AstraZeneca's (AZN) Tagrisso Gets EU Nod for First-Line NSCLC

AstraZeneca AZN announced that the European Commission (EC) has approved its blockbuster lung cancer drug, Tagrisso (osimertinib) for expanded use in a lung cancer indication.

The EC has now approved Tagrisso in combination with chemotherapy for the first-line treatment of advanced EGFR-mutated (EGFRm) non-small cell lung cancer (NSCLC) in adult patients whose tumors have exon 19 deletions or exon 21 (L858R) mutations.

The latest approval was based on data from the phase III FLAURA2 study. Data from the study showed that treatment with Tagrisso plus chemotherapy reduced the risk of disease progression or death by 38% compared with Tagrisso monotherapy. Patients who were treated with Tagrisso plus chemotherapy experienced a median progression-free survival of 25.5 months compared with 16.7 months for patients who received Tagrisso monotherapy.

The approval in the European Union was expected as the Committee for Medicinal Products for Human Use had recommended the expanded use of Tagrisso plus chemotherapy in first-line EGFR-mutated NSCLC in June.

In the United States, the FDA approved Tagrisso in combination with chemotherapy for frontline EGFR-mutated NSCLC based on data from the FLAURA2 study in February 2024.

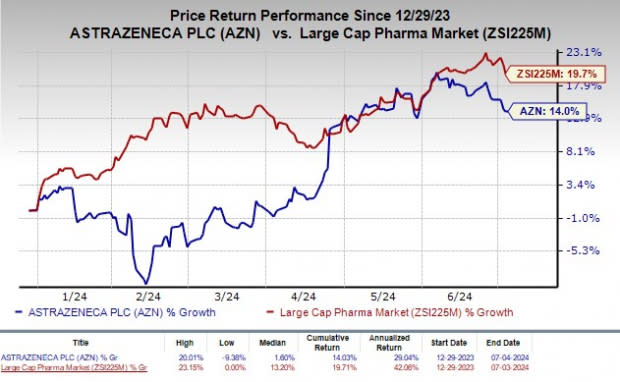

Shares of AstraZeneca have risen 14% year to date compared with the industry’s rally of 19.7%.

Image Source: Zacks Investment Research

Currently, Tagrisso is approved as a monotherapy for the first-line treatment of EFGR-mutated NSCLC, locally advanced or metastatic EGFR T790M mutation-positive NSCLC and adjuvant treatment of early-stage EGFRm NSCLC. The drug is the current standard of care in the first-line setting.

We note that a supplemental new drug application (sNDA) seeking approval for Tagrisso for the treatment of adult patients with unresectable, stage III EGFR-mutated NSCLC following treatment with chemoradiotherapy is currently under priority review in the United States. This sNDA was based on data from the phase III LAURA study.

A decision from the FDA is expected in the fourth quarter of 2024.

Tagrisso has been one of the key revenue drivers for AstraZeneca. In the first quarter of 2024, Tagrisso recorded sales worth $1.60 billion, increasing 15% year over year at constant exchange rates, on strong demand as a first-line and adjuvant treatment. Tagrisso sales could improve going forward with the approval for frontline NSCLC in Europe.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.05 to $2.47. Loss per share estimates for 2025 have narrowed from $3.04 to $2.55. Year to date, ACRV shares have rallied 24.8%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, ALGS shares have declined 36.4%.

Aligos’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, RAPT shares have declined 89.1%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance