Atomera Inc (ATOM) Reports Q1 2024 Earnings: A Closer Look Against Analyst Projections

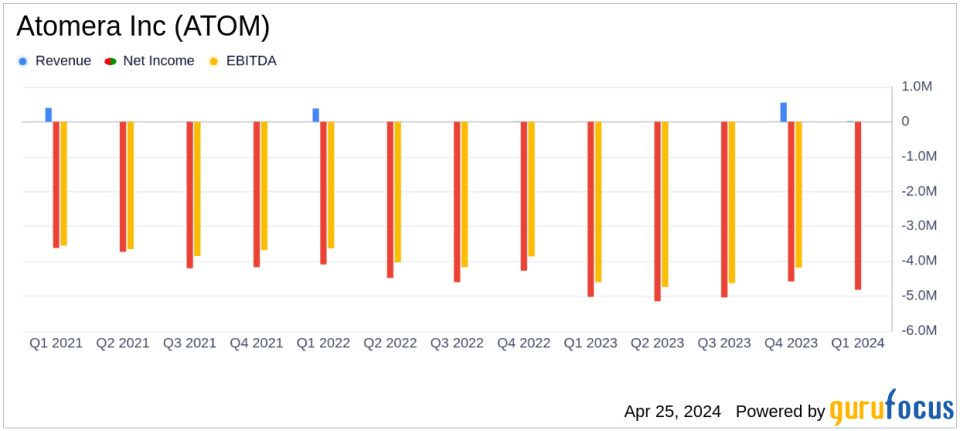

Net Loss: Reported a net loss of $4.8 million in Q1 2024, which is an improvement from a net loss of $5.0 million in Q1 2023, and fell short of the estimated net loss of $3.9 million.

Earnings Per Share (EPS): Recorded a loss of $0.19 per share, slightly better than the previous year's $0.21 per share but below the estimated loss of $0.15 per share.

Revenue: Generated $18K in revenue, surpassing the estimated revenue of $0.00 million.

Cash Position: Held $19.3 million in cash, cash equivalents, and short-term investments as of March 31, 2024, slightly down from $19.5 million at the end of 2023.

Adjusted EBITDA: Posted an adjusted EBITDA loss of $4.0 million, a slight improvement from a loss of $4.2 million in the same quarter the previous year.

Shares Outstanding: Total shares outstanding were 26.9 million as of March 31, 2024.

On April 25, 2024, Atomera Inc (NASDAQ:ATOM) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company, a key player in the semiconductor materials and technology licensing sector, reported a net loss of $4.8 million, or $0.19 per share, which did not align with analyst expectations of a $3.9 million loss, or $0.15 per share.

About Atomera Incorporated

Atomera Incorporated specializes in enhancing semiconductor performance through its proprietary technology, Mears Silicon Technology (MST). MST, a thin film of re-engineered silicon, can be integrated into the fabrication of semiconductors to improve the efficiency and performance of transistors, which are critical components in a myriad of electronic devices.

Financial Performance and Market Activity

The company's financial health showed a slight improvement in its adjusted EBITDA, with a loss of $4.0 million compared to a loss of $4.2 million in the same quarter the previous year. Despite the net loss widening from the previous year, Atomera highlighted significant strategic advancements, including a record number of commercial proposals and promising results in the compound semiconductors market segment.

Strategic Developments and Industry Position

President and CEO Scott Bibaud emphasized the increased activity in license agreements and the company's entry into new market segments, projecting these movements as foundational for sustained growth. "We believe this proposal activity, combined with our potential to enter the compound semiconductor market segment will provide sustaining growth on top of a solid foundation to build Atomera into a premier leader in the semiconductor industry," Bibaud noted.

Analysis of Financial Statements

Atomera's balance sheet as of March 31, 2024, shows a slight decrease in cash and cash equivalents from $19.5 million at the end of 2023 to $19.3 million. This marginal reduction reflects ongoing investments in research and development despite the financial losses. The company's efforts in R&D and marketing are pivotal, given the competitive nature of the semiconductor industry and the need for continuous innovation.

Investor Outlook

While the financial results did not meet analyst expectations for the quarter, the strategic developments might hold promise for long-term value creation. Investors and stakeholders might be particularly interested in the company's ability to convert proposals into actual revenue-generating projects and its strategic entry into new semiconductor categories.

For a more detailed financial analysis and future updates on Atomera Inc (NASDAQ:ATOM), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Atomera Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance