ASX Growth Companies With High Insider Ownership To Watch

The Australian stock market has shown varied performance recently, with the ASX200 experiencing a slight downturn, while sectors like Health Care have seen gains. In such a fluctuating market environment, investors might find particular interest in growth companies with high insider ownership, as these can indicate confidence from those closest to the company's operations and potential resilience in turbulent times.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.6% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 59.8% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

BlueBet Holdings (ASX:BBT) | 25.2% | 85.1% |

SiteMinder (ASX:SDR) | 11.3% | 74.7% |

Let's explore several standout options from the results in the screener.

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

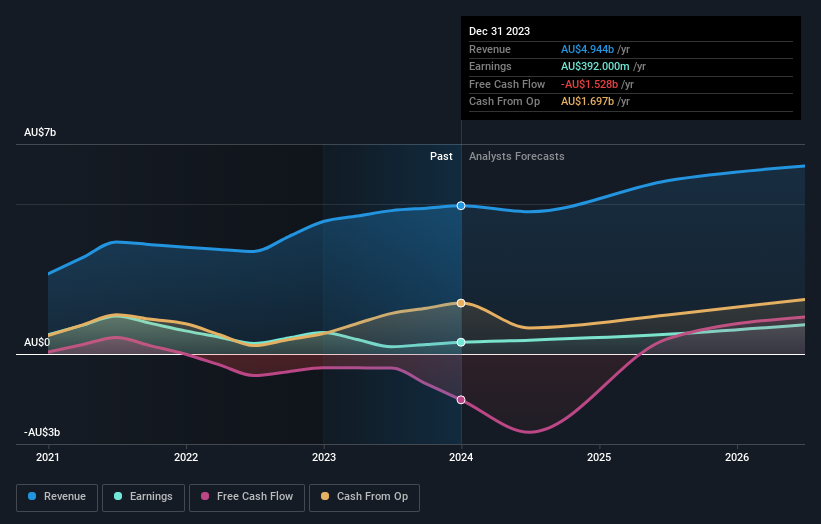

Overview: Mineral Resources Limited is a diversified mining services company operating in Australia, Asia, and internationally, with a market capitalization of approximately A$11.38 billion.

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 27.5% p.a.

Mineral Resources, trading at A$39.1% below its fair value estimate, shows promising growth potential with earnings expected to increase by 27.5% annually, outpacing the broader Australian market's 13.1%. Despite this robust profit outlook and faster-than-market revenue growth of 12.1%, challenges persist such as lower profit margins compared to last year and earnings not sufficiently covering interest payments. Insider transactions have been quiet over the past three months, indicating a watchful approach from those within the company.

Nanosonics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is an infection prevention company that operates both in Australia and internationally, with a market capitalization of approximately A$899.90 million.

Operations: The company generates its revenue primarily from the healthcare equipment segment, totaling approximately A$164.07 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 23% p.a.

Nanosonics, with a forecasted revenue growth of 9.9% per year, is set to outperform the Australian market's average of 5.3%. Earnings are expected to surge by 23% annually over the next three years, significantly above the market's 13.1%. Despite trading at A$42.4% below its estimated fair value and robust insider buying activity recently, concerns arise from its projected low return on equity at 12.6%, suggesting potential efficiency challenges ahead.

RPMGlobal Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited is an Australian company that develops and provides mining software solutions across multiple continents, with a market capitalization of approximately A$560.74 million.

Operations: The company generates revenue primarily through two segments: Advisory, which brings in A$28.56 million, and Software, contributing A$71.72 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 24% p.a.

RPMGlobal Holdings recently became profitable and is poised for significant growth, with earnings expected to increase by 24% annually over the next three years, outpacing the Australian market's forecast of 13.1%. Revenue growth is projected at 10.2% per year, also above the market average of 5.3%. Additionally, the company has expanded its equity buyback plan, signaling confidence in its future prospects despite not being a top performer in high insider ownership sectors.

Turning Ideas Into Actions

Click through to start exploring the rest of the 89 Fast Growing ASX Companies With High Insider Ownership now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:MIN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance