

Bonus Warrants and Early Warning Report

Aton announces that, further to its news release dated March 7, 2023, it has issued 20,000,000 bonus warrants (the "Warrants") to OU Moonrider ("Moonrider"), a significant shareholder of the Company, in respect of a $4M loan (the "Loan") provided to the Company by Moonrider. The Warrants are exercisable at a price of $0.20 per share until March 6, 2024.

Pursuant to National Instrument 62-103 - The Early Warning System and Related Take Over Bid and Insider Reporting Issues, Moonrider acquired the Warrants in consideration for the Loan.

Prior to acquiring the Warrants, Moonrider beneficially owned, controlled, or directed an aggregate of 18,510,638 common shares and 12,566,686 share purchase warrants, representing approximately 33.04% of the outstanding common shares of Aton on a non-diluted basis and approximately 45.31% on a partially diluted basis, assuming Moonrider's exercise of its previously held warrants (the "Prior Warrants").

Following the acquisition of the Warrants, Moonrider beneficially owns, controls, or directs an aggregate of 18,510,638 common shares and 32,566,686 share purchase warrants, representing approximately 33.04% of the outstanding common shares of Aton on a non-diluted basis and approximately 57.65% on a partially diluted basis, assuming Moonrider's exercise of both the Warrants and Prior Warrants.

Moonrider may, depending on market or other conditions, increase or decrease its beneficial ownership, control or direction over, or exercise its current rights to acquire, common shares through market transactions, private agreements or otherwise.

Moonrider's head office is located at Toompuiestee 37, 10133 Tallinn, Estonia.

The early warning report, as required under National Instrument 62-103, contains additional information with respect to the foregoing matters and will be filed by Moonrider on Aton's SEDAR profile at www.sedar.com.

Aton Resources Inc. (AAN: TSX-V) is focused on its 100% owned Abu Marawat Concession ("Abu Marawat"), located in Egypt's Arabian-Nubian Shield, approximately 200 km north of Centamin's world-class Sukari gold mine. Aton has identified numerous gold and base metal exploration targets at Abu Marawat, including the Hamama deposit in the west, the Abu Marawat deposit in the northeast, and the advanced Rodruin exploration prospect in the south of the Concession. Two historic British gold mines are also located on the Concession at Sir Bakis and Semna. Aton has identified several distinct geological trends within Abu Marawat, which display potential for the development of a variety of styles of precious and base metal mineralisation. Abu Marawat is 447.7 km2 in size and is located in an area of excellent infrastructure; a four-lane highway, a 220kV power line, and a water pipeline are in close proximity, as are the international airports at Hurghada and Luxor. | The technical information contained in this News Release was prepared by Javier Orduña BSc (hons), MSc, MCSM, DIC, MAIG, SEG(M), Exploration Manager of Aton Resources Inc. Mr. Orduña is a qualified person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects. For further information regarding Aton Resources Inc., please visit us at www.atonresources.com or contact: TONNO VAHK Interim CEO |

Some of the statements contained in this release are forward-looking statements. Since forward-looking statements address future events and conditions; by their very nature they involve inherent risks and uncertainties. Actual results in each case could differ materially from those currently anticipated in such statements. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. | |

Appendix A - Drilling Intersections

Hole ID | Intersection (m) 1 | Au (g/t) | Ag (g/t) | AuEq (g/t) 2 | Cu (%) | Pb (%) | Zn (%) | Comments | ||

From | To | Interval | ||||||||

HAD-014 | - | - | - | - | - | - | - | - | - | Hamama Central |

HAD-015 | - | - | - | - | - | - | - | - | - | Hamama Central |

HAD-016 | - | - | - | - | - | - | - | - | - | Hamama Central |

HAD-017 | 11.00 | 26.90 | 15.90 | 1.20 | 15.17 | 1.38 | 0.07 | 0.34 | 0.67 | Hamama Central |

HAD-018 | 29.20 | 32.30 | 3.10 | 0.29 | 4.56 | 0.34 | 0.37 | 0.49 | 21.34 | Hamama East |

HAD-019 | - | - | - | - | - | - | - | - | - | Hamama East |

HAD-020 | 11.20 | 29.50 | 18.30 | 0.75 | 33.47 | 1.15 | 0.09 | 0.32 | 2.85 | Hamama East |

incl. | 11.20 | 23.30 | 12.10 | 0.92 | 34.32 | 1.33 | 0.11 | 0.41 | 3.11 | |

and incl. | 27.00 | 29.50 | 2.50 | 0.84 | 42.08 | 1.33 | 0.08 | 0.21 | 4.77 | |

HAD-021 | 0.45 | 23.15 | 22.70 | 0.60 | 43.49 | 1.11 | 0.21 | 0.33 | 3.25 | Hamama East |

incl. | 0.45 | 16.05 | 15.60 | 0.75 | 53.74 | 1.38 | 0.29 | 0.34 | 4.39 | |

and incl. | 20.10 | 23.15 | 3.05 | 0.50 | 35.14 | 0.92 | 0.05 | 0.65 | 1.37 | |

HAD-022 | 0.00 | 22.50 | 22.50 | 0.82 | 47.39 | 1.38 | 0.30 | 0.71 | 8.20 | Hamama East |

incl. | 0.00 | 3.00 | 3.00 | 1.37 | 24.90 | 1.66 | 0.38 | 0.99 | 7.77 | |

and incl. | 10.00 | 22.50 | 12.50 | 1.05 | 62.92 | 1.79 | 0.24 | 0.89 | 7.24 | |

HAD-023 | 0.00 | 16.20 | 16.20 | 0.72 | 37.37 | 1.16 | 0.16 | 0.36 | 4.09 | Hamama East |

incl. | 8.05 | 15.30 | 7.25 | 1.24 | 56.72 | 1.90 | 0.13 | 0.51 | 3.59 | |

HAD-024 | 0.00 | 13.65 | 13.65 | 0.61 | 40.63 | 1.09 | 0.11 | 0.37 | 2.56 | Hamama East |

incl. | 0.00 | 4.80 | 4.80 | 0.87 | 60.52 | 1.58 | 0.07 | 0.36 | 1.89 | |

and incl. | 9.55 | 13.65 | 4.10 | 0.96 | 33.13 | 1.35 | 0.16 | 0.50 | 3.43 | |

HAD-025 | 0.00 | 13.40 | 13.40 | 0.56 | 27.29 | 0.88 | 0.06 | 0.26 | 1.51 | Hamama East |

incl. | 0.00 | 3.10 | 3.10 | 1.67 | 60.30 | 2.38 | 0.06 | 0.30 | 1.93 | |

and incl. | 9.70 | 13.40 | 3.70 | 0.47 | 20.41 | 0.71 | 0.06 | 0.28 | 1.49 | |

HAD-026 | 13.82 | 20.40 | 6.58 | 0.54 | 18.2 | 0.75 | 0.16 | 0.22 | 2.28 | Hamama East |

HAD-027 | - | - | - | - | - | - | - | - | - | Hamama East |

HAD-028 | 0.00 | 9.30 | 9.30 | 0.40 | 27.54 | 0.73 | 0.03 | 0.13 | 0.84 | Hamama East |

HAD-029 | 6.20 | 18.75 | 12.55 | 0.60 | 56.44 | 1.26 | 0.15 | 0.76 | 5.34 | Hamama East |

HAD-030 | 13.00 | 23.90 | 10.90 | 0.65 | 76.78 | 1.55 | 0.04 | 0.13 | 0.40 | Hamama East |

HAD-031 | 23.20 | 26.30 | 3.10 | 0.80 | 46.73 | 1.35 | 0.05 | 0.07 | 0.35 | Hamama East |

HAD-032 | - | - | - | - | - | - | - | - | - | Hamama East |

HAD-033 | - | - | - | - | - | - | - | - | - | Hamama East |

HAD-034 | 36.70 | 44.80 | 8.10 | 1.06 | 60.98 | 1.78 | 0.11 | 0.39 | 2.03 | Hamama East |

HAD-035 | 19.20 | 26.30 | 7.10 | 0.75 | 40.08 | 1.22 | 0.07 | 0.47 | 1.23 | Hamama East |

HAD-036 | - | - | - | - | - | - | - | - | - | Hamama East |

HAD-037 | 49.80 | 59.00 | 9.20 | 0.27 | 48.18 | 0.84 | 0.04 | 0.18 | 0.47 | Hamama East |

HAD-038 | 59.60 | 66.20 | 6.60 | 0.17 | 28.86 | 0.51 | 0.00 | 0.01 | 0.09 | Hamama East |

HAD-039 | 2.10 | 24.60 | 22.50 | 0.47 | 28.82 | 0.81 | 0.27 | 0.41 | 6.23 | Hamama East |

incl. | 3.10 | 13.60 | 10.50 | 0.88 | 38.15 | 1.33 | 0.28 | 0.53 | 5.36 | |

HAD-040 | 18.00 | 26.70 | 8.70 | 0.75 | 17.17 | 0.95 | 0.02 | 0.04 | 0.06 | Hamama Central |

Notes:

| ||||||||||

SOURCE: Aton Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/746350/Aton-Reports-Diamond-Drill-Results-from-the-Hamama-East-and-Central-Areas-Including-138-gt-Au-Equivalent-and-820-Zn-over-225m-from-Surface-and-Announces-the-Issuance-of-Bonus-Warrants-and-Early-Warning-Report

Yahoo Finance

Yahoo Finance