Atlassian (TEAM) to Report Q1 Earnings: What's in the Cards?

Atlassian Corporation Plc TEAM is scheduled to report first-quarter fiscal 2019 results on Oct 18.

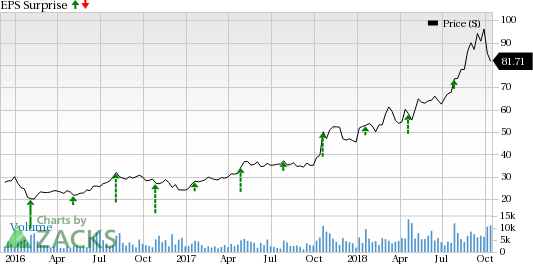

Notably, the company surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average positive surprise of 18.75%.

In the last reported quarter, the company’s earnings and revenues surpassed the Zacks Consensus Estimate as well as the guided range. Also, the top and the bottom lines recorded year-over-year improvement.

For the fiscal first quarter, Atlassian anticipates revenues of $258-$260 million. The Zacks Consensus Estimate is pegged at $259.4 million, which is 33.8% higher than the figure reported in the year-ago quarter.

On a non-IFRS basis, the company expects earnings per share to be 19 cents, which indicates a year-over-year increase of 58.3%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Atlassian is benefiting from solid customer additions on the back of a diverse product portfolio. The company added 6,638 net customers in the last reported quarter. Notably, its client base reached 126K by the end of fiscal 2018.

The company’s cloud and data center products are driving its subscription revenues. Robust growth in Jira Service Desk continues to be a key driver for the company.

Atlassian also acquired OpsGenie and launched Jira Ops in the last quarter to better compete with ServiceNow (CRM). Moreover, the company sold its corporate chat assets Stride and HipChat to rival, Slack Technologies.

The withdrawal from the communications market as well as the OpsGenie buyout highlights the company’s strategy to focus on high-growth areas.

However, surging expenses continue to be a drag on its margins and the bottom line. The company’s increasing investments on research and development and its go-to-market sales strategy are expected to hurt margins going ahead.

Atlassian Corporation PLC Price and EPS Surprise

Atlassian Corporation PLC Price and EPS Surprise | Atlassian Corporation PLC Quote

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or #5 (Strong Sell) stocks are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Atlassian currently carries a Zacks Rank #3 but has an Earnings ESP of -1.07%.

Stocks to Consider

Here are some stocks that you may consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Apple AAPL with an Earnings ESP of +2.39%, and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Fortinet FTNT with an Earnings ESP of +2.57% and a Zacks Rank #3.

Paycom Software PAYC with an Earnings ESP of +4.52% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance